When a bigger competitor sees your startup, they do not get scared by your pitch deck. They get scared by what they cannot copy. That is what strong IP does. It turns your best ideas—your method, your system, your edge—into an asset that slows down teams with more people, more money, and more reach.

This article is about using IP as a wedge. Not as paperwork. Not as a trophy. As a real, practical tool to win deals, lock in customers, protect pricing, and keep copycats stuck behind you.

And if you are building in robotics, AI, or deep tech and want help doing this the right way—without wasting months or burning cash—you can apply anytime at https://www.tran.vc/apply-now-form/

The hard truth: bigger competitors do not need to be “better” to beat you

If you are early, you are probably doing something fresh. Maybe it is a new control loop for a robot arm. Maybe it is a new way to train a model with less data. Maybe it is a pipeline that turns messy sensor input into clean actions. You might be faster, more creative, and closer to the real problem than any big company.

But big companies have three unfair advantages:

They can copy and ship faster than you expect.

They can sell trust, even when the product is average.

They can outspend you in marketing, hiring, and deals.

This is why “we will just move fast” is not a full plan. Speed matters, yes. But speed without protection turns into a race you do not control.

IP is how you change the race.

IP is how you make it costly for a larger player to copy you. It is how you create friction. And in business, friction is power. When the other side has to slow down, ask lawyers, or take a risk, you get room to breathe. You can keep building while they hesitate.

This is also why the right IP can help you sell. Customers do not always say it out loud, but they worry about betting on a small team. If you can show that you own the core method—and that others cannot simply take it—you reduce that fear. You look less like a “nice demo” and more like a real company.

That is the wedge: the thing you drive into the market so you can open space, even when giants already stand there.

If you want Tran.vc to help you build that wedge (with up to $50,000 in-kind patent and IP work), you can apply here: https://www.tran.vc/apply-now-form/

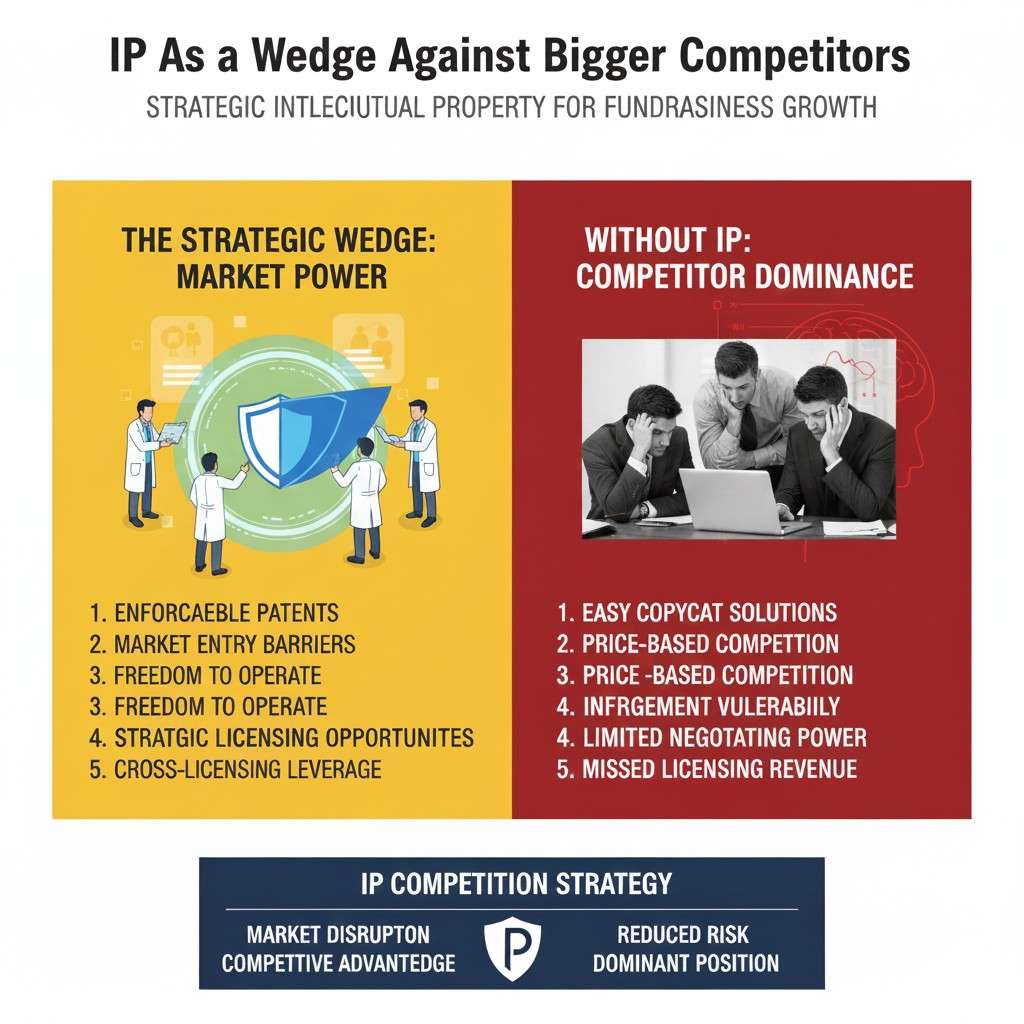

IP as a Wedge Against Bigger Competitors

Introduction: why this matters now

Big competitors do not win because they are smarter. They win because they have more time, more money, and more people. If you are early, that can feel unfair. But you do have something they do not: you can pick one sharp angle and drive it into the market before they even notice what is happening.

That sharp angle is IP when it is used with intent. Not as paperwork. Not as a badge. As a tool that slows down copycats, builds trust with buyers, and makes your startup look “real” to investors.

Tran.vc helps founders do this early, in a clean and founder-friendly way, by investing up to $50,000 in in-kind patent and IP services. If you want to explore it, you can apply anytime at https://www.tran.vc/apply-now-form/

The goal of this article

This piece is meant to be practical. It is not a legal lecture. It is a guide for robotics, AI, and deep tech founders who want to compete with bigger teams without losing control or burning cash on the wrong work.

As you read, keep one thought in mind: the best IP work is the work that protects the part of your product people will copy first.

The hard truth about bigger competitors

They do not need to be better to beat you

Large companies have a steady machine. They can launch features quickly once they decide something matters. They can also reuse teams, tools, and distribution they already have. Even when their product is not special, the market often treats them as the safe choice.

As a startup, you can still win. But you need a plan that does not rely only on speed or hope. You need a way to make the easy path harder for them.

They copy in quiet ways, not loud ways

Many founders imagine copying as a direct clone. In real life, copying is often subtle. A competitor sees your demo, your docs, your blog posts, your job listings, or your open-source repo. They rebuild the core idea with their own branding and then act like it was always their plan.

If your product is truly useful, you should assume copying will happen. That does not mean you should hide. It means you should protect what matters before the market gets noisy.

They win with trust, not just features

In B2B, buyers are careful. They worry about risk, support, and long-term stability. Big companies sell trust even when their tech is average. Startups must earn trust in other ways, and strong IP is one of the cleanest signals you can show.

When you can say, in simple terms, “we own the core method,” the buyer hears something deeper: “we are not easy to replace.”

What IP is really for at the early stage

IP is leverage, not a lawsuit plan

A common mistake is to think patents matter only if you plan to sue. That is not how most startups benefit from IP. The early advantage is that patents shape decisions. They slow down competitors, change partner talks, and give you a stronger position in deals.

A patent does not need to end in court to be valuable. If it makes a competitor hesitate, it already did work for you.

IP helps you sell when you are small

Early buyers want proof that your product is not a one-off demo. They want to know you have something defensible, not just a clever trick. When your IP story is clear, it lowers fear and shortens the “wait and see” delay many startups face.

This matters even more in robotics and AI, where buyers often assume “someone else will build the same thing.” IP helps you counter that assumption with something real.

IP protects pricing power

If competitors can copy your core value fast, the market pushes you into a price fight. Startups usually lose that fight because they cannot discount forever. Strong IP supports a premium story because it protects the path that creates the results customers pay for.

Pricing power is not only about brand. It is also about owning a method others cannot freely use.

What “IP as a wedge” actually means

The wedge is a small part that creates a big opening

A wedge is not the whole product. It is one sharp piece that, when protected, opens space for you. It is the part that makes your startup hard to imitate in the way that matters to the buyer.

The wedge works because it forces the competitor to take a slower route. They can still compete, but they cannot take the shortest path.

A wedge is strongest when it matches a buyer’s pain

The best wedge is tied to a problem customers feel every day. If your patent covers something buyers do not care about, it will not help you win deals. But if it covers the part that delivers the key outcome, it becomes a real business tool.

For example, a robotics company may not win by patenting “a robot with a camera.” They may win by protecting a specific calibration method that cuts install time from weeks to days.

A wedge makes your story simple

Investors and buyers do not want a long explanation. They want one clear reason you are hard to copy. A strong wedge lets you say something like, “We own the core workflow that makes this accurate at low cost,” or “We own the method that makes deployment safe in real factories.”

When your story is simple, people repeat it. That is when it starts working for you even when you are not in the room.

How to find your wedge inside your tech

Start with what would get copied first

Here is a clean way to spot wedge candidates. Imagine your product becomes popular next month. A big company decides they want your market. What is the first thing they would try to copy from your approach?

This thought experiment is useful because it focuses on reality. Competitors copy value, not vanity. They copy what closes deals.

Look for “hidden work” that others overlook

Many deep tech moats live in work that is not obvious. It might be a training pipeline that prevents drift. It might be a sensor fusion method that handles rare edge cases. It might be a motion plan that stays stable even with bad input.

This “hidden work” is often your best wedge because competitors may not notice it until they fail in production. If you protect it early, you make it even harder for them to catch up.

Tie the wedge to a measurable result

A wedge becomes much stronger when it is linked to a clear result. Faster cycle time, lower error rate, fewer support tickets, less downtime, safer behavior, lower compute cost. These outcomes are what buyers and investors remember.

When you can point to a measurable result, your IP becomes more than “legal.” It becomes part of your business narrative.

A practical way to think about patents vs trade secrets

Patents are public, but they create clear ownership

A patent is a public document. That scares some founders. But the public nature is also the point: it draws a clear boundary around what you own. It becomes something you can point to in diligence and deal talks.

In many deep tech areas, patents also travel well. They can be licensed, sold, used in partnerships, and carried across product versions.

Trade secrets are quiet, but they require discipline

A trade secret can be powerful when the method is hard to reverse engineer. But it demands strong internal discipline. You must control access, document what is secret, and avoid careless leaks. A trade secret that is shared too freely is not a secret for long.

In robotics and AI, many teams end up with a mix. They patent what can be described cleanly and is likely to be copied, and keep certain parameters, data work, or tuning methods as secrets.

The best choice depends on how easy it is to copy

If a competitor can figure out your method by watching the product or reading your outputs, a patent is often safer. If the value lives in a private dataset, a hidden process, or careful tuning that cannot be inferred, a secret may work better.

The key is not to choose based on fear. Choose based on how the real world works.

The most common IP mistakes technical founders make

Filing too late, after the market is watching

Many founders wait until they raise money or get bigger customers. By then, the story is already out. You may have shown it in a demo, a pitch, a conference talk, or a partner call. Waiting can reduce options and create risk.

Early does not mean rushing. It means capturing the invention while it is fresh and before it is widely exposed.

Protecting the wrong thing

A patent on a broad idea that is easy to design around will not help you. A patent that does not match your true wedge can even distract you, because it gives a false sense of safety.

Good IP work starts with strategy. What is your wedge, and where does it live in your system? That is where you focus.

Treating IP like a checklist

Some startups file because they think investors want it. That approach leads to weak filings and wasted money. Investors are not impressed by a pile of patents that do not map to real product value.

A small number of strong patents, tied to your wedge, is often better than many vague ones.

How Tran.vc fits into this picture

In-kind IP support that acts like seed fuel

Tran.vc invests up to $50,000 in in-kind patenting and IP services. That means you get real strategic work done early, without giving away control too soon or burning cash you need for product.

This is designed for founders building real tech: robotics, AI, and deep tech systems where a defensible edge matters.

The focus is building an IP-backed foundation

The goal is not just to “file something.” The goal is to build a foundation that supports your product and your future raise. That includes identifying the wedge, shaping claims around it, and making sure your work matches where the market is going.

When IP is done well, it becomes a part of how you build, sell, and raise. It stops being a side project and becomes a core tool.

If you want to see if this fit is right for your startup, you can apply anytime at https://www.tran.vc/apply-now-form/

Turning your product roadmap into an IP roadmap

Why product plans and IP plans must move together

Most startups treat product work and IP work as two separate tracks. Product moves fast. IP is handled later, often in a rush. This gap creates risk. Important inventions get shared before they are protected, and filings end up disconnected from what actually ships.

When product and IP move together, you gain control. You decide which parts of the system matter most and protect them before the market sees them. This does not slow teams down. It gives direction to what should be captured and when.

Using milestones as natural IP checkpoints

Every product roadmap has moments of change. A new architecture. A new training loop. A new deployment model. These moments are perfect checkpoints for IP review. Not to write legal text, but to ask a simple question: did we just invent something that creates leverage?

If the answer is yes, it should be recorded. A short internal note, a diagram, or a clear description is often enough to start. The goal is not polish. The goal is memory. You want to capture the idea while it is still clear in the team’s head.

Protecting systems, not features

Features change. Systems last. When you align IP with your roadmap, focus on the system-level ideas that will stay even as features evolve. In robotics, this might be how perception feeds planning under uncertainty. In AI, it might be how data is filtered, labeled, or reused across tasks.

When your IP protects systems, you stay covered even as your product grows. This is how small teams build long-term protection without constant rework.

Capturing inventions without slowing engineering

Engineers do not need to “think like lawyers”

One fear founders have is that IP work will distract engineers. It does not have to. Engineers do not need to write claims or legal language. They only need to explain what they built and why it is different.

Simple questions work best. What problem did this solve? Why did the old way fail? What steps made it work? These answers are gold for strong IP when captured early.

Make invention capture part of normal work

Invention capture works best when it feels normal. A short review at the end of a sprint. A quick write-up after a breakthrough. A diagram saved in a shared folder. These habits take minutes, not days.

Over time, teams get better at spotting what matters. They start to see which ideas are just implementation and which ideas create real leverage.

Clean records reduce future pain

Clear records help later in many ways. They make patent drafting easier. They reduce confusion about who invented what. They support diligence when investors ask questions. They also help new team members understand why certain choices were made.

This is quiet work, but it pays off when the company starts to grow.

Using IP as a sales tool, without sounding legal

Buyers care about outcomes, not claim numbers

When selling, do not talk about patents like a lawyer. Talk about them like a builder. Focus on what the IP protects in terms of results. Faster setup. Safer operation. Lower cost. More reliable output.

The patent is not the story. The outcome is. The patent just supports why that outcome is hard to copy.

When to mention IP in sales conversations

You do not need to lead with IP. But when a buyer asks, “What stops others from doing this?” or “How do we know this will last?” that is your moment. A calm, simple explanation builds confidence.

You can say something like, “The core method we use is protected. It is not just configuration or tuning. That is why we can stand behind these results.”

IP reduces fear in long-term deals

In robotics and enterprise AI, deals often involve long timelines. Buyers worry about vendor risk. IP helps reduce that fear because it signals intent and seriousness. It shows you are building something meant to last, not just test the market.

This trust can be the difference between a pilot and a real contract.

Using IP in fundraising without overplaying it

Investors look for alignment, not volume

Investors do not want a long list of filings. They want to see that your IP matches your business. One strong story that connects tech, market, and protection is more powerful than many disconnected filings.

When IP lines up with your wedge, it tells investors you understand where value lives.

IP helps you raise with leverage

When you have clear ownership of a core method, you negotiate from a stronger place. You are not just selling momentum. You are showing assets. This matters in early rounds when terms are shaped by perceived risk.

Strong IP can help you avoid bad deals, not just close good ones.

Early IP shows founder maturity

Founders who think about IP early signal long-term thinking. It shows they are not just chasing a quick win. This often matters more to good investors than raw speed.

IP becomes part of your credibility.

How bigger competitors react to strong IP

They slow down before copying

When a competitor sees clear IP around a core method, they pause. They ask legal teams. They look for workarounds. This delay is often invisible to the market, but it gives you time.

Time is the real prize. It lets you deepen customer ties and improve the product.

They may choose a weaker path

Sometimes competitors avoid the protected path and choose a weaker approach. That can leave them with a product that looks similar on the surface but fails in real use. Customers notice this over time.

This is how strong IP quietly protects quality.

They may seek partnership instead

In some cases, strong IP turns competitors into partners. Licensing, integration, or acquisition talks become possible when ownership is clear. Ambiguity kills deals. Clarity enables them.

This optionality is valuable, even if you never use it.

Why early-stage IP work fails without strategy

Filing without a clear wedge wastes effort

Many early filings fail because they are not anchored to a real wedge. They describe ideas that sound technical but do not block meaningful competition. This creates cost without leverage.

Strategy comes first. Paper comes second.

IP must evolve as the product evolves

A startup’s first idea is rarely the final one. Good IP strategy accounts for this. It focuses on core principles that remain even as details change. This keeps protection relevant over time.

Without this mindset, IP becomes stale.

Expert guidance matters more than volume

Early IP choices shape everything that follows. Having guidance from people who understand both tech and startups reduces mistakes that are hard to undo later.

This is one reason Tran.vc focuses on hands-on, expert-led IP work rather than generic filings.

If you want to explore this approach, you can apply anytime at https://www.tran.vc/apply-now-form/