In the world of AI, timing is everything. Moving too slowly means someone else will own the space before you arrive. Moving too quickly without clarity means you risk burning through time, credibility, and trust before you even have something to sell. But here’s the reality—most AI startups don’t have a polished product when they first need to raise interest, build a brand, or get in front of investors. That’s not a flaw—it’s the natural rhythm of building something ambitious.

Positioning an AI startup before you have a product isn’t about faking progress. It’s about creating a clear, compelling identity that makes people believe you’re already worth watching. The right positioning helps you own a space in people’s minds long before you own market share. It allows you to have conversations with partners, attract early believers, and prepare the runway for when your product finally launches.

This is where most founders stumble. They talk in vague terms, drown their story in technical jargon, or focus entirely on the future instead of anchoring it in present credibility. The trick is to balance vision with proof—showing that while the product may be coming later, the business is already moving with purpose today.

Understanding the Investor Mindset When You Don’t Have a Product Yet

When you walk into a room to talk about an AI startup without a working product, you’re not asking investors to judge what you’ve built—you’re asking them to judge you, your idea, and your ability to make it real. That changes everything about how they listen. Without a tangible product to point to, every part of your pitch has to carry more weight, because the investor is leaning on signals instead of metrics.

Why Investors See Pre-Product Startups Differently

Investors know that early-stage AI companies often need significant upfront work before anything customer-ready appears. Training models, gathering datasets, securing compute resources—these are not overnight tasks.

But they also know that AI is one of the most competitive spaces in tech right now. If they sense that you’re drifting without a defined angle, they’ll assume someone else will move faster and claim the opportunity.

When there’s no product, investors shift their focus. They look for proof that you deeply understand the problem you’re solving and that your approach is both unique and feasible. They watch closely for signs of clarity in your thinking—because clarity now often predicts execution later.

They also listen for your ability to communicate your vision in a way that non-technical audiences can understand. If you can’t do that in the pitch, they’ll worry about how you’ll do it with customers, partners, or future hires.

The Weight of Credibility Without Code

Without a product to demonstrate, your credibility comes from three main places: your track record, your insights into the market, and your visible progress toward making the idea real. If you have prior experience shipping technology, scaling teams, or solving hard problems, this is the moment to connect that history to what you’re building now.

If you don’t have a long founder resume, you can still create credibility by showing deep domain expertise and a strong understanding of the competitive landscape.

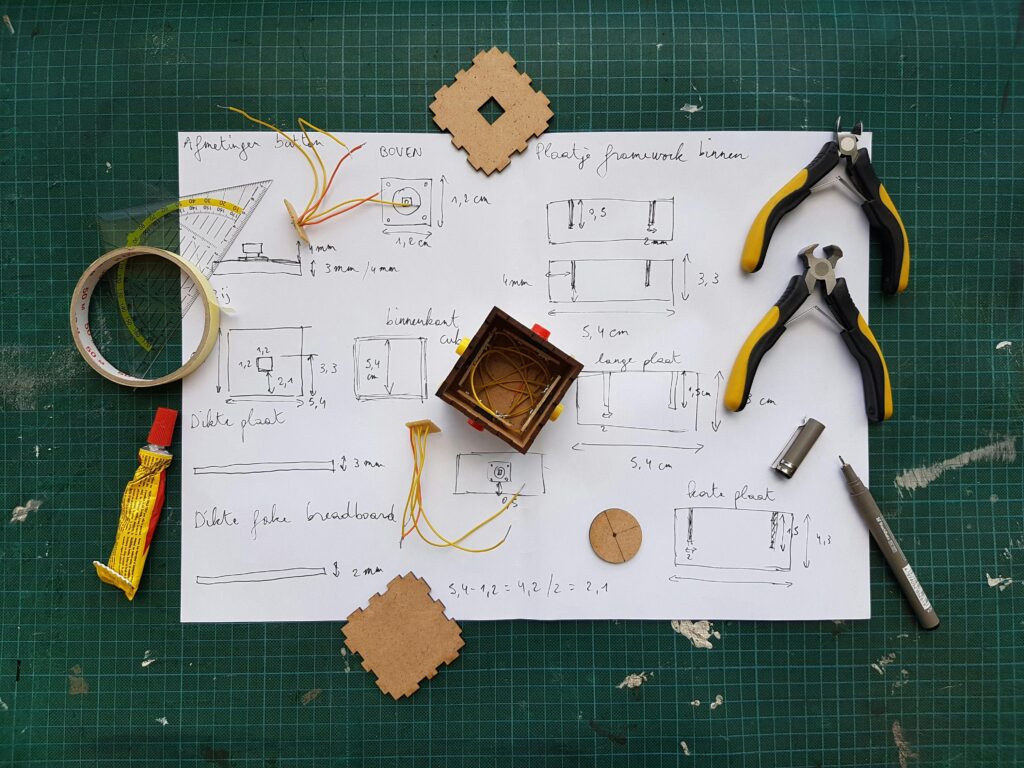

Progress, even in pre-product form, matters more than most founders think. This could be early prototypes, private demos of model outputs, or even clear architectural diagrams that explain how your system will work. Investors want to know that you’re not just talking about building—you’ve already started in ways they can see.

How the AI Angle Changes the Equation

In AI, the investor mindset is even sharper on two points: defensibility and timing. AI moves so quickly that an idea without a moat can be replicated before you get to market.

That’s why, even without a product, you need to make them believe you have something that will be hard to copy—whether that’s proprietary data, a unique application, or a specific integration into an industry workflow.

Timing matters because the window for certain AI opportunities can close in months, not years. If you’re entering a space where the market is already crowded, you need to show how you’ll leapfrog competitors even if you’re launching later. This might mean highlighting a distribution advantage, an exclusive data source, or a customer acquisition strategy no one else has.

When investors can’t evaluate your product, they evaluate your ability to navigate these two realities. If you can make them believe you understand the race you’re running—and that you have a plan to win—they’ll lean in.

Crafting a Clear and Believable Narrative Without Relying on a Product Demo

When you don’t have a product to show, your narrative becomes your most important asset. A great narrative does more than explain what you’re building—it makes people feel the inevitability of your success.

It creates a sense that the market is moving in your direction, that your team is perfectly positioned to lead it, and that your vision is already in motion. Without this, your pitch risks sounding like wishful thinking rather than a grounded plan.

Building the Story Around the Problem

The anchor of your narrative should always be the problem you’re solving. This isn’t about describing it in abstract terms—it’s about making it vivid and urgent.

You need to take investors into the world of your target customers and show them what’s broken, what’s frustrating, or what’s costing them money. In AI, this often means pointing out inefficiencies that humans can’t fix at scale, or opportunities that are invisible without machine intelligence.

A strong problem narrative avoids jargon and speaks to universal business truths—lost revenue, wasted time, missed opportunities, or unnecessary risk. The more specific and relatable you make the problem, the easier it is for people to see why your solution needs to exist now, not later.

Framing the Vision Without Overpromising

The temptation for many founders without a product is to make the future sound bigger than life. But investors can smell overpromising from across the table.

Your vision should be ambitious, but it should also be tethered to logical steps you can take. Instead of painting a vague picture of dominating an entire industry, focus on the first meaningful outcome you can deliver and how it will set the stage for bigger wins.

Describe your solution in a way that makes it easy to imagine even without a demo. Walk them through how it would work in the hands of a real customer. If you can create that mental movie—where they can see your product making a measurable difference—you don’t need a fully functional product to make them believe in it.

Replacing the Demo With Proof of Capability

A product demo is powerful because it makes the abstract real. Without one, you need to give investors other kinds of proof that you can build what you claim.

This could be early outputs from a partially trained model, simulations of your system in action, or evidence that you’ve already solved key technical challenges in isolation. Even showing the progression of your prototypes can create confidence that the product is on its way.

If you have access to proprietary data or exclusive partnerships that will feed your AI, make them part of the story. These are assets that competitors can’t easily match and they signal that you’re building on a foundation others can’t simply replicate.

Keeping the Narrative Human

The danger with AI startups is drifting into a purely technical pitch. While the tech matters, the emotional connection is what sticks.

If you can weave in customer stories, hypothetical scenarios, or even your own “aha” moment that led to the idea, you create a bond between you and the listener. People invest in people, not just in technology.

When you can tell a story that is clear, believable, and emotionally engaging, you take away the biggest weakness of being pre-product—you give people something they can picture, repeat, and rally behind.

Building Market Credibility Before You Launch

Without a live product in the market, credibility is not something you inherit—it’s something you construct piece by piece. The moment you start talking publicly about your AI startup, every conversation, every mention, and every signal you put out begins shaping how the market sees you. The goal isn’t to convince people you’re bigger than you are. The goal is to convince them that you are exactly the type of team that will turn an idea into a market leader.

Owning a Clear Position in the Conversation

The easiest way to vanish into the noise is to talk about AI in broad, generic terms. If you want credibility, you need a sharp point of view that you can repeat consistently. This means staking a claim in a specific niche or application and speaking about it with authority. Even before your product exists, you can position yourself as an expert in that space by sharing insights, data, and informed predictions.

Investors and potential partners watch for founders who understand their market deeply enough to say something worth hearing. If you can identify trends before they become obvious, or explain complexities in a way that decision-makers understand instantly, you signal that you’re not just building—you’re leading.

Making Early Moves That Signal Momentum

In a pre-product stage, your credibility comes from motion. This can be securing strategic partnerships, running small pilot programs, or gaining access to data sources that competitors can’t touch. Each milestone, no matter how small, becomes a proof point that you are moving forward.

If you can show that you’ve lined up potential customers willing to participate in trials once the product is ready, you turn a future “maybe” into a current “yes.” These commitments give investors confidence that demand exists and that you already have a foot in the door with your market.

Using IP and Patents as Strategic Assets

For AI startups, intellectual property can be a credibility multiplier, especially when you don’t yet have a product. Filing patents, securing trademarks, or building proprietary datasets shows you are serious about creating defensible value. It tells the market that you’re not just chasing a trend—you’re protecting something that will matter later.

If you’re working with partners who can help you navigate the patenting process early, that can be a major advantage. Being able to say “we have filed for protection on our core methods” changes how investors evaluate your long-term potential. It shifts you from being one more AI idea to being an AI company with assets.

Becoming Visible in the Right Circles

Credibility grows faster when the right people talk about you. This means making sure your name, your company, and your vision are showing up where industry decision-makers spend their attention. Speaking at targeted events, contributing to respected publications, and engaging with influential voices in your sector can all raise your profile without requiring a finished product.

Visibility is not just about volume—it’s about placement. A thoughtful comment in a high-value industry discussion can do more for your positioning than a dozen generic blog posts. The goal is to be seen as someone shaping the conversation, not just following it.

When you treat credibility-building as an active part of your pre-launch phase, you create the kind of anticipation that makes your eventual product debut feel like the natural next step in a story the market is already invested in.

Turning Your Technology Roadmap Into an Investor Confidence Tool

When you don’t have a product in hand, your technology roadmap becomes the clearest proof of how you plan to get there. To investors, it’s not just a timeline—it’s a window into how you think, prioritize, and execute. A vague or overly optimistic roadmap signals guesswork. A clear, realistic one shows discipline and foresight, two qualities that matter as much as technical brilliance.

Making the Roadmap Tangible

A strong roadmap turns abstract ambition into visible, trackable progress. Instead of dropping vague milestones like “launch MVP in six months,” break your plan into clear phases that show what happens before launch, at launch, and after. Even without revealing sensitive details, you should be able to explain what’s being built, why it matters, and how each stage moves you closer to a market-ready solution.

For AI startups, this means showing the logical sequence of tasks like data collection, model training, validation, integration, and deployment. If certain stages depend on securing external resources—like cloud compute capacity, labeling support, or specialized datasets—call that out. It proves you’ve thought through not just the technical build, but also the operational realities.

Balancing Ambition With Credibility

The biggest trap in pre-product pitches is creating a roadmap that’s too aggressive. While it may seem like fast timelines will excite investors, unrealistic projections often have the opposite effect—they make you look inexperienced. Experienced backers know AI development is full of unexpected delays, from data quality issues to model drift.

Instead of selling speed at all costs, sell momentum with credibility. Show that you’re building in ways that reduce risk, validate early assumptions, and deliver usable outcomes at each stage. If you can explain how your roadmap allows for iteration and feedback, it communicates that you’re not just racing—you’re learning as you go.

Connecting the Roadmap to Commercial Goals

A roadmap isn’t just a technical document; it’s a business growth plan. Every milestone should link to something measurable in the market. This might mean that early model prototypes are being tested with selected customers, or that a private beta is aligned with a specific sales push.

When you can connect technical milestones to commercial outcomes, you make it easy for investors to see the return on each phase of your development. It’s not “we’ll build this feature by Q3,” it’s “this feature will allow us to sign our first three enterprise pilots in Q3.” That shift changes the entire tone of the conversation.

Using the Roadmap as a Living Proof Document

One of the best ways to keep investor interest alive pre-launch is to keep updating them with visible progress against your roadmap. Every achieved milestone becomes another reason for them to believe you can deliver. This doesn’t mean flooding them with technical updates—it means sharing just enough to show that what you promised is happening on schedule.

Handled well, your roadmap becomes more than a planning tool. It becomes a trust-building device. It shows that even without a product in the market, you operate like a company that delivers. And in early-stage investing, that perception is sometimes all it takes to open the door to the next conversation.

Securing Early Supporters and Strategic Partners Before Launch

When you don’t yet have a product, the people and organizations willing to stand behind you become a critical part of your story. Early supporters do more than cheer from the sidelines—they signal to investors and the market that your idea already has traction in the minds of credible players.

Strategic partners, in particular, can create an instant bridge between your current stage and future market access.

Why Early Support Matters More Than You Think

In a pre-product stage, you don’t have revenue or user growth to point to. What you can point to is validation from people who know your space. This could be respected advisors lending their name to your venture, early adopter customers committing to pilots, or industry insiders willing to vouch for the importance of the problem you’re solving.

The presence of these early believers shifts perception. Instead of being a startup trying to convince the world on its own, you become part of a growing network that is already leaning toward your success. Investors read these signals as proof that your market understands and supports your vision, even before it’s tangible.

Finding Partners Who Add Real Leverage

Not all partners are equal. In AI especially, strategic partnerships can unlock access to data, distribution channels, and technical resources that would take you years to build on your own. The right partner can shorten your development cycle, reduce your costs, or give you an immediate credibility boost.

For example, partnering with an established player in your target industry can open doors to customer insights and integration opportunities. Collaborating with research institutions can strengthen your technical capabilities and give you access to talent pipelines. Aligning with cloud providers or AI infrastructure companies can ensure you have the resources to scale when the time comes.

Creating Partnerships Without a Product

You don’t need a finished product to start forming valuable relationships—you need a compelling story and a clear ask. When approaching potential partners, focus on the shared upside. Explain how being involved early gives them an advantage, whether it’s shaping the final product, securing exclusive access, or positioning themselves as innovators in their field.

Offering structured ways for partners to engage before launch can make it easier for them to say yes. This could be as light as joining an advisory group, or as committed as signing a letter of intent to test the product once it’s ready. The key is to make their involvement feel low-risk but high-potential.

Turning Early Relationships Into Momentum

Once you have even a few credible supporters, make sure the market knows about them. Featuring advisors on your website, mentioning pilot customers in conversations, or highlighting partnerships in investor updates helps create the impression of a growing ecosystem around your startup.

Handled well, early supporters become your most persuasive advocates. They can open doors to more investors, more partners, and even your first hires. And because they’ve been involved before launch, they’re more likely to be invested—personally and professionally—in helping you succeed once you do hit the market.

Conclusion

Positioning an AI startup before you have a product is not about pretending you’re further ahead—it’s about proving you’re already on the path to winning. Without a demo or live users, your credibility comes from clarity, momentum, and the network you build around your idea.

Investors and partners want to see that you understand your market deeply, have a believable roadmap, and can attract the right people and resources even before launch. Every conversation, early supporter, and proof point should work together to tell one story: that your startup is inevitable.

When you frame your vision with precision, back it with tangible progress, and surround it with credible advocates, you create a presence that makes the market take you seriously now—so that when your product finally arrives, the world is already waiting for it.