Tax withholding can feel like a “small line item” in a cross-border deal… right up until it delays closing, changes the price, or creates a surprise tax bill months later.

If you are raising money from outside your home country (or investing across borders), withholding tax is one of the first things you should get clear on. It decides who must hold back tax, how much, when it must be paid, and what proof you need so nobody gets stuck later.

And for deep tech founders—AI, robotics, hard engineering—this matters even more because cross-border deals often include things beyond simple equity. They can include license fees, IP assignments, service work, interest, and dividends. Each one can trigger different withholding rules.

Tran.vc works with technical founders early, often before a priced round, to help turn inventions into protected assets. If you’re building something truly new and want to raise with more leverage, you can apply any time here: https://www.tran.vc/apply-now-form/

Why “withholding” exists at all (in plain words)

When money leaves one country and goes to a person or company in another country, the paying country often says:

“Before you send the full amount, hold back some tax and send it to us.”

That “held back” part is the withholding tax.

It is not a penalty. It is not a special fee. It is simply the government making sure it can collect tax from a party that may not have an office or assets in that country.

In many cases, withholding is required even if the receiver ends up owing less tax (or even no tax) after they file. That is why the right paperwork and planning matter. If the withholding is too high and you do not plan for it, someone will feel cheated. It can turn into a dispute fast: “You said you’d pay $X, but I received less.”

Here’s the key idea: withholding tax is usually the payer’s job.

That means the company that sends the money is often the one that must:

- calculate the withholding amount

- keep that amount back

- pay it to the tax office

- file forms on time

- provide a certificate to the receiver

So if you are the startup paying a foreign person or foreign company, you might carry the risk. If you miss it, the tax office may come after you, not the receiver.

This is where deals get messy: everyone focuses on valuation and control, but the closing can get stuck on a simple question:

“Is this payment subject to withholding, and at what rate?”

If you cannot answer that cleanly, lawyers will slow down the deal and investors may push for stronger protections.

The most common cross-border payments that trigger withholding

In venture deals, you may think withholding is only about dividends. But early-stage companies often trigger withholding through other payments first.

A simple way to think about it is: what kind of money is crossing the border?

If it is one of these, you should assume withholding may apply:

Equity purchase price (buying shares)

In many countries, the act of an investor buying shares from a company (primary issuance) does not create withholding tax, because it is not “income” being paid out. It is an investment into the company.

But be careful: if the investor buys shares from an existing shareholder (a secondary sale), some countries treat part of the payment like gain that must be taxed. Whether withholding applies depends on local rules and the seller’s tax status.

Dividends

Dividends are one of the classic withholding areas. Countries often withhold tax when dividends go to foreign shareholders. Rates can be reduced by a tax treaty, but only if you do the paperwork.

Interest (like venture debt or notes)

Interest paid to a foreign lender often triggers withholding. This includes interest on loans, convertible notes (in some cases), and other debt-like items.

Royalties and IP license fees

This is a big one for deep tech. If your startup pays a foreign party for:

- patent licenses

- software licenses

- know-how

- technical IP rights

- use of a brand or process

…many countries call that “royalty” income. Royalties are commonly subject to withholding. Treaty rates can help, but only if you can prove the receiver qualifies.

This is also why having a clean IP plan matters early. If your IP ownership is messy, you may end up needing cross-border assignments or licenses that create avoidable tax friction. Tran.vc’s core work is helping founders build strong, defensible IP early, with real patent support. If you want help building that base, apply here: https://www.tran.vc/apply-now-form/

Services and consulting fees

Payments for services can trigger withholding depending on where the work is performed, how long it runs, and whether the foreign provider is treated as having a “tax presence” in the payer’s country.

Founders hit this when they hire overseas contractors, overseas R&D teams, or foreign advisors.

Capital gains (sale of shares)

When a foreign investor sells shares in your company, the tax question is usually about where the gain is taxed. Some countries tax gains on local company shares even if the seller is foreign. Some require withholding by the buyer. Many do not. It depends.

This becomes real during exits: if you sell to a buyer in another country, or if the buyer is local but the sellers are abroad, withholding may show up late in the process. Planning early avoids deal panic.

The “rate” problem: domestic law vs tax treaties

Every country has its own default withholding rates under local law. These can be high.

Then, many countries also have tax treaties with other countries. A treaty can reduce the withholding rate if the receiver meets the treaty conditions.

This is why you will often hear phrases like:

- “Treaty rate”

- “Relief at source”

- “Reduced rate”

- “Beneficial owner”

But treaties are not automatic. You usually must collect forms before you pay.

A practical example (just to make the idea clear):

- Local law says 30% withholding on royalties to foreign companies.

- A treaty with the receiver’s country says royalties should be withheld at 10%.

- If you have the right certificate from the receiver, you withhold 10%.

- If you do not have it, you may be forced to withhold 30%, even if everyone agrees the treaty exists.

Then what? The receiver may file for a refund. Refunds can take a long time, and sometimes they are not worth the effort. This can create bad blood.

So the tactical point is simple: the tax rate is not just a number. It is a process.

If you want the better rate, you must plan ahead.

Why withholding creates hidden deal risk

In a cross-border investment deal, withholding can change:

1) Net money received

If you promise a person or company they will receive $100,000 and you later withhold $30,000, they only receive $70,000. They will not be happy unless the contract clearly said the amount is “gross” and withholding is allowed.

2) Purchase price math

In M&A or secondary sales, a buyer might say: “I will pay $X, but I must withhold $Y.” The seller then pushes: “No, you must pay me $X net.” That argument can go on for weeks.

3) Closing timing

Some countries require a clearance certificate before payment can be made without withholding, or before a lower rate applies. That certificate might take time.

4) Your legal exposure

If you do not withhold when required, the tax office may still demand the tax from you later, plus penalties. Even if the receiver paid tax elsewhere, the local tax office may still say you failed your withholding duty.

5) Investor confidence

Sophisticated investors notice when a company is sloppy with cross-border compliance. It signals weak operations. And if the company is weak in something as basic as paying vendors and handling taxes, investors worry about bigger risks.

A founder does not need to become a tax expert. But you do need a simple habit: flag withholding early—before money moves.

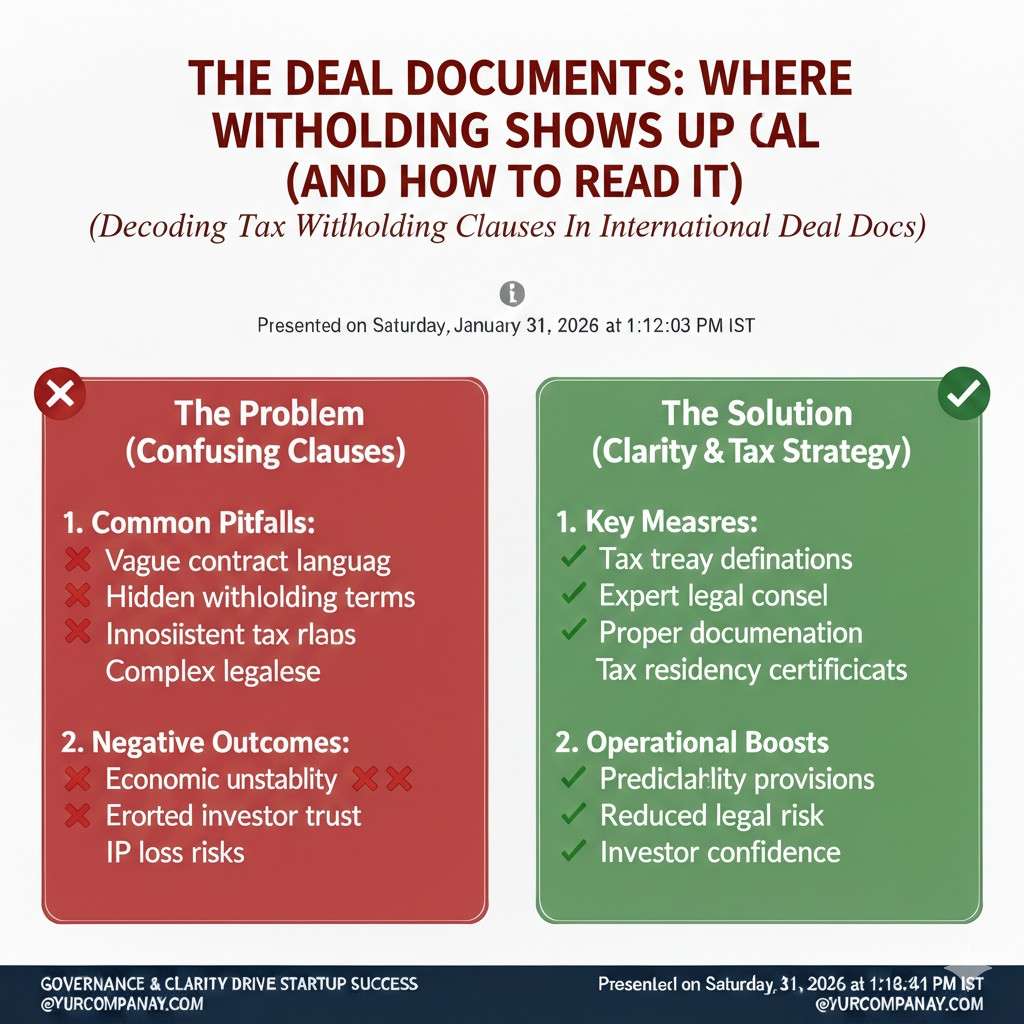

The deal documents: where withholding shows up (and how to read it)

Most cross-border deals include clauses about withholding. These clauses are often ignored until a payment is made.

Look for phrases like:

- “Payments shall be made free and clear of deductions…”

- “Subject to applicable withholding…”

- “Gross-up”

- “Tax forms and certificates”

- “Indemnity for withholding”

Here is what they usually mean in real life:

“Subject to withholding”

This means the payer can deduct withholding tax if the law requires it. That protects the payer.

“Gross-up”

This means if withholding applies, the payer must increase the payment so the receiver still gets the agreed net amount.

Gross-up sounds nice for the receiver, but it can be expensive for the payer. Also, gross-up can create odd incentives. If the receiver does not provide treaty paperwork, the payer might still be forced to gross up at the higher rate.

A very common fight is:

“Is it gross or net? Who bears the tax cost?”

There is no universal answer. It depends on bargaining power and deal type. But you do need to decide it clearly.

“Tax forms and cooperation”

This clause says the receiver must provide documents so a treaty rate can apply. It also says both sides must help each other with filings.

This is a big deal. Without that obligation, the payer may be stuck with higher withholding.

Indemnity

This says if one side causes penalties (like the receiver gives wrong info, or the payer fails to withhold), the responsible side must cover the damage.

If you are a startup, you want these clauses to be clear, because you cannot afford a surprise liability.

Practical steps founders can take before they sign anything

Most withholding problems come from two things: late discovery and unclear contracts.

So your job is to reduce both.

When you know money will cross borders (investment, IP license, services, debt), do these steps early:

- Write down: who pays, who receives, what the payment is for, and which countries are involved.

Even this simple page helps your counsel spot issues fast. - Identify the payment type correctly.

A payment labeled “services” can be treated like a royalty in some cases, especially if it really pays for use of technology. The label matters, but the real facts matter more. - Ask: “Is there a tax treaty? And can the receiver claim it?”

Treaties reduce rates, but only if the receiver qualifies and provides proof. - Plan for gross vs net.

If you want to avoid fights, decide in the term sheet stage whether amounts are gross or net. - Put responsibility on the party that can actually do the paperwork.

Usually, the receiver can most easily obtain residency certificates and treaty forms. The payer can file and remit. - Do not wait until the day before payment.

Some certificates take time. Some tax offices require pre-approval. If you wait, you lose leverage and time.

Founders building deep tech often face cross-border IP steps early—like inventors in different countries, overseas contractors, or patent filings in multiple places. If you want Tran.vc’s help to structure IP early so you raise with strength (and avoid messy surprises), apply here: https://www.tran.vc/apply-now-form/

How Withholding Shows Up in Venture Deal Structures

Equity Rounds: Why Most Primary Share Purchases Avoid Withholding

In a normal priced equity round, new shares are issued by the company and the investor pays the company. In many places, that payment is treated as a capital investment, not a payout of income. Because of that, there is often no withholding tax on the money coming into the company.

Still, founders get into trouble when the round is not “clean equity” in practice. If the documents bundle in other payments—like an IP license fee paid to a foreign entity, or a success fee paid to an overseas advisor—those side payments can trigger withholding even if the share purchase does not.

The practical move is to read the full money flow, not just the cap table. Ask, “Is any part of the closing money going out of the company to someone abroad?” If yes, treat withholding as a closing item, not as a later accounting detail.

Secondary Sales: When Share Purchases Can Become Withholding Problems

A secondary sale is when an investor buys shares from an existing shareholder, not from the company. This is common when early employees, angels, or founders sell a portion of their holdings. In cross-border cases, that seller might be in another country, and the buyer might be required to withhold tax under local rules.

Even when withholding is not required, buyers often ask for protections. They may demand that some money be held back in escrow until they are sure no tax issue will come back to them. This can slow down a deal and create tension because the seller feels they are being treated like a risk.

If you expect secondaries, plan early with your counsel. Clean seller paperwork, tax residency proof, and clear sale terms can keep the deal from turning into a last-minute scramble.

Dividends: Rare Early, But Important to Understand

Early-stage startups usually do not pay dividends, but investors still care about the rules because dividend withholding is a “known category.” It shows up in diligence because it is a simple test of whether the company can follow basic cross-border tax steps.

If your company ever plans to return cash to shareholders, dividend withholding can reduce what foreign holders receive. Treaties can lower the rate, but only if you collect the right residency documents and file the correct forms on time.

The point is not to master dividend law today. The point is to build a habit of clean records now, so when the company gets bigger, you are not rebuilding your processes under pressure.

SAFEs and Convertibles: The Withholding Confusion Zone

SAFEs: Usually Simple, But Watch Side Letters and “Extra Rights”

A SAFE is often simple because it is not debt and it usually does not pay interest. If there are no periodic payments to the investor, there is often no withholding trigger during the life of the SAFE. Many founders assume that means withholding is never relevant.

Problems appear when you add “extras” that change the money flow. If the SAFE includes a fee paid to a foreign party, or a reimbursement that is not clearly documented, or a special return that looks like interest, you can create withholding questions that did not exist before.

Keep the SAFE clean. Avoid adding payment features unless there is a strong reason, and make sure your counsel checks whether any payment can be seen as income to a foreign investor.

Convertible Notes: Interest Can Trigger Withholding

Convertible notes often include interest, and interest payments to a foreign lender can be subject to withholding. Even if the interest is not paid in cash and instead accrues, some countries still treat it as a payment for tax purposes at certain moments.

This is where founders get surprised. They think, “We are not paying cash interest, so there is no tax issue.” But tax rules can treat accrued interest differently than business logic does. If withholding applies and you miss it, the company may face penalties later.

If you use notes with foreign investors, ask early whether interest will be paid, accrued, or converted. Then ask your tax advisor what the local rule treats as a withholding event and what paperwork the investor must provide.

Conversion Events: Why “No Cash” Does Not Always Mean “No Tax”

Many founders relax at conversion because no money changes hands at the moment a note converts into shares. But withholding concerns can still appear if the conversion includes a settlement of interest, fees, or other amounts that are treated as income to the investor.

Also, some countries tax certain gains or deemed payments tied to conversion mechanics. The details depend on local law and treaty rules. You do not need to memorize them, but you do need to flag conversions as moments that deserve a quick check.

A good process is simple: before you sign the note, map the full lifecycle—issue, accrue, maturity, conversion, and repayment. Wherever cash or value moves to a foreign party, treat it as a potential withholding point.

Venture Debt and Cross-Border Loans: Where Withholding Is Most Common

Interest Payments: The Classic Withholding Trigger

If your startup borrows money from a lender in another country, interest withholding is one of the first issues to check. Many countries require a percentage of the interest to be withheld and paid to the tax office, even if the lender has no local presence.

Treaties can lower the rate, but lenders often require you to prove you applied the treaty correctly. That means collecting residency certificates and sometimes specific forms before the first interest payment date.

This is one reason founders should not treat venture debt as “just a bank-style deal.” Cross-border lenders often run tighter compliance, and mistakes can lead to default claims or forced reserve accounts.

Fees and “Other Charges”: Small Words That Cause Big Disputes

Loan deals often include fees: arrangement fees, commitment fees, monitoring fees, and early repayment fees. Some of these can be treated like interest under tax law, even if the contract calls them “fees.”

If a fee is treated like interest, it can be subject to withholding too. Then the lender may argue that the fee must be paid net, while you assumed the contract price was the full amount.

To avoid this, force clarity in the documents. Ask counsel to mark which amounts are subject to withholding, whether the payment is gross or net, and what happens if the treaty rate cannot be applied on time.

Gross-Up Clauses: When Withholding Becomes Your Cost

Many loan agreements include a gross-up clause. It often says that if withholding is required, the borrower must increase the payment so the lender receives the full amount as if no withholding applied.

This shifts the tax cost to the startup. It may be fair in some deals, but you must understand the math. A “10% withholding” does not mean you pay 10% more. If you must pay net $100 and withhold 10%, the gross amount is higher than $100 because the withholding is taken from the gross.

Founders should treat gross-up as a pricing term, not as a legal footnote. If you accept it, build it into your runway planning so the cost does not surprise you later.

IP, Royalties, and Cross-Border Tech Rights: The Deep Tech Hot Spot

Licenses: Why Royalty Withholding Can Hit Robotics and AI Teams Early

Deep tech startups often use IP in complex ways. You might license a university patent, license a foreign lab’s technology, or pay for rights to use a core method. Many countries treat those payments as royalties, and royalties commonly face withholding.

This can show up even before you are “big.” A small monthly license fee to a foreign owner can create a recurring withholding duty, filings, and certificates. If you miss it, the tax office may treat every payment as non-compliant, which can snowball into penalties.

If your startup is building real technical advantage, you want clean ownership and clear license terms from day one. Tran.vc helps founders do that early with patent strategy and filings as in-kind support. You can apply any time at https://www.tran.vc/apply-now-form/

IP Assignments: When Buying IP Abroad Creates Tax Questions

Sometimes you do not license IP—you buy it. An IP assignment can look like a one-time purchase, but tax rules may still treat part of the payment as a royalty-like amount, depending on how the rights are described and where the IP is used.

This is one of the reasons “simple words” in contracts matter. Phrases like “use rights,” “territory,” “perpetual license,” or “transfer of all rights” can shift how the payment is viewed. That shift can change withholding.

If you are acquiring IP from abroad, ask your counsel to confirm how the payment is classified under local law, and whether splitting the payment into clear parts changes the tax result.

Services vs Royalties: The Line That Gets Blurry

In AI and robotics, a foreign team might do model tuning, algorithm design, or hardware optimization. You might pay them as a “service provider.” But if the work includes giving you reusable code, reusable models, or ongoing rights, the payment can start to look like IP income.

Tax offices look at facts. If what you really paid for was the right to use a method, they may treat it as a royalty even if your invoice says “consulting.” That is where withholding surprises come from.

A simple way to reduce risk is to match documents to reality. If the foreign party is truly doing services and handing over work product with full ownership transfer, write it clearly. If it is a license, call it a license and price it with withholding in mind.

Term Sheets and Closing: Tactical Moves to Avoid Pain Later

Decide “Gross” vs “Net” Up Front

Many fights happen because people avoid one sentence early. If payments may be subject to withholding, decide whether the stated amounts are gross (before withholding) or net (after withholding).

If you are paying a foreign party and you can’t afford a gross-up, do not leave it vague. Put it into the deal terms that payments are subject to withholding and that the receiver bears the tax cost unless the law clearly requires otherwise.

If you are receiving money and want certainty, ask for clear language on gross-up or treaty cooperation so you are not stuck chasing refunds later.

Make Paperwork a Deliverable, Not a Favor

Treaty benefits usually require proof of residency and sometimes other forms. If you do not get them before payment, you may be forced to withhold at the higher domestic rate.

So make it a closing or pre-payment requirement: no form, no wire. That sounds strict, but it prevents future arguments because it keeps everyone aligned on what must happen first.

This also protects your company. If the tax office asks why you used a lower rate, you can show you collected the correct documents on time.

Build a “Money Flow” Page for Every Cross-Border Deal

Founders often rely on long legal documents to explain how money moves. That is risky because people interpret long documents differently, especially across countries.

A one-page “money flow” summary reduces confusion. It states who pays whom, for what, from which country, on what dates, and under what tax rule assumption. When your legal and finance teams agree on that page, the rest of the deal usually becomes smoother.

If you are raising across borders while building IP-heavy tech, doing this early also helps you avoid messy IP payments that scare investors. If you want Tran.vc’s help building an IP-backed foundation that investors respect, apply here: https://www.tran.vc/apply-now-form/