Picture this: you finally get that “yes” from an investor. You shake hands. You feel the momentum. And then… the investor’s lawyer or fund admin sends a quiet email that says something like:

“Please complete KYC/AML.”

This part can feel strange the first time. It can also feel personal. “Why do they need my passport? Why do they want to see bank papers? I’m not doing anything wrong.”

Here is the simple truth: KYC and AML are not about you being “suspect.” They are about the investor being allowed to invest.

Most investors, funds, and syndicates are required by law and by their own banks to verify who you are, where money comes from, and whether the deal is clean. If they do not do it, they can get in serious trouble. Their bank can freeze wires. Their fund admin can block the closing. Their regulators can fine them. So they check, even when you are a great founder with a great company.

If you understand what they will ask for, you can move faster and look more prepared. You can also avoid the most common delays that slow down wires for days or even weeks.

This guide will walk you through what you will likely be asked for, why it matters, and how to prepare it so you do not get stuck right when you should be building.

Investor KYC and AML: What You’ll Be Asked For

Why this shows up right after a “yes”

Once an investor agrees to invest, the deal is not truly “done” until the money lands in your company bank account. Between those two moments, there is a compliance step most founders do not expect. That step is KYC and AML. It often arrives as a form, a portal invite, or a short list of documents from the investor, their fund admin, or their legal team.

This is not a test of your character. It is a rule set that investors must follow to protect their fund, their bank relationships, and the people who put money into their fund. If they skip these checks, the wire can be blocked, the deal can be delayed, and in some cases the investor can be forced to return money later.

The best way to think about it is simple. The investor is proving to their bank and their auditors that the money is real, the people are real, and the path of money is clear. When you help them do that quickly, you get to closing faster and you look like a team that understands how serious money works.

A quick note on who is checked

Founders often assume only the investor is checked. In real life, both sides can be asked for things. The investor may need to verify your company and the people who control it. You may need to provide details so they can complete their file and clear the wire.

If your company is outside the investor’s home country, the requests may be more detailed. If the investor is a fund with large limited partners, there may be strict internal rules. If the investor uses a third-party admin, the admin will often ask for more items than a single angel would.

What KYC and AML mean in plain words

KYC means “Know Your Customer.” In this context, it means the investor must know who they are dealing with. They want to confirm identity, ownership, and control. They also want to confirm that the company exists and is allowed to do business.

AML means “Anti–Money Laundering.” It means the investor must check that the money and the deal are not being used to hide illegal funds. They also check that the people involved are not on sanctions lists or linked to certain restricted activities.

Together, these steps create a paper trail. It is not meant to slow you down, but it does slow deals down when founders are not prepared. The goal of this article is to help you be ready so the compliance step becomes a quick formality.

When KYC/AML happens in the deal timeline

The common moment it shows up

In many seed deals, KYC/AML begins after the investor commits and before the wire is sent. Sometimes it starts right after you sign the SAFE. Other times it starts when the investor’s counsel or admin begins closing steps. If you are doing a priced round, it often happens around the time the stock purchase agreement is being finalized.

In practice, the request may arrive when you least want paperwork. You are hiring, building, and talking to other investors. That is why having your documents ready in advance can protect your momentum. The faster you respond, the faster the investor can clear their side and release funds.

What can delay the wire

Delays usually come from small issues, not big ones. A passport photo that is blurry. A proof of address that is too old. A mismatch between your legal name on the document and your name in the cap table. A company record that shows an old address while your SAFE shows a new one.

Another common delay is when founders respond in pieces. They send one document, then wait, then send the next. The investor’s admin often cannot approve anything until the full set is complete. When you send a clean, complete package the first time, you reduce back-and-forth and you keep the deal moving.

How to stay in control of the process

You do not need to become a compliance expert. You just need a simple habit. Treat KYC/AML like a closing checklist item, the same way you treat signatures and banking details. If you handle it early, it stops being stressful and becomes routine.

A good founder move is to ask the investor, right after they commit, “Who handles your KYC/AML and where should we upload documents?” That one question makes you look prepared and helps you plan your timeline.

What investors are trying to confirm

Identity is real and consistent

At the core, investors are checking that the people behind the deal are real human beings, using real names, tied to real documents. They want to see consistency across what you sign, what you claim, and what you submit. If your SAFE says one name and your ID says another variation, it can trigger questions.

This does not mean you did anything wrong. Many founders use short names or have different naming formats across countries. The investor just needs to reconcile them. You can help by using the same legal name across your deal documents and your compliance files.

The company exists and can accept funds

The investor also needs to confirm your company is properly formed and active. They want proof that the entity they are wiring money to is real and in good standing. They also want to confirm the company’s registered address and sometimes its tax ID.

If you have a U.S. Delaware C-Corp, the process is usually smoother because investors see those every day. If your company is registered abroad or has a more complex structure, they may ask for extra supporting documents to understand the ownership and control.

Ownership and control are clear

This is the part that surprises some founders. Investors may ask who owns the company and who controls decisions. They may ask for a cap table or a similar ownership record. They may also ask for details on anyone who owns a large share or has strong control rights.

They ask because AML rules focus on “beneficial owners,” meaning the people who truly benefit from or control the entity. Even if the company is the receiving party, the investor still needs to understand who sits behind it.

Funds and payments are not linked to restricted people

Investors check sanctions lists and other watch lists. They need to confirm they are not doing business with restricted individuals or entities. These checks are often automated. That means a similar name can cause a false match, and then the admin will ask for more documents to clear it.

If you have a common name, or your name matches someone else in a database, do not panic. It happens often. The admin just needs enough details to confirm you are not the same person.

KYC: the specific things you may be asked for

Government ID for key people

A common request is a government-issued ID for each founder and sometimes for other key people. Usually that means a passport. Sometimes a driver’s license or national ID is accepted, but passports are the most widely accepted across borders.

They will want a clear color scan. Many portals reject images that are cut off, too dark, or have glare. If your passport has a signature page or a page with personal details, they usually want the page with your photo and the data lines.

Proof of address

Investors often ask for proof of address, which is usually a recent document showing your name and where you live. A utility bill is common. A bank statement is also common. Some admins accept a lease agreement, but many prefer bills or statements because they show ongoing activity.

The document is usually required to be recent, often within the last three months. If it is older, the portal may reject it automatically. Founders get stuck here because they upload the first thing they find, and it turns out to be outdated.

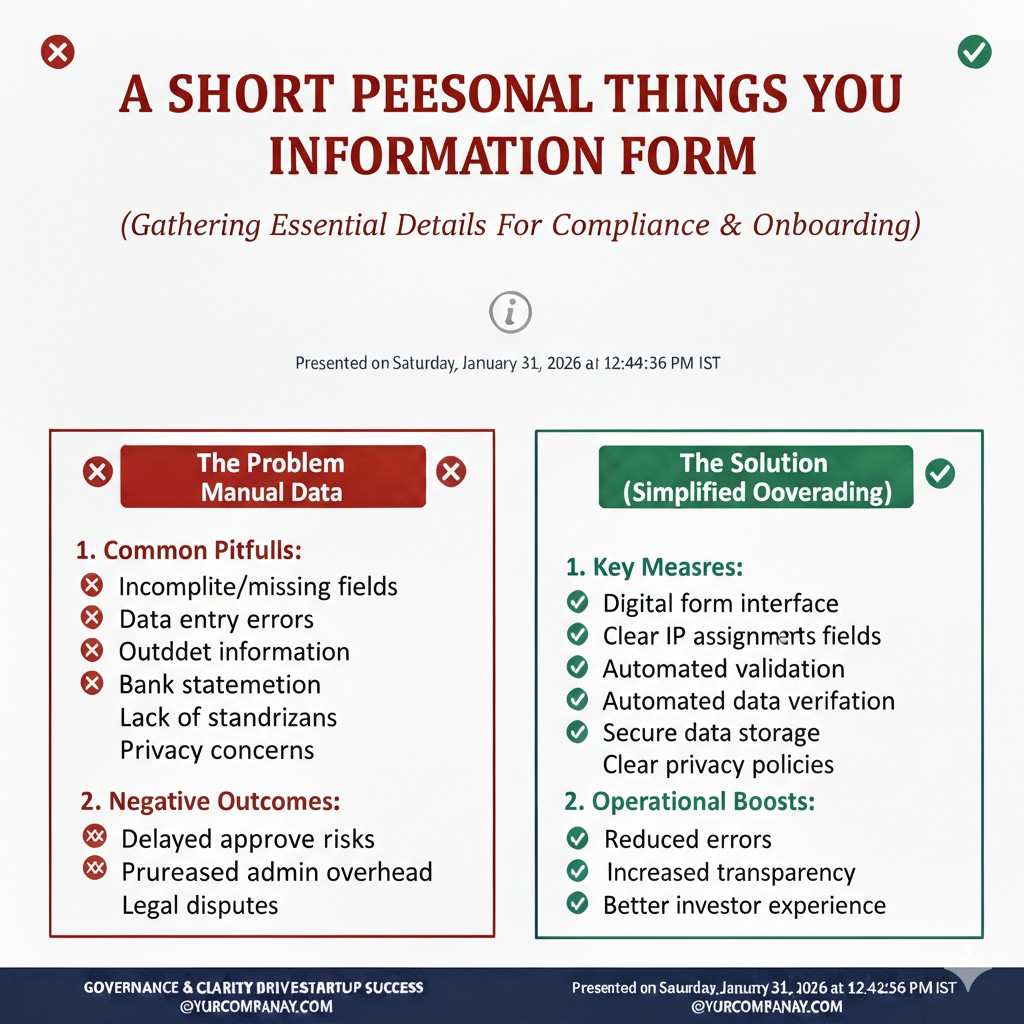

A short personal information form

You may be asked to fill a form with basic details like full legal name, date of birth, nationality, and current address. You might also be asked if you are a “politically exposed person,” which is a standard compliance term.

This is where you should go slowly and be consistent. If you type an address format that does not match the document you upload, it can cause a mismatch. If your name has special characters, try to match your passport format. The goal is not perfection, it is consistency.

Questions about roles and ownership

The investor may ask your role in the company and whether you are a beneficial owner. If you own a large part of the company, you may need to confirm it. If there are other large owners, the investor may ask for their details too.

This can feel like a lot. But it is usually a basic threshold check. Many systems use simple triggers like “anyone above 25% ownership.” If no one crosses the threshold, they may accept a statement saying that.

AML: the specific things you may be asked for

Source of funds and source of wealth

This is the part that makes people uncomfortable, because it sounds like an accusation. It is not. “Source of funds” means where the money for the investment is coming from. “Source of wealth” means how that person earned their wealth in general, such as salary, sale of a company, or long-term investments.

In most cases, founders are not asked to prove the investor’s source of funds. The investor handles that on their side. But you may be asked questions if you are receiving money through a structure that is unusual, or if the investor is an entity that needs deeper checks.

If you are asked for anything here, the right move is to respond calmly and clearly. Simple explanations help. The compliance teams are not looking for a story. They are looking for a clean trail.

Sanctions and watchlist screening

Sanctions checks happen in the background most of the time. You do not see them. If the system flags a match, the admin may ask for extra details like your middle name, a second ID, or a clarification about citizenship.

If you are from a country that is heavily screened, it may trigger more checks. That does not mean you cannot raise. It simply means the investor must do more work to document that the deal is allowed.

Business activity and industry questions

Some KYC/AML processes ask what your company does. They may ask your website, a short description, and your industry. They may also ask if you deal with certain restricted industries.

This is a good moment to keep your answer clean and simple. If you are an AI or robotics startup, say what you build, who it is for, and how it is used. You do not need to oversell. You just need to make the business easy to understand for someone who is not deep in your field.

Bank details and payment verification

At some stage, you will provide bank details for the wire. Investors may ask for a bank letter or a voided check, depending on the country and bank. They do this to reduce fraud risk and to make sure the wire goes to the right place.

A common mistake is sending bank details in a messy email thread. It is safer to use the investor’s secure portal when possible. If you must send by email, double-check every digit and confirm the bank name, address, and account holder match your company’s legal name.

Entity checks: what your company may need to provide

Formation documents and good standing

Investors often ask for basic formation documents. For a U.S. company, that could include a certificate of incorporation and a certificate of good standing. Some investors also ask for your EIN confirmation letter.

These documents prove the company exists and is active. If you do not have them ready, you can usually obtain them from your state’s website or through your lawyer. The key is to keep a clean folder for closing documents so you do not scramble each time.

Cap table or ownership statement

Many investors ask for a cap table, even in a SAFE round. They may not need deep detail. They just need to see who owns meaningful chunks and whether there is any unusual ownership pattern that could raise compliance questions.

If your cap table is messy, this is where it will show. A clean, updated cap table is not only good for fundraising. It also makes compliance easy. It reduces questions and helps you close faster.

Board and control information

Sometimes investors ask who controls the company. That could mean board members or managers, depending on structure. If you have a simple early-stage setup, you can often answer quickly.

If you have multiple entities or holding structures, expect deeper questions. Investors may ask for an org chart showing the entities and ownership percentages. This can feel like busywork, but it is standard when structures are complex.

How to prepare so this does not slow your round

Create a “KYC/AML-ready” folder

You can save hours by keeping a simple folder with your core documents. Include clear scans of passports for founders, a recent proof of address for each, and your company formation records. Add your cap table and basic bank details. Keep it updated when you move or renew documents.

This is not about being fancy. It is about being fast. When you can respond in one clean message or one upload session, you protect your momentum and you reduce stress during closing.

Keep your legal name consistent everywhere

Small inconsistencies create big delays. Use your legal name on SAFE signatures, investor forms, and portal entries. If you prefer a short name socially, keep it for email signatures, but use your legal name in documents.

If your name has multiple parts or different order across documents, add a short note to the admin. A single sentence like “My full legal name on passport is X; I sign as Y in email” can prevent unnecessary confusion.

Use high-quality scans and keep them readable

Compliance tools often reject low-quality images. Use a phone scanner app or a proper scanner. Make sure the full document is visible, including corners. Avoid shadows and glare. Save as PDF or high-res image.

These details matter because many portals do automated checks. If you pass the automated check, you often clear within hours. If you fail it, a human has to review it, and that is where timelines stretch.

Make your company story easy to understand

When asked what you do, avoid jargon. Clear sentences help. If you build robotics software, say what the robot does, who uses it, and where it operates. If you build AI models, say what problem it solves and what data it uses at a high level.

This is also useful beyond compliance. Investors often forward these descriptions internally. A clear description reduces internal friction and helps your champion inside the fund move faster.

A founder’s perspective: why this matters beyond paperwork

It signals maturity to investors

Fast, clean compliance responses make you look like a team that can handle growth. Investors notice this. It reduces their fear of operational chaos. It also makes them more willing to introduce you to other investors, because they know you will not create friction.

In early-stage fundraising, small signals matter. Most startups are similar at the surface level. The teams that move well through process stand out.

It protects your company from wire fraud

There is a real reason investors are strict about bank details. Fraud is common. Hackers target founders during fundraising because wires are large and timing is emotional. When you treat bank details as sensitive and follow secure steps, you protect yourself.

If you ever receive a strange email asking to change wire instructions, treat it as a red flag. Call the investor using a known number. Confirm through a second channel. It is better to be slow for five minutes than to lose a wire.

It keeps your round moving when you have leverage

Momentum is leverage. If you lose momentum due to paperwork delays, other investors can hesitate. They may think something is wrong. Even when nothing is wrong, a slow close can change the tone of your round.

That is why being KYC/AML-ready is not just compliance. It is fundraising strategy. It helps you keep control of the timeline.

Tran.vc note: IP-first founders should plan for this early

Why deep tech teams often get more questions

If you build in AI, robotics, or other deep tech fields, investors sometimes ask more questions because your company may operate across borders, handle sensitive data, or work with regulated customers. Even if you are early, your business can look “complex” on paper.

That is not a problem. It just means you should plan for smoother paperwork. The stronger your documentation, the easier it is for others to trust you. This is also why building defensible IP early matters. It gives your company structure, clarity, and real assets.

If you are building something hard and valuable, and you want to build leverage early through strong patents and IP strategy, you can apply to Tran.vc anytime at https://www.tran.vc/apply-now-form/

How IP work connects to investor trust

Investors do not only look for tech. They look for proof that the tech can be owned and protected. When your patents and IP strategy are clear, your company looks less risky. It becomes easier for investors to justify checks internally, and easier to move through diligence steps.

This is one reason Tran.vc exists. We help technical founders turn inventions into assets, early, before the round gets crowded and before competitors copy what you built.

You can apply anytime at https://www.tran.vc/apply-now-form/