Hiring a great team is hard. Hiring a great team across countries is even harder.

When your engineers are in Bengaluru, your designer is in Warsaw, your sales lead is in Austin, and your first product manager is in Singapore, you are not just running a startup. You are also running a mini legal and tax maze—whether you like it or not.

And yet, global teams are now normal. The best people are everywhere.

That is why employee stock options matter so much. Options help you attract strong talent when you do not want to burn cash. They help you keep people around when things get tough. And they help your team feel like owners, not just helpers.

But options get tricky the moment your team is global.

The same plan that works for a full-time employee in the US can break when you offer it to someone in India, Germany, Brazil, or the UAE. Not because anyone did anything wrong. Simply because each country has its own rules for taxes, labor laws, and how “equity” is treated.

So this guide is built for founders who want to do this the right way—without making it a giant project.

Here’s what we will cover in the full article:

- What stock options really are (in plain words) and why global teams change the game

- How to decide who should get options and how much, without guessing

- The biggest mistakes founders make with international grants (and how to avoid them)

- Smart ways to structure equity for contractors, employees, and mixed teams

- How vesting, cliffs, and exercise windows should change for global reality

- What to watch out for with taxes, paperwork, and cross-border rules

- How to keep your cap table clean while still moving fast

- How IP, patents, and equity fit together when your team builds across borders

One important point before we go deeper: options are only one part of “ownership.” The other part is protection. If your team is building core tech—AI models, robotics systems, edge compute, hardware designs—your company value is not just the people. It is the inventions.

That is where many startups get caught. They give equity, but they do not lock down IP early. Then, when they raise, investors ask: “Who owns the inventions? Are there patents? Are assignments signed? Did overseas contractors assign rights correctly?”

If you are building deep tech, you want both: a fair equity plan and a clear IP plan.

That is exactly what Tran.vc helps with. Tran.vc invests up to $50,000 in-kind in patenting and IP services so technical teams can build a real moat early—before a seed round forces rushed decisions. If you want support on the IP side while you build your team and your option plan, you can apply anytime here: https://www.tran.vc/apply-now-form/

Employee Stock Options for Global Teams

Why global options feel harder than they should

Stock options already have a learning curve. Most founders did not study equity plans in school. They learned by copying what other startups did, or by asking a lawyer to “set up a plan.” That can work when everyone is in one country.

The moment your team is spread out, the plan is no longer just a plan. It becomes a set of promises that touches tax rules, labor rules, and even how ownership is treated in each place. Small differences that seem harmless at the start can turn into big issues later.

A global option plan is still possible. It just needs clearer choices. The goal is not perfection. The goal is to be fair, stay compliant, and avoid surprises that break trust.

If you are building AI, robotics, or other deep tech, there is one more layer. Your people may create inventions. So you are not only sharing upside. You are also making sure your company truly owns what gets built. Tran.vc helps founders do both, and you can apply here anytime: https://www.tran.vc/apply-now-form/

What “stock options” really mean in simple words

A stock option is a right, not a gift. It is the right to buy company shares later at a fixed price. That fixed price is usually set around the time you grant the option. People often call it the “strike price” or “exercise price.”

If the company grows and the share value goes up, the option can become valuable. The team member can buy shares at the lower fixed price, then hold them or sell later if there is a sale or IPO.

If the company does not grow, the option may not be worth using. That is not a failure. It is simply how options work. They are upside, not a salary replacement.

Why options are not the same as real shares

Many team members hear “equity” and think they already own a piece of the company. Options are different. Until the person exercises, they do not own shares. They also usually do not get voting rights, and they typically do not get dividends.

This gap between “I have options” and “I own shares” is where confusion starts. In global teams, confusion spreads faster because people compare notes across countries, and each country treats options differently.

The fix is simple. Explain early, in plain words, what your plan is giving them today and what it could become later. That single step prevents a lot of future damage.

The moving parts of an option plan

Grant, vesting, and exercise: the three words you must teach

A grant is the number of options you give someone. Vesting is the schedule that decides when those options become earned. Exercise is the act of paying the strike price to turn options into shares.

These are not legal words to show off. They are the core of the deal. If your team does not understand them, they will guess. And guessing leads to disappointment, even when you are doing your best.

For global teams, it helps to explain this using the same story every time. “You earn your options over time. Once earned, you can buy shares at the fixed price. Those shares may be worth more later.”

Why vesting exists and why it protects both sides

Vesting is not a trick. It exists because startups change fast. People join, roles shift, and sometimes a person leaves early. Vesting protects the company from giving away too much ownership for work that was never done.

It also protects the team member, in a different way. It creates a clear path. If they stay and do the work, they earn more ownership step by step. That predictability matters, especially when people are far away and cannot “feel” the company every day.

Most startups use four years of vesting with a one-year cliff. That means nothing is earned in the first year, then after the first year a chunk vests, and the rest vests monthly or quarterly. It is common, but not mandatory.

Why global teams may need different vesting choices

A remote contractor in another country is not the same as a full-time employee in your home country. The law may treat them differently, taxes may hit them differently, and the relationship may be easier to end.

That does not mean you should treat people unfairly. It means you should match the tool to the reality. Some roles are core and long-term, and those often fit classic vesting. Some roles are project-based, and those may fit milestone-based equity, cash, or a bonus plan instead.

When you try to force every person into one structure, it usually breaks. A thoughtful plan is one where the structure reflects the working relationship.

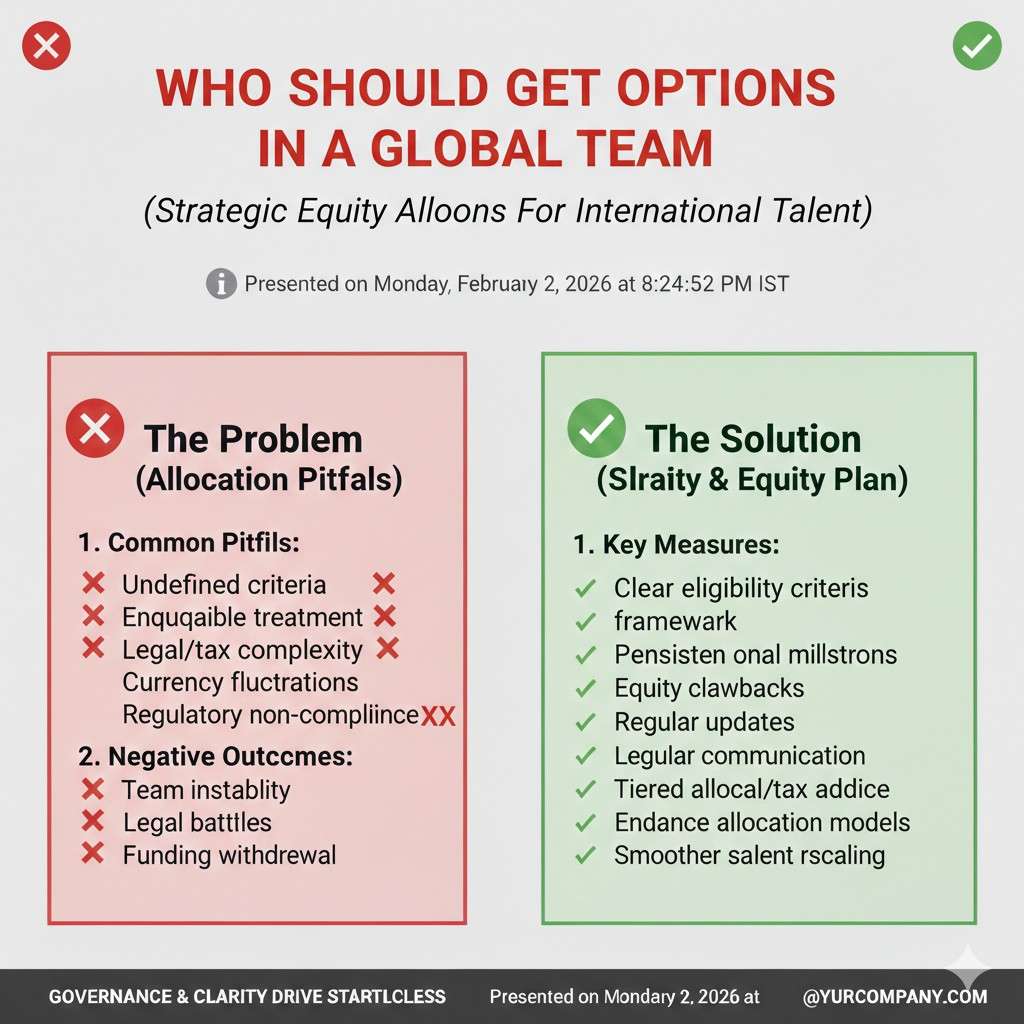

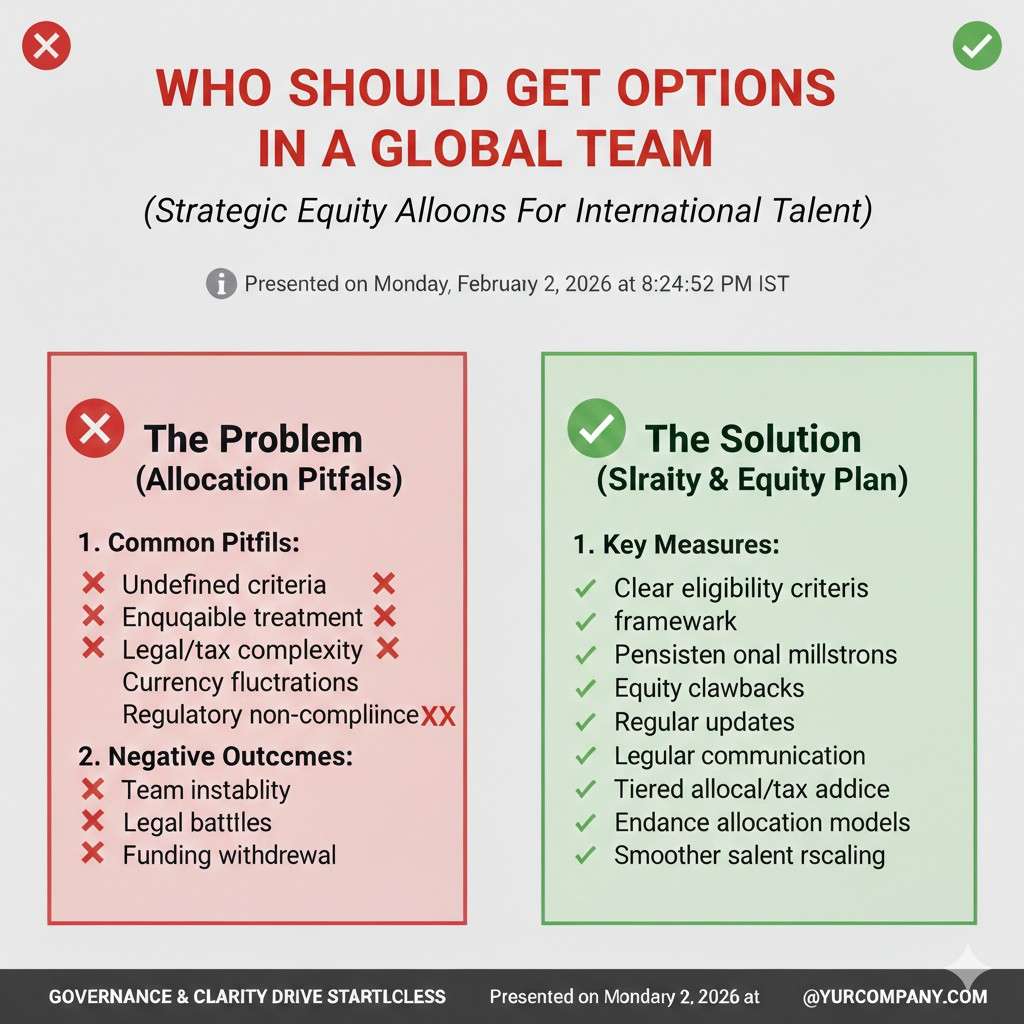

Who should get options in a global team

Start with impact, not job title

Founders often ask, “Should every employee get options?” The better question is, “Who is creating long-term value that will still matter in two years?”

For a deep tech startup, that may include core engineering, robotics design, AI research, product leadership, and sometimes key commercial roles. It can also include a critical early operator who keeps the company alive.

Job titles change across countries. A “lead engineer” in one market might be equal to a “senior engineer” in another. If you base equity only on title, you will overpay in some cases and underpay in others.

Avoid the “everyone gets the same” trap

Equal treatment is not always fair treatment. Giving the same grant to people in very different roles can feel polite at first, but it creates quiet resentment later. High-impact people will feel unseen, and lower-impact people may feel entitled to a level of ownership that does not match their contribution.

The best approach is to decide what ownership means for each role. If someone is building the core system that makes the company special, their equity should reflect that. If someone is doing a supporting role with a shorter timeline, you can still be generous, but the grant should be smaller.

When your team is global, this also helps with clarity. People can accept smaller grants when they understand the logic behind them. Confusion hurts. Clear reasoning builds trust.

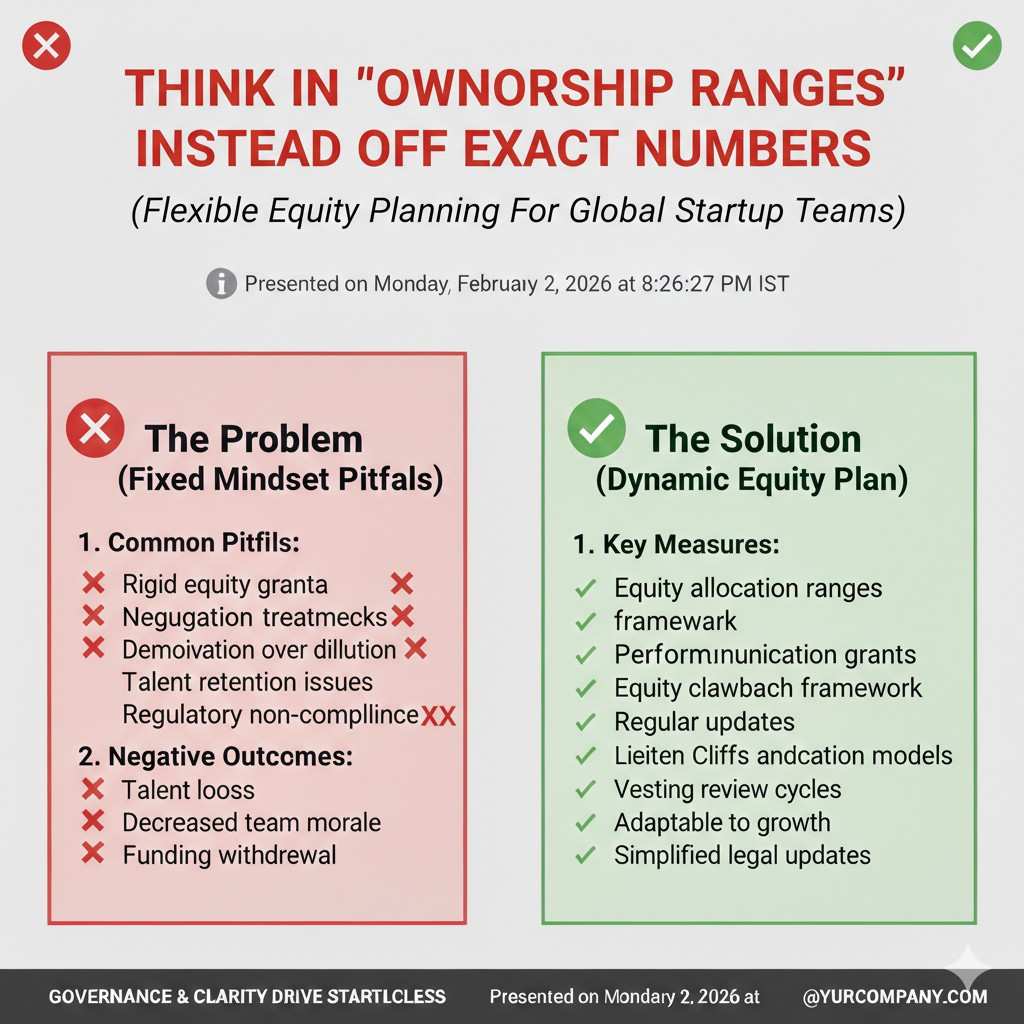

Think in “ownership ranges” instead of exact numbers

Founders often get stuck trying to pick the perfect number of options. In reality, equity is rarely perfect. It is a range that should make sense for the stage, the role, and the risk.

An easy way to work is to set a range for each role level. Then you place a person within that range based on skill, scarcity, and expected impact. This keeps you consistent without forcing you into a rigid formula.

This is also healthier for global teams, because local pay differences can be wide. Equity can help bridge the gap, but you still want a structured way to decide.

The biggest global equity problem: taxes and timing

Why the same grant can mean different tax pain

Two people can receive the same option grant and have very different outcomes. In some countries, taxes hit at grant. In others, taxes hit when the options vest. In others, taxes hit at exercise or sale.

This matters because a tax bill without cash is a real problem. If a team member owes tax before they can sell shares, they may feel trapped. That can turn a “benefit” into a burden.

You do not need to become a tax expert. But you do need to know enough to avoid giving a promise that hurts the person you are trying to reward.

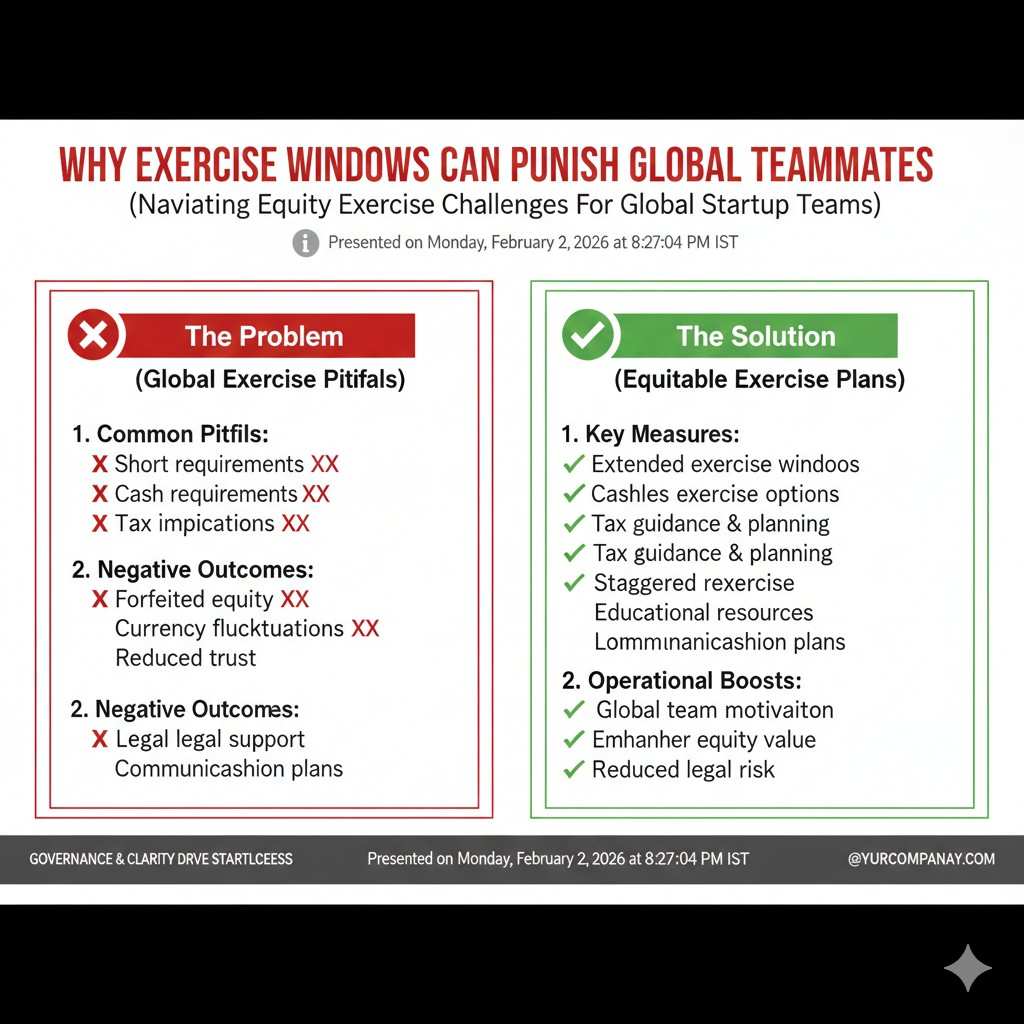

Why exercise windows can punish global teammates

Many plans give employees a short time to exercise after leaving, often 90 days. That might be normal in the US, but it can be painful for global workers.

Why? Because exercising requires cash. If someone leaves, they may not have spare money to buy shares quickly. And if their local tax rules create extra cost at exercise, the cash need can be even higher.

Some startups handle this by offering longer exercise windows, especially for long-tenure employees. It is not always possible, and it depends on the plan and local rules, but it is worth exploring early.

The “paperwork gap” that breaks trust

Global options also fail when paperwork is messy. A person signs an offer letter, starts working, builds key systems, and only later learns that the option grant never happened because the board did not approve it, or because the plan cannot cover their country.

That is not just a legal issue. It is a trust issue. The person feels misled, even if it was accidental.

The fix is discipline. Make sure grants are approved on time, agreements are signed, and the person receives a clear summary of what they got and how it works.

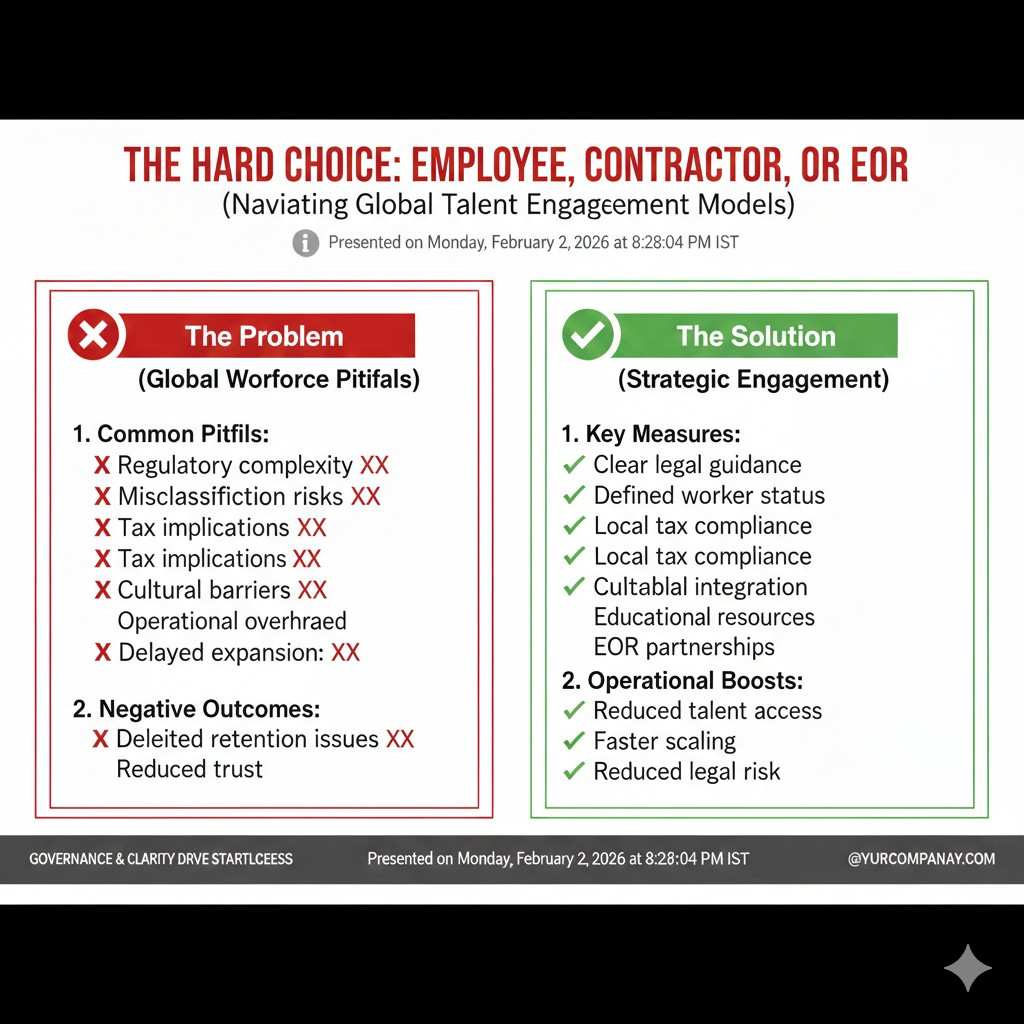

The hard choice: employee, contractor, or EOR

Why classification changes everything

In global hiring, you may use employees, contractors, or an Employer of Record (EOR). This choice changes what you can offer and how hard it is to comply.

Contractors may not be allowed to receive options under some plans, or it may create risk. Employees hired through an EOR may count as employees for some purposes but not others. Local law may add extra steps.

Founders often make a hiring choice based on speed. That is normal. But it helps to know that the hiring method can affect equity later, so you can plan instead of patch.

When contractors ask for equity

Many global contractors will ask for equity, especially if they work like full-time team members. You have a few paths. You can offer them options if your plan allows it. You can offer a cash bonus tied to company milestones. Or you can use a different equity-like tool, depending on where they live and what your counsel supports.

The wrong move is to promise options casually before you confirm you can legally and cleanly grant them. Promises made too early are hard to unwind.

A better move is to say, in plain language, “We want you to share in upside. We will structure this in a way that works in your country and keeps things clean for both sides.” Then you follow through quickly.

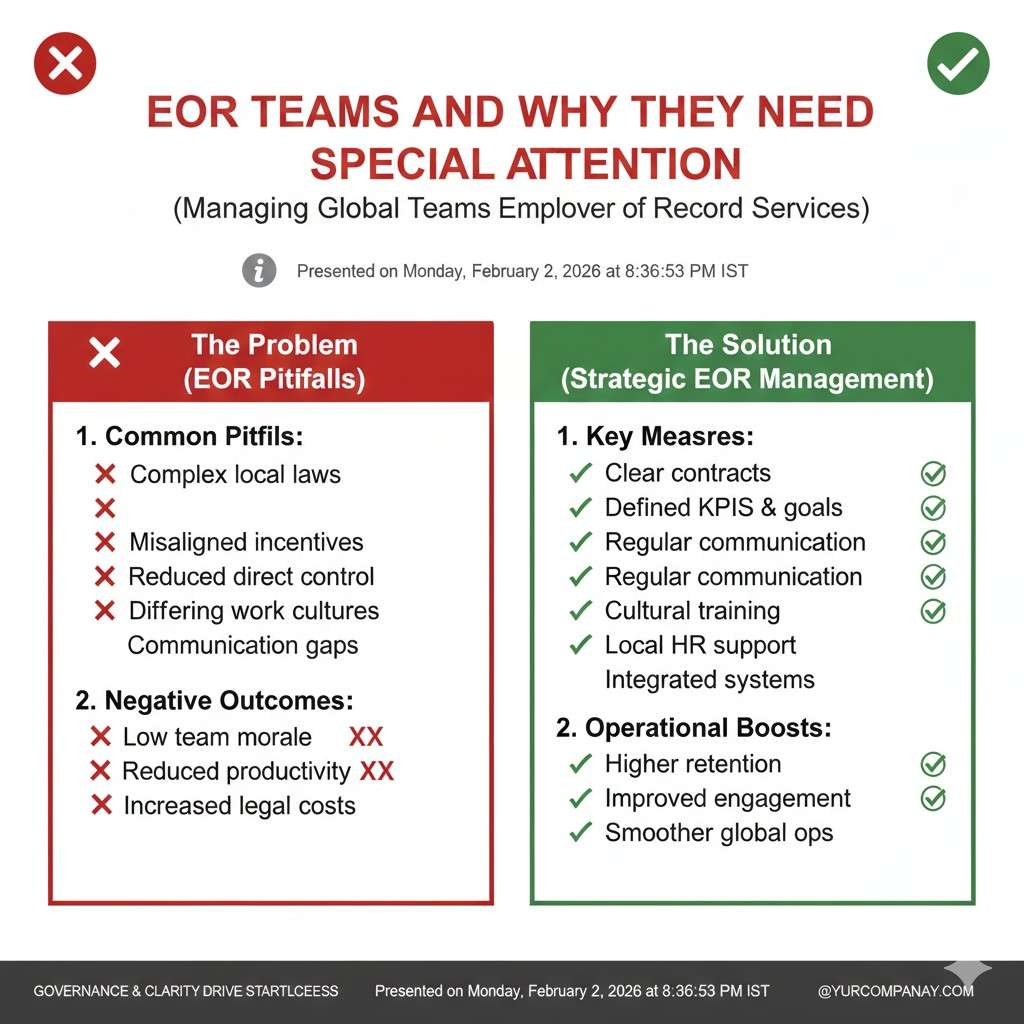

EOR teams and why they need special attention

EOR is popular because it helps you hire fast without setting up a local entity. But equity still needs careful handling because the legal employer is not you.

Some EOR providers have standard processes for equity communication, but the plan itself is still your plan. You must make sure the grant documents, local notices, and any local filings are handled properly.

This is where many founders benefit from having a clear equity workflow. Not complicated. Just consistent steps, written down, so nothing falls through.

Where IP and options collide in global teams

Equity does not automatically secure invention ownership

This is a common misunderstanding. Giving someone options does not automatically mean the company owns what they invent. Ownership depends on signed invention assignment agreements, local labor laws, and how the work relationship is structured.

If you have engineers or researchers abroad, you must be extra careful. Some countries have rules that protect employee inventions in ways founders do not expect. Contractors may require very specific assignment language.

If this is not handled early, investors will ask hard questions later. And in deep tech, those questions can slow down a round or reduce your leverage.

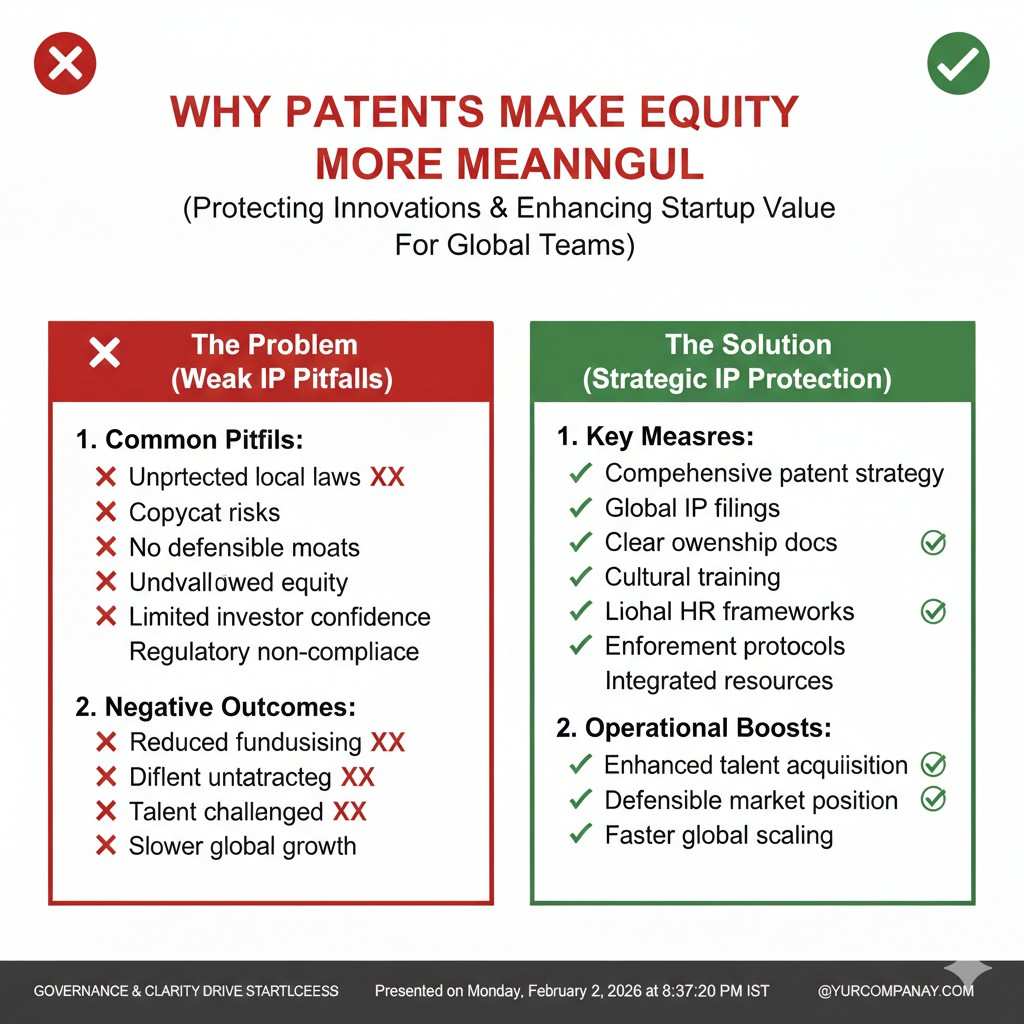

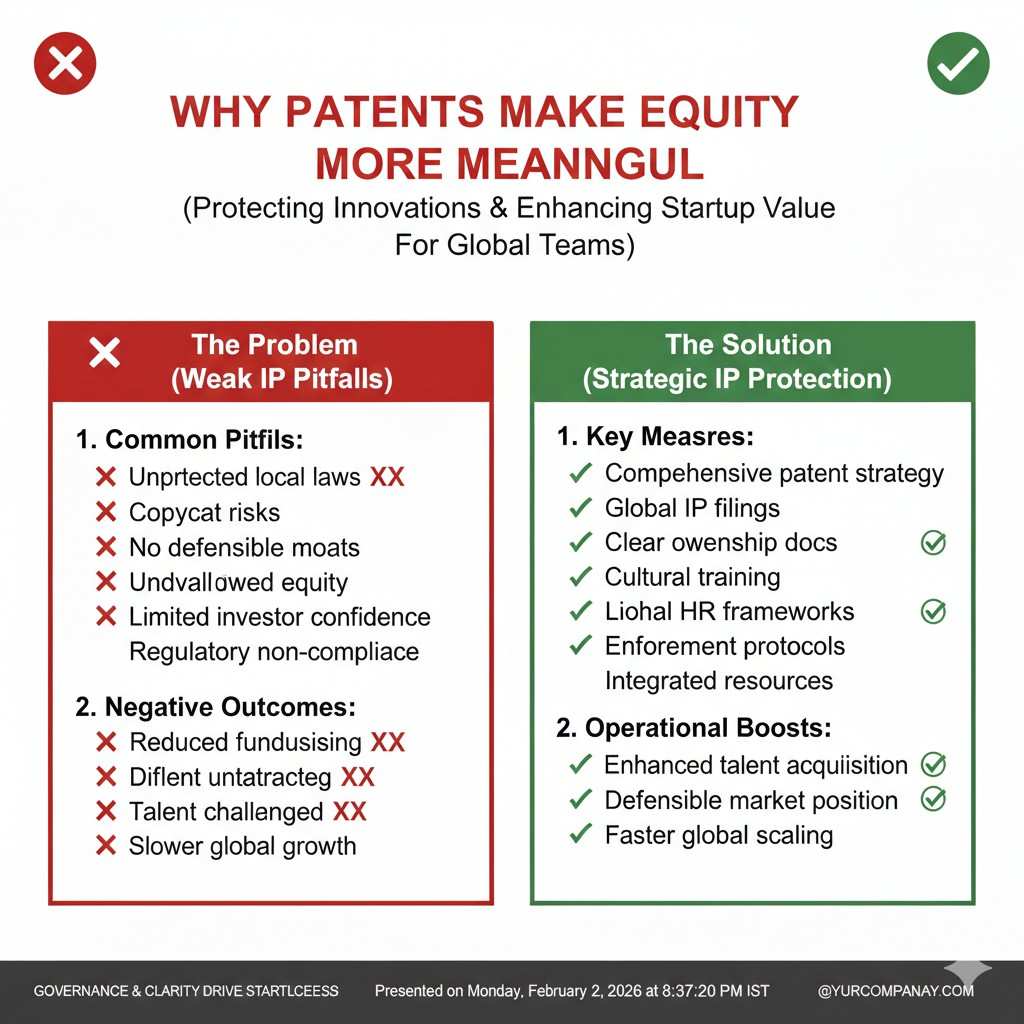

Why patents make equity more meaningful

Options feel more real when the company has real assets. In deep tech, patents can be a big part of that. A patent does not replace execution, but it can protect key inventions and reduce copy risk.

When your team is global, patents can also bring order. They force you to document what was invented, who contributed, and how it ties to the company. That discipline supports both fundraising and internal clarity.

Tran.vc exists for this exact moment. If you are building robotics, AI, or other hard tech, and you want an IP plan that matches your equity plan, you can apply here: https://www.tran.vc/apply-now-form/

Building a simple “IP + equity” onboarding flow

You do not need a huge policy book. You need a clean onboarding flow that every new hire follows. This usually includes signing IP assignment documents, getting a clear equity summary, and understanding what must stay confidential.

When you do this early, equity becomes a positive story. People understand what they are earning and what the company is protecting. That shared understanding reduces fear and rumor, especially across time zones.

Employee Stock Options for Global Teams

Designing a global option plan without losing your mind

A global plan works best when you stop trying to make it “fit everyone perfectly.” That goal sounds noble, but it leads to endless changes, delays, and awkward exceptions.

Instead, aim for a plan that is clear, repeatable, and fair in spirit. You want a core structure that covers most people. Then you build a small set of approved alternatives for cases that truly need a different approach.

The best founders treat equity like a product. They design the system, test it on real cases, and improve it over time. They do not treat it like a one-time legal document that sits in a folder.

Start with one global story, then adapt the tool

People do not need to memorize tax rules. They need to understand the “why.” Your story should sound the same no matter where someone lives.

It can be as simple as: “We are giving you the right to buy shares later at today’s price. If we grow, you share in that growth. You earn this right over time by staying and doing great work.”

Once that story is clear, you pick the tool that makes the story true in practice. Sometimes that is classic options. Sometimes it is a different form of equity-like reward because options would create tax pain or legal risk in that location.