In the world of hardware startups, traction often feels like a chicken-and-egg problem. Investors want to see proof that your product has market demand, but you might not have sales yet—especially if you’re building complex technology that takes time to develop. For many founders, the challenge isn’t whether the product works; it’s showing the outside world—especially potential backers—that the market believes in what you’re building.

When you’re in software, traction without revenue might be as simple as showcasing user growth, app downloads, or engagement metrics. But in hardware, especially deep tech like robotics or AI-enabled devices, those signals aren’t always available early on. Instead, you need to find other ways to make your progress tangible and convincing.

The truth is, traction without revenue is entirely possible. You just have to know how to measure and present it in a way that makes investors lean forward. And while the tactics differ from business to business, the principle is the same: you must create proof that people care enough about your product to engage with it—before money changes hands.

Why “Traction” Doesn’t Always Mean Revenue in Hardware

In the startup world, “traction” has almost become a magic word. It signals to investors that something is working, that a product is connecting with its market, and that the business is on a path to growth. But in hardware, the way traction is measured can look very different from the software playbook.

For a SaaS startup, traction might be a chart of paying subscribers, a rising monthly recurring revenue figure, or an increase in customer lifetime value. But in hardware—especially in robotics, AI-powered devices, or complex consumer products—there’s often a long road between the first concept and the first sale.

You might spend months or even years in R&D, prototyping, compliance testing, and manufacturing setup before a customer can even buy your product. If you only defined traction as revenue, you’d be ignoring the progress you’ve already made.

The reality is, hardware investors understand that early sales are not always possible. What they want instead is evidence that you’re solving a real problem, that your solution is viable, and that there’s a market willing to engage. They want to see signals of momentum—proof that you’re not building in a vacuum.

The Misconception About Revenue as the Only Proof

Many founders fall into the trap of thinking, “If I’m not making money yet, I don’t have traction.” That belief is both limiting and misleading. Traction is about momentum, not just transactions. In hardware, you can have enormous traction without a single dollar coming in, provided you can point to meaningful evidence of progress.

Think about it from the investor’s perspective. If you’re pitching a robotics product designed for warehouse automation, your first purchase order might take months after building a production-ready unit.

But if, in the meantime, you have a signed letter of intent from a top logistics company, a successful pilot in two warehouses, and engineering validation from a respected industry body, you’ve demonstrated traction in a way that’s arguably more compelling than early revenue.

This is especially true for deep tech and regulated industries. A medical device startup might not generate revenue for years due to regulatory requirements, but an investor could still see strong traction through clinical trial results, hospital partnerships, and endorsements from leading surgeons.

Why Hardware Timelines Require a Different Mindset

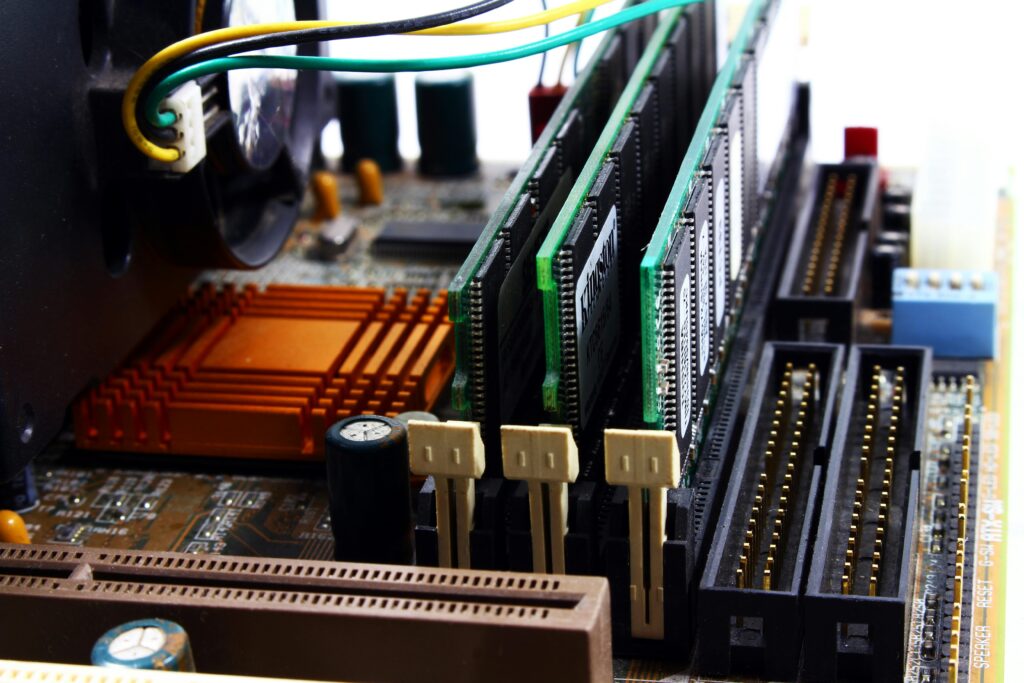

Hardware development is a different beast. The timeline from idea to market is longer, the capital needs are higher, and the stakes for production quality are huge.

A software bug can be patched in hours; a hardware defect in production can delay a launch by months and cost thousands to fix. That’s why hardware founders need to communicate progress in a way that makes sense for the physical world.

You can’t show monthly active users while still in the prototyping phase, but you can show engineering milestones reached ahead of schedule.

You can’t show conversion rates before launching, but you can show increasing engagement from potential customers at trade shows, industry events, and private demos.

The proof investors are looking for is evidence that each stage of your journey is being completed efficiently and with market buy-in. That’s why the most successful hardware founders treat traction as a mix of technical validation, customer validation, and ecosystem engagement.

The Three Pillars of Non-Revenue Traction in Hardware

While every startup is different, most hardware founders can think about traction in three broad categories. These aren’t official investor checkboxes, but they’re patterns you’ll see in companies that raise successfully without revenue.

The first is technical progress—clear proof that the product is being developed toward a functional, market-ready version. This could be working prototypes, patents filed, or successful lab tests. It’s about showing that your technology isn’t just a concept on paper.

The second is market validation—evidence that the right customers are aware of, interested in, and willing to adopt your product when it’s ready. This could be letters of intent, beta tester waitlists, or strong engagement at industry showcases.

The third is ecosystem credibility—signals that respected people or organizations believe in your product. This could come from partnerships, accelerator acceptance, awards, or media coverage. It’s about showing that your idea has weight beyond your own team’s enthusiasm.

Shifting the Investor Conversation

The way you talk about traction can either make or break your early fundraising conversations. If you walk into a meeting and say, “We don’t have revenue yet,” you’ve already set the wrong tone. Instead, you want to say, “Here’s what we’ve achieved so far, and here’s why it’s a clear signal of demand.”

Investors don’t expect early-stage hardware companies to be profitable—or even selling yet—but they do expect you to have a story about how you’re moving from concept to market.

When you can confidently explain the milestones you’ve hit and how they directly connect to future sales, you make the absence of revenue a non-issue.

For example, if you’re building an AI-enabled prosthetic arm, telling investors that “we’ve secured three pilot programs with leading rehabilitation centers, signed NDAs with two major prosthetics distributors, and completed 80% of our certification testing” gives them a picture of a company on the move.

They can connect the dots to future revenue because you’ve shown them that your technology is real, customers are interested, and the path to market is mapped out.

Why Traction Without Revenue Can Be Even More Convincing

Here’s the surprising truth: in some cases, traction without revenue can be more persuasive than early revenue numbers. That’s because small early sales can sometimes distort the picture. If you’re selling a handful of units at a heavily discounted price, it might look like your product isn’t ready for scale.

But if instead you’ve built a 500-company waitlist, secured a government grant for manufacturing, and completed successful pilot programs, you’ve given investors a bigger reason to believe in long-term potential.

Many hardware investors look for depth of validation, not just speed of sales. They want to see that when your product is ready, adoption will be strong and sustainable. That’s why an in-progress but well-validated product can be a stronger bet than one with minimal, unproven sales.

Recognizing the Right Signals to Track and Share

The key to proving traction without revenue is deciding which signals matter most for your specific hardware product. A robotics startup will have different proof points than a consumer wearables company. The secret is to pick metrics and milestones that are both impressive and relevant to your target market.

If you’re building for enterprise customers, you might focus on pilot project results, manufacturing readiness, and strategic partnerships. If you’re targeting consumers, you might highlight pre-launch media buzz, influencer interest, and prototype feedback from target demographics.

What matters most is that you tie each proof point to your bigger growth story. If you can say, “We achieved this milestone, which moves us closer to X customers at Y price point within Z months,” you’re not just sharing progress—you’re mapping the road to revenue.

How to Turn Prototypes and Pilots into Convincing Traction Signals for Investors

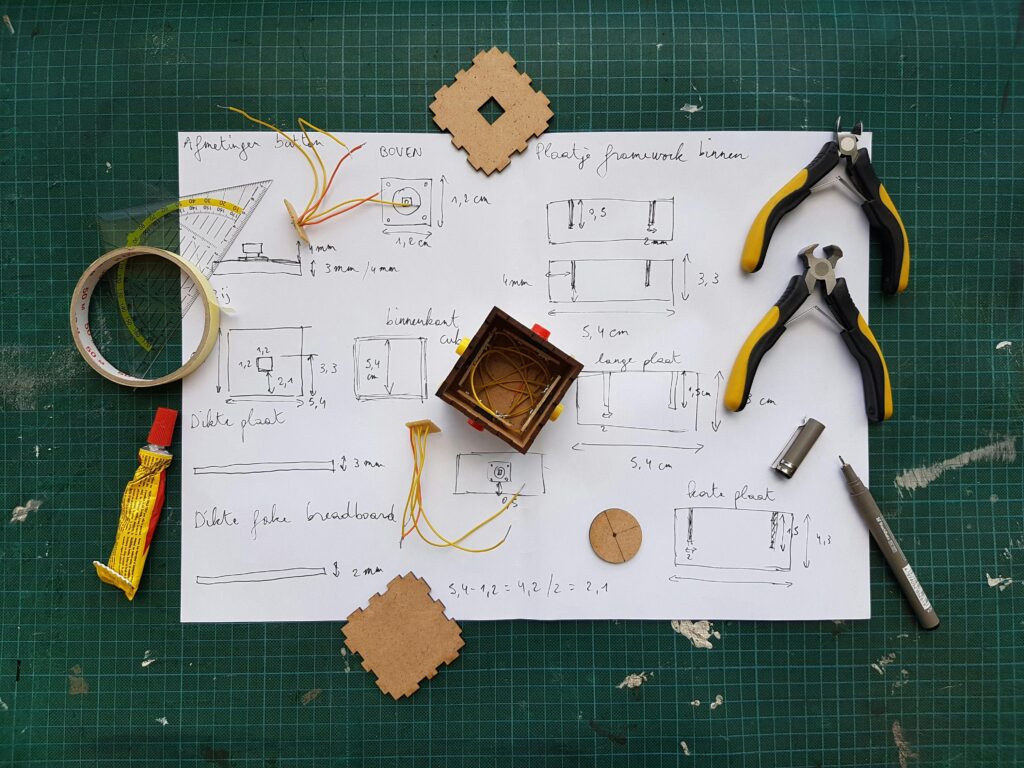

In hardware, your prototype is more than just a rough version of your product—it’s a powerful storytelling tool. It’s the bridge between your vision and an investor’s imagination. While a deck full of renderings and concept diagrams might excite them, a tangible, functioning prototype makes them believe. But the real opportunity lies in what you do with that prototype once it exists.

The goal is not simply to have a prototype; it’s to leverage it as a magnet for attention, partnerships, and commitments that prove your market exists. That means thinking about your prototype and any early pilots not as internal milestones, but as marketing and validation assets.

Prototypes as Proof of Capability

An investor can hear about your technical idea and think, that sounds great, but until they see it in action, it remains abstract.

When you put a prototype in front of them, even if it’s not polished, it shifts the conversation from theory to reality. They’re no longer imagining if you can build it—they’re starting to think about how far you can take it.

The secret is to make your prototype feel alive, not just functional. This is not about over-engineering or making it perfect—it’s about making it credible.

In robotics, that might mean demonstrating the core movement or AI decision-making in a simple, reliable way. In consumer hardware, it might mean a version that shows the design intent and the main features, even if the battery life or durability isn’t final.

The magic happens when you can connect that prototype to a specific market need. If you’re showing an AI-powered inspection drone, don’t just show it flying—show it capturing and processing data relevant to a real-world problem, like detecting cracks in solar panels. That instantly ties your technical capability to a measurable, valuable outcome.

Pilots as the First Step Toward Market Validation

If the prototype is your proof of capability, the pilot is your proof of relevance. A pilot project places your product in the hands of real users in a real environment, even if only for a short time. It transforms your pitch from “we believe this will work” to “we’ve seen it work here, with these results.”

Pilots are one of the strongest traction signals you can have without revenue, but they need to be designed strategically. The biggest mistake founders make is running a pilot without a clear set of outcomes to measure. A vague “try it and tell us what you think” approach will yield feedback, but it won’t give you the crisp, investor-ready proof you need.

Instead, go into a pilot with defined success metrics. For example, if you’re testing a warehouse robot, decide that the goal is to reduce picking time by 15% or decrease worker strain injuries by a certain percentage. These numbers give you hard data to share later, turning an anecdote into a business case.

Making Pilots Work for You Before They’re Finished

You don’t have to wait until a pilot is complete to extract value from it. Simply announcing that you’re running a pilot with a recognized partner can be a credibility boost. A line in your pitch that says, “Currently piloting with [well-known company]” signals to investors that others see potential in your product.

You can also create content during the pilot that helps build your story. Short videos of the product in use, quotes from early testers, and behind-the-scenes glimpses all make your journey more visible. This visibility can generate interest from future partners or customers before you’ve even finished testing.

Turning Technical Wins into Investor Language

Investors might appreciate your technical achievements, but what they care about most is how those achievements translate into business outcomes. If your prototype now functions with 20% less power consumption than planned, don’t just say that—explain that it means lower manufacturing costs, longer battery life for customers, or a new competitive advantage.

Every improvement you make during prototyping or piloting should be reframed as a business benefit. For example:

- A faster production process becomes shorter time to market.

- An increase in range or precision becomes broader market applicability.

- A simplified assembly design becomes a stronger margin per unit.

By framing technical wins this way, you help investors connect the dots between your engineering progress and the market impact they’re betting on.

Positioning Pilots as Commitments, Not Experiments

One subtle but powerful shift you can make is to present pilots as the first step in a commercial relationship, not as a free trial. While pilots are often unpaid in early stages, you want to communicate that they’re part of a journey toward adoption.

That could mean having an MOU (memorandum of understanding) that outlines the conditions for a future purchase, or it could mean structuring the pilot so that success metrics automatically lead to a larger rollout. This doesn’t just look better in investor conversations—it also trains your pilot partners to think of themselves as future customers.

Stacking Multiple Pilots for Bigger Impact

A single pilot can be powerful, but multiple pilots running in parallel—especially in different industries or geographies—can make your traction story irresistible. It shows that your solution isn’t just relevant in one narrow scenario, but has broader applicability.

For example, if your robotic arm is being tested in both an automotive manufacturing plant and a food processing facility, you’ve instantly expanded your perceived market size. The key is to highlight how these different pilots confirm different aspects of your product’s value, from precision and speed to safety and adaptability.

Showcasing Prototypes and Pilots in Your Pitch

When you talk about your prototype or pilot in an investor meeting, don’t bury it in the middle of your deck. Make it one of the emotional peaks of your presentation. Show a short clip of the prototype in action early in the conversation. Share a customer quote from a pilot that hints at future adoption. Bring a physical unit if possible—let them touch it.

The aim is to move your audience from passive listening to active interest. When they can see, hear, or even hold part of your vision, you’ve broken down one of the biggest barriers to belief.

The Narrative Arc: From Prototype to Revenue

Your prototype and pilot aren’t just milestones—they’re the foundation of a narrative that connects today’s progress to tomorrow’s revenue. You want to be able to say:

“We built this prototype to prove the technology works. We ran these pilots to prove the market wants it. Now, we’re raising funds to scale production and capture the demand we’ve validated.”

That sequence is simple, logical, and satisfying. It reassures investors that you’re not guessing your way forward—you’re building with proof at every step.

How Partnerships, Press, and Third-Party Validation Can Replace Early Revenue as Proof of Traction

When you don’t have revenue yet, you need other people’s belief in your product to carry weight in the market. Partnerships, press coverage, and endorsements from credible third parties can act as powerful substitutes for early sales. They help you borrow trust, credibility, and visibility from people or organizations who already have the ear of your target customers—or of the investors you want to attract.

The beauty of this approach is that it shifts the conversation from “We think our product is valuable” to “Others with influence in this industry think our product is valuable.” This external validation helps de-risk your startup in the eyes of potential backers, making them more comfortable taking the leap with you before your first unit is sold.

Strategic Partnerships as Validation Engines

A strategic partnership in the early stages of a hardware company is less about joint revenue and more about symbolic alignment. When a respected company in your industry decides to work with you—even if it’s only for co-development, early testing, or access to facilities—it signals to investors that your idea has passed a filter they trust.

For example, a robotics startup partnering with a well-known manufacturing brand to run trials gains instant credibility, because it shows that a serious player in the field believes your technology is worth exploring. Even better, partnerships like these can open doors to distribution, supply chain support, or co-marketing opportunities later.

But partnerships don’t just happen—you need to approach them strategically. That starts with understanding what value you can bring to the partner. If you can help them test new markets, lower costs, or explore innovative capabilities, they have a reason to attach their name to yours. Even if they aren’t paying you yet, that association becomes part of your traction narrative.

Press Coverage as Social Proof

In the absence of revenue, media coverage can function as another form of traction. The right press piece does more than raise awareness—it positions you as part of the conversation in your industry.

However, not all press is equal. A short blurb in a generic startup roundup won’t have the same impact as an in-depth feature in an industry-specific outlet your target customers actually read. If you’re building an AI-powered agricultural robot, a glowing write-up in Modern Farmer or AgFunder News might matter more than a mention in a big tech blog.

Press coverage works best when it’s timely and tied to tangible progress. Launching a prototype? Opening a pilot program? Securing a government grant? Each of these is a newsworthy hook you can use to pitch journalists.

And once you land that coverage, you can leverage it in investor conversations, on your website, and in outreach to potential partners. The key is to frame the story around the impact you’re making, not just the product features.

Third-Party Validation from Experts and Institutions

Sometimes the most powerful form of traction is having a credible, independent authority say your technology works. This can come from industry awards, competition wins, academic collaborations, or certifications.

For instance, if you’re developing a new battery technology, having it tested and endorsed by a respected engineering lab can carry more weight than a handful of early sales. If your medical device wins approval to begin clinical trials, that’s not revenue, but it’s a major validation milestone investors understand.

Even small forms of third-party validation—like being selected for a competitive accelerator program—signal that others have vetted your team and your product. These wins become part of the story you tell about momentum, market interest, and readiness to scale.

Making Partnerships and Validation Visible

Simply having partnerships or endorsements isn’t enough—you need to present them in a way that reinforces your traction story. That means:

- Including partner logos on your pitch deck and website.

- Quoting respected individuals who’ve praised your work.

- Publicly announcing collaborations in press releases and on social media.

Visibility is critical because it multiplies the credibility effect. The more people see respected brands and experts linked to your product, the more they assume you’re doing something important.

Turning Soft Commitments into Hard Signals

Not all partnerships or validations are created equal. A verbal “we like what you’re doing” is nice, but it won’t carry much weight with investors. What you need are concrete signs of commitment, even if they don’t involve money yet.

That could be:

- A signed letter of intent stating that a partner plans to buy or deploy your product once it’s available.

- A joint press announcement outlining plans to explore your technology together.

- A co-authored whitepaper or case study showing results from early tests.

The more tangible the commitment, the stronger the traction signal. It shows investors that you’re not just collecting polite interest—you’re building real momentum toward adoption.

How External Validation De-Risks Hardware

One of the reasons investors like seeing external validation is because it helps reduce the perceived risk of hardware. Unlike software, hardware requires significant upfront investment in production before scaling is possible. External validation—whether from a partner, the press, or a third-party expert—reduces uncertainty about whether that investment will pay off.

Think of it as a chain of belief. You believe in your product, your team believes in it, and now, external players who could choose to ignore you are signaling that they believe in it too. That social proof builds confidence in the market opportunity, even before the first sale.

The Cumulative Effect of Multiple Validation Sources

The real magic happens when you combine these elements. A startup that has:

- A strategic partnership with a recognized industry leader.

- A feature article in a respected trade publication.

- A technical endorsement from a credible third-party institution.

…is operating with a triple layer of borrowed credibility. Each piece reinforces the others, creating a network of validation that makes investors far less concerned about the absence of revenue.

When you can weave these signals together into a cohesive story—one where multiple external voices are pointing toward the same conclusion—you give your startup the appearance of inevitability.

And that’s what investors love: the sense that it’s only a matter of time before your product hits the market and begins generating sales.

Building a Traction-First Pitch That Wins Investors Before the First Sale

If you’re raising money for a hardware startup before you have revenue, your pitch must work twice as hard. It needs to persuade investors that the absence of sales isn’t a red flag—it’s simply a natural stage in your journey.

The way to do this is by building a traction-first pitch, where every slide, every sentence, and every proof point reinforces the idea that momentum is already on your side.

This is not about padding your deck with fluff or overhyping early wins. It’s about taking the real traction you’ve built—whether from prototypes, pilots, partnerships, press, or third-party validation—and weaving it into a compelling narrative that makes investors believe they’re stepping onto a moving train, not buying a ticket for a train that’s still on the tracks.

Starting with Momentum, Not the Product

Most founders instinctively open their pitch with a product overview. In early hardware fundraising, this can be a mistake. Leading with a detailed technical description before you’ve established credibility can cause investors to focus on what’s missing—namely, revenue.

Instead, start with momentum. Show that you’re already making things happen in the market. That could mean opening with a headline achievement, like:

- “Currently piloting with three Fortune 500 companies.”

- “Selected as one of only 12 startups in the [well-known accelerator program].”

- “Featured in [industry-leading publication] as a top innovation to watch.”

By starting here, you immediately shift the conversation from if the market cares to how much the market cares. Once investors see that others are engaged, they’re far more open to hearing your technical story.

Framing Traction as a Chain of Evidence

Without revenue, you need a clear and logical sequence of proof points that leads naturally to future sales. This is where many founders lose investors—not because they lack traction, but because they present it as scattered wins rather than a coherent chain of evidence.

Think of it like a courtroom case. Each piece of traction should build on the last, leading to the conclusion that customers will buy once the product is available. For example:

- Prototype works – you’ve proven the technology.

- Pilots deliver measurable results – you’ve proven it works in real environments.

- Partners commit to next steps – you’ve proven that adoption is likely.

This structure makes the absence of revenue feel like a temporary detail, not a gap in your story.

Using Numbers to Anchor Perception

Even without sales, you can use numbers to make your traction feel concrete. Numbers anchor investor perception—they make your progress feel real and measurable.

Instead of saying “We’ve had strong interest,” you can say “We’ve built a waitlist of 2,000 targeted customers in under three months.” Instead of “Our pilot went well,” you can say “Our pilot reduced process time by 17% over four weeks.”

Numbers don’t just quantify your progress—they make your story sound like business, not just hope. And in early hardware pitching, that’s essential.

Anticipating and Pre-Empting Objections

Any investor hearing “no revenue yet” is going to have questions. The worst thing you can do is avoid the topic. The best thing you can do is acknowledge it and explain why it’s not a problem.

This could sound like:

“We haven’t launched commercially yet because our certification process is scheduled for completion in six months. In the meantime, we’ve secured [X] pilot partners and signed [Y] letters of intent, representing [Z] potential revenue in our first year post-launch.”

By showing that you’ve thought about the revenue path and are already taking steps toward it, you reduce the perceived risk and keep the conversation moving forward.

Weaving Investor Logic into Your Story

Hardware investors don’t just want to see that your product works—they want to believe that the market will move quickly once you launch. To make that case, your pitch should answer three unspoken questions:

- Is there real demand for this?

- Is this team capable of delivering it?

- Is now the right time?

Everything you include in your pitch should connect back to one of these points. Press coverage shows market interest. A strong prototype shows capability. Industry trends or regulatory shifts can show why timing is on your side.

When you build your pitch around these core investor concerns, you keep the focus on opportunity instead of risk.

Positioning Fundraising as Fuel for Acceleration

Investors don’t want to fund slow progress—they want to fund acceleration. That means you need to position your raise as the missing piece that will take you from proven traction to market dominance.

For example:

“With our current resources, we can complete two more pilots over the next 12 months. With this round, we can scale manufacturing, expand to 10 pilot programs in key industries, and enter the market with signed orders in hand.”

This framing makes it clear that you’re already on the path, and their money isn’t for figuring things out—it’s for capitalizing on momentum you’ve already built.

Making the Absence of Revenue an Advantage

One of the most overlooked tactics in pre-revenue pitching is reframing the lack of sales as a strategic choice. You might say:

“We made the deliberate decision not to launch prematurely. This allowed us to refine the product through targeted pilots, secure manufacturing agreements, and lock in strategic partners. We’re now entering the market with lower risk and higher adoption potential.”

By presenting it this way, you turn what could be seen as a weakness into a sign of discipline, focus, and market readiness.

Closing with Inevitability

Your closing moments in a pitch are critical. You want investors to leave with the sense that your success is not a question of if, but when. This means ending on your strongest proof point—one that clearly implies future revenue.

It could be a signed agreement, a list of committed pilot partners, or a data point from a successful field test. The key is to make it obvious that the market is already moving in your direction, and their capital will simply accelerate that momentum.

The Mindset Shift for Founders

Finally, building a traction-first pitch isn’t just about slides—it’s about mindset. You need to stop thinking of yourself as a pre-revenue company and start thinking of yourself as a pre-launch company with validated demand.

That mental shift changes the way you speak about your business, the way you answer investor questions, and the confidence you project in every interaction.

When you approach fundraising this way, you stop apologizing for the absence of revenue and start owning the progress you’ve made. And in the world of hardware, that’s often the difference between a “come back later” and a signed term sheet.

Conclusion

Proving traction without revenue in hardware is not only possible—it can be your strongest advantage when done right. By turning prototypes into proof of capability, pilots into proof of relevance, and partnerships, press, and third-party endorsements into layers of credibility, you create a compelling case that momentum is already on your side.

Investors aren’t funding your past; they’re betting on your future. When you present a traction-first pitch, you show them that the market is already engaging, the technology is validated, and adoption is only a matter of timing. This reframes “no revenue yet” from a weakness into a mark of strategic readiness.

At Tran.vc, we know that early-stage hardware founders need more than capital—they need belief. By building and showcasing traction in the right way, you can secure that belief long before your first sale, positioning your startup for the funding, partnerships, and market entry that turn vision into reality.