In the startup world, first impressions are currency. A great product can still fail to get funding if it’s introduced with the wrong pitch. And when you’re sitting across the table from investors, the way you present your idea should change depending on what you’re building. The pitch for a hardware product is not the same as the pitch for a SaaS solution—and treating them the same is one of the fastest ways to lose investor attention.

This isn’t just about swapping out a few buzzwords. It’s about understanding that hardware and SaaS companies live in different realities—different risks, different development timelines, different customer adoption patterns, and different capital needs. Investors know this. They expect you to know it too.

How Investors Think Differently About Hardware vs SaaS

When you step into a room to pitch, you’re not just selling your vision—you’re stepping into the investor’s mental framework. Every investor has a mental playbook for how different business models behave, how they scale, and what risks they carry.

If you’re pitching hardware, you’re automatically triggering one set of assumptions. If you’re pitching SaaS, you’re triggering another. Knowing these mental models—and speaking directly to them—can change the entire trajectory of your pitch.

The Investor’s View on Hardware

To an investor, hardware feels tangible, but it also feels heavy. Heavy in terms of upfront costs, manufacturing cycles, supply chain dependencies, and time to market. Even when the technology is groundbreaking, they’ll see layers of execution risk.

They know that a hardware company can spend years perfecting the product before revenue starts flowing. That means they’re looking at you through a lens that focuses on resilience, operational discipline, and capital efficiency.

When you pitch a hardware startup, they want to know if you’ve already thought about sourcing, manufacturing partners, and distribution channels. They’ll want to see evidence that you can protect your intellectual property, especially if you’re competing in a space where copycats can move quickly.

They’ll look for proof that you understand production costs inside out—not just now, but when you’re scaling. And above all, they’ll be watching to see if you can show traction in a market where adoption curves are slower and customer education is often harder.

In a hardware pitch, the trust you build comes from showing that you can navigate complexity without burning cash too fast. That’s why investors respond well to founders who can explain not just the product vision, but the precise steps between concept and mass production.

They want to hear you talk about how you’ll shorten development cycles, manage component shortages, and adapt when the unexpected happens. In hardware, the investor is buying into your operational plan as much as your innovation.

The Investor’s View on SaaS

When you pitch SaaS, the conversation starts in a completely different place. To an investor, SaaS feels lighter, more agile, and infinitely more scalable. They know that once the product is built, the cost to deliver it to one more customer is often close to zero. That makes growth curves steeper and revenue models more predictable—if you can prove product-market fit.

But this speed and scalability come with their own risks. Investors know that SaaS markets move quickly and competition can appear overnight. They expect you to prove why your product will win, and keep winning, in a landscape where switching costs are low and customers have endless alternatives.

They’ll want you to show how you’ll acquire customers efficiently, keep churn rates low, and build a product moat that can’t be replicated by the next well-funded competitor.

SaaS investors also think in terms of recurring revenue and predictable cash flow. If your pitch doesn’t clearly show how you’ll get to a stable Monthly Recurring Revenue (MRR) and keep it growing, you’re not speaking their language.

They’ll want to know your customer acquisition cost (CAC) and lifetime value (LTV), and they’ll expect you to have a plan for improving both over time. In SaaS, the investor is buying into your growth engine—the repeatable, measurable process that turns interest into paying subscribers and keeps them engaged for years.

The Mindset Shift You Need as a Founder

The most successful founders adjust their entire pitch structure depending on whether they’re in the hardware or SaaS lane. That doesn’t mean you change your story—it means you adapt the emphasis.

For hardware, you focus on de-risking production, proving market readiness, and showing how you’ll survive the long road to scale. For SaaS, you focus on speed, defensibility, and customer lifetime value.

When you understand that investors are not evaluating you against a single universal checklist but against a model-specific set of expectations, you stop making the mistake of delivering a generic pitch.

You start showing them that you’ve done the hard work of thinking like they do. And that is where trust begins.

Framing Your Value Proposition for Hardware vs SaaS

Your value proposition is the sharpest tool in your pitch. It’s the single, crystal-clear reason why your business deserves to exist and why it will win. But here’s the catch—what makes a value proposition compelling in hardware is not the same as what makes it compelling in SaaS. The core story might be similar, but the framing, proof, and emotional hooks have to change to match the investor’s mental model.

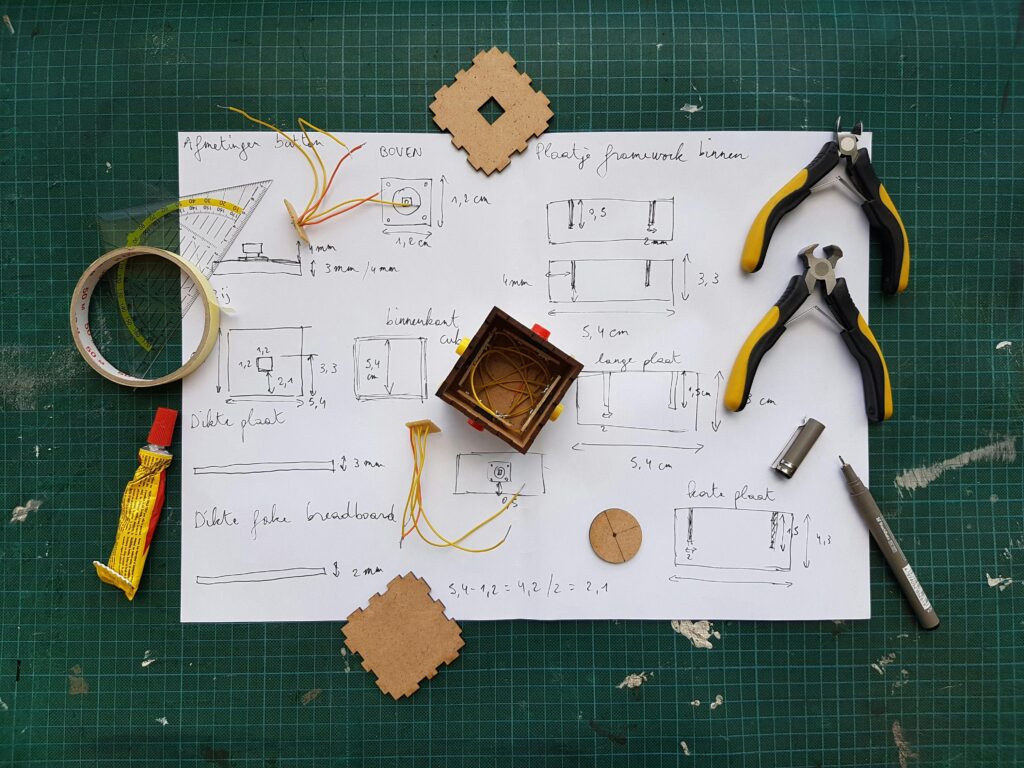

Crafting a Hardware Value Proposition

For hardware, the value proposition has to prove two things at once: the technology’s potential to change the market and your ability to bring it to life without drowning in costs or delays. Investors have seen brilliant prototypes die in the desert of manufacturing reality. They’re not just buying into an invention—they’re buying into your ability to turn it into a repeatable, profitable product.

That means your pitch should make the tangible benefits obvious. If your product saves time, explain exactly how much time and what that means in dollar terms. If it increases safety, paint a picture of the risks avoided and the regulations met.

Use concrete metrics that connect your innovation to measurable impact. But don’t stop there—hardware investors also want to see how you’ll protect your idea. Talk about patents you’ve filed or plan to file, explain your approach to guarding trade secrets, and show that you’ve thought through how to stay ahead even if competitors try to copy you.

The emotional angle in hardware pitches often comes from the real-world problems your product will solve. Investors respond when they can visualize it in action—being used, installed, or shipped to customers. Bring them into that moment. Show them that it’s not just a piece of tech, but a tool that’s going to make lives easier, safer, or more productive.

Crafting a SaaS Value Proposition

When you’re pitching SaaS, your value proposition needs to be a promise of ongoing transformation, not just a one-time solution. The investor is thinking about recurring revenue from the start, so you need to show that your product delivers continuous value that keeps customers paying month after month.

Clarity is key here. You should be able to explain in one sentence how your software makes a user’s life better, easier, or more profitable. The best SaaS value propositions hit on both efficiency and insight—saving users time while giving them better information, better results, or better decision-making power.

If your software automates something tedious, quantify how much time it saves and what users can do with that time. If it improves outcomes, back it up with data that shows the difference between before and after.

But unlike hardware, where the physical product can act as a moat, SaaS needs defensibility in other ways. Your value proposition should make it clear why switching away from your product would be painful for customers.

This could be because your software becomes deeply embedded in their workflows, or because it offers unique insights that competitors can’t match. Investors want to see a future where customers not only sign up but also stay, and your value proposition has to make that future easy to imagine.

Why This Difference Matters

In hardware, your value proposition is about proving you can deliver something real, protect it, and sell it profitably at scale. In SaaS, it’s about proving you can deliver ongoing value, build customer loyalty, and expand revenue predictably over time.

One is anchored in tangible production, the other in intangible but sticky relationships with customers.

When you frame your pitch in a way that matches these expectations, you’re no longer asking investors to translate your idea into their mental model—you’re delivering it in their language. And that not only makes your message sharper but also makes it much harder to forget.

Presenting Traction for Hardware vs SaaS

Traction is the heartbeat of your pitch. It’s the proof that your idea is not just possible but already moving toward success. Yet traction looks very different in hardware compared to SaaS, and investors will interpret the same data points in completely different ways depending on your business model. Knowing how to present traction in the right context can mean the difference between a polite pass and a serious funding conversation.

Traction in a Hardware Pitch

When you’re pitching hardware, traction is less about user counts and more about tangible milestones that bring your product closer to market. Investors know you can’t just launch in a week and start collecting subscriptions. They expect to see a staged path from prototype to production, and they’ll want to know where you stand on that path.

If you have working prototypes, show them. If you’ve completed successful field tests, talk about the results and what they proved. Demonstrating that your hardware has already been tested in real-world conditions can be more persuasive than showing a long list of early sign-ups.

Manufacturing partnerships, supplier agreements, and certifications also count as traction because they signal you’ve de-risked some of the hardest parts of hardware development.

Pre-orders can be especially powerful here. They don’t just indicate demand—they show that people are willing to pay before the product even exists at scale. If you have letters of intent from distributors or enterprise customers, highlight them.

These concrete commitments give investors a clear line of sight between your current stage and actual revenue.

And in hardware, every traction milestone should be tied back to risk reduction. Show how each step you’ve completed has lowered technical risk, supply chain risk, or market risk. Investors know hardware takes longer to scale; your job is to make them believe you’re shortening that road.

Traction in a SaaS Pitch

For SaaS, traction is almost entirely about adoption and retention. Investors want to see that people are not only trying your product but also sticking around and paying for it. Early traction can be demonstrated through active user growth, low churn rates, and increasing monthly recurring revenue.

Metrics like daily active users (DAU), monthly active users (MAU), and user engagement time carry weight because they indicate your product is becoming a habit, not a novelty.

Investors will also pay attention to conversion rates from free trials to paid plans and to your customer acquisition cost relative to lifetime value. Even if your revenue is still modest, strong retention and user engagement can be a green light that you’ve found product-market fit.

If you have case studies or testimonials that show how your SaaS has delivered measurable results for customers, include them. This isn’t just feel-good marketing—it’s proof that your software delivers consistent value.

And because SaaS can scale rapidly once product-market fit is established, investors will be eager to see any evidence that your growth is accelerating.

The Psychology Behind Traction Stories

For hardware investors, traction stories are about showing that the heavy lifting has been done and that the journey from idea to shipping product is no longer an uncertain leap. They’re reassured by seeing each risk reduced step by step.

For SaaS investors, traction stories are about momentum—once the product works and customers are happy, they expect revenue to snowball. They’re reassured by seeing metrics that prove the flywheel is already turning.

The same word—traction—means two entirely different things depending on the audience. That’s why a founder who uses the wrong framing risks sending the wrong signals, even with good numbers.

When your traction story aligns with the investor’s model of success, it stops being data on a slide and starts being a narrative they can believe in.

Talking About Your Team for Hardware vs SaaS

An investor isn’t just investing in your product—they’re investing in you and the people standing beside you. The way you present your team can quietly make or break the pitch. And just like every other part of your story, the emphasis has to change depending on whether you’re building hardware or SaaS.

The skills, experience, and credibility markers that matter most aren’t the same, and a founder who doesn’t adapt their framing risks underselling their strongest asset.

Positioning a Hardware Team

For hardware, the investor’s mind goes straight to execution risk. They know that building a physical product demands a blend of engineering precision, manufacturing expertise, and supply chain mastery. Your team’s credibility in this space depends on showing that you’ve already navigated these worlds or have advisors who can bridge the gaps.

If you or your co-founders have backgrounds in mechanical engineering, robotics, industrial design, or electronics manufacturing, those details aren’t just resume filler—they’re proof that you understand the grind of turning a prototype into a repeatable product.

Talk about past projects you’ve shipped, especially if they involved complex logistics or compliance challenges. Even better, if you’ve worked on products that made it to market before, walk the investor through that journey.

Highlight operational leadership as well. A great hardware team isn’t only about the technical build; it’s about orchestrating suppliers, coordinating with manufacturers, and ensuring quality control under pressure.

If you have a COO or operations lead with deep supply chain experience, make sure their expertise is front and center. Investors want to know that when parts run late or a manufacturing line has issues, your team has the calm and know-how to fix it without derailing timelines.

Positioning a SaaS Team

In SaaS, the investor’s attention is drawn to product velocity and go-to-market execution. They want to see a team that can ship quickly, iterate often, and outlearn competitors in real time. This means your technical founders’ ability to architect scalable, reliable software is crucial, but so is your ability to understand and serve a market deeply.

If your CTO or lead developer has built scalable systems before, talk about it. If your product lead has experience in UX that directly led to high adoption rates in previous roles, that’s the kind of story that makes an investor lean forward. Investors also pay close attention to whether you have sales and marketing leadership in place early on, or at least a clear plan for it.

In SaaS, a product that sits idle in a code repository is useless; what matters is your ability to get it into the hands of the right customers and keep them engaged.

Credibility in SaaS often comes from domain expertise as well. If your software serves a specific industry, having team members who’ve lived and worked in that industry can dramatically boost your trustworthiness. It signals that you not only understand the problem but can anticipate the needs and objections of your ideal customer.

Why Team Framing Shapes Investor Trust

In hardware, investors need to feel confident that your team won’t be overwhelmed by the physical, logistical, and regulatory challenges that stand between you and your market. In SaaS, they need to feel confident that you can move fast, stay adaptable, and build a product moat before competitors catch up.

A common mistake founders make is presenting their team with the same emphasis regardless of model—listing titles and degrees without connecting them to the unique challenges of the business.

The best pitches go deeper. They tell a story about why these specific people are uniquely qualified to win in this specific space. That’s what turns a slide full of headshots into a powerful moment of trust.

Discussing Financial Projections for Hardware vs SaaS

When you get to the financials in your pitch, you’re stepping into the part of the conversation where investors are actively visualizing the risk and reward. The numbers you show are not just math—they’re a reflection of how well you understand your business model and the realities of scaling it. And because hardware and SaaS generate, spend, and multiply money in such different ways, your projections need to be framed with a deep awareness of those differences.

Financial Projections for Hardware

In hardware, investors expect a front-loaded cost structure. They know that before a single unit is sold, there are months or years of expenses for prototyping, tooling, certifications, and early manufacturing runs. The cash burn in those early stages can be steep, and your projections need to make it clear that you’ve planned for it.

Break your financial story into phases—development, pilot production, and full-scale manufacturing. Show that you’ve factored in realistic timelines and potential delays, because experienced hardware investors will mentally add them anyway.

Be transparent about unit economics from the start. Investors want to see your cost per unit today, what it will be when you scale, and how you’ll bring that number down without sacrificing quality.

Revenue projections in hardware should feel grounded in actual purchase intent. Pre-orders, signed contracts, or letters of intent can bridge the credibility gap between a cost-heavy present and a revenue-rich future.

It’s not enough to say “we’ll sell 100,000 units in year one.” You need to show how those units will be sold, who will buy them, and what distribution channels will make it happen.

Margin expectations in hardware also differ from SaaS. Investors know that physical products rarely hit the astronomical gross margins of software, but they will want to see healthy margins that can improve over time through scale efficiencies, better supplier deals, and optimized production processes.

Financial Projections for SaaS

In SaaS, investors expect a very different curve. The upfront costs are often lower, but the burn rate is driven by talent, infrastructure, and customer acquisition. Your projections should show a steady climb in recurring revenue that eventually outpaces your monthly expenses, leading to a clear breakeven point and, later, strong profitability.

Your Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR) are the stars of the show. Investors want to see how quickly these numbers grow, but they also care deeply about the efficiency of that growth.

This means having a clear handle on your Customer Acquisition Cost (CAC) and your Customer Lifetime Value (LTV). The relationship between these two numbers tells them whether your business model can sustain itself once you push for scale.

Because SaaS scales fast when it works, your projections should highlight what happens when retention is strong and upselling is effective. Show how small improvements in churn rates or expansion revenue can significantly boost your profitability over time. Investors are not just looking at how much you can make in year one—they’re looking for a model that compounds and becomes more efficient as it grows.

In SaaS, margins are expected to be high from the beginning, often in the range of 70–90%. If your margins are significantly lower, you’ll need to explain why and show a path to improvement. And while it’s tempting to paint a hockey-stick revenue curve, seasoned SaaS investors will look closely at your assumptions—so those need to be airtight.

Making the Numbers Work for You

For hardware, the credibility of your financials comes from showing a realistic path through heavy upfront costs toward sustainable production and healthy margins. For SaaS, it comes from showing a repeatable, scalable revenue engine that improves over time.

In both cases, the financials are not just about impressing investors—they’re about showing that you understand how money moves in your specific business model and that you’ve already thought through the challenges ahead.

When your projections feel honest, detailed, and aligned with the realities of your model, they do more than fill a slide—they give investors confidence that you’re not just dreaming, you’re planning.

Conclusion

Pitching hardware and SaaS is not about recycling the same story with different labels—it’s about shaping your message to fit the reality of the model you’re building. Hardware demands proof that you can navigate long, costly, and complex paths to market without losing momentum. SaaS demands proof that you can move fast, win users, and keep them for the long haul.

Investors are not only buying into your product; they’re buying into your understanding of the game you’re playing. When you frame your value proposition, traction, team, financials, and risk in ways that match their expectations, you make it easy for them to believe in your vision.

The best pitches aren’t just heard—they’re remembered. And the ones that are remembered are the ones that make the investor think, “This founder gets it.” Whether you’re holding a prototype or a live dashboard, that’s the moment you’re aiming for.