Most founders think funding starts with a pitch deck.

In real life, it often starts with proof.

Not proof that your product is perfect. Not proof that your market is huge. Early checks come when investors feel one thing: this team is building something real, and it will be hard to copy.

That “hard to copy” part is where IP (intellectual property) becomes a quiet superpower. It turns your work from “cool demo” into an asset. Something a buyer can value. Something an investor can defend. Something that gives your startup more leverage in a deal.

Here is the hard truth: at pre-seed and seed, many startups look the same on paper. Smart people. Strong code. Big goals. A fast prototype. So investors hunt for signals. They want signs that you can win even when the market gets loud and crowded.

IP milestones are strong signals because they show three things at once:

- You have a real invention, not just a feature.

- You can turn work into an owned asset, not just a sprint output.

- You are reducing risk, which makes a check feel safer.

This article is about those milestones. Not the textbook kind. The kind that actually changes how a pre-seed or seed investor sees you.

You will learn what to do in the right order, how to avoid common traps, and how to talk about your IP in a way that makes sense to people who do not write code.

And if you want help building these milestones fast, Tran.vc can step in early. Tran.vc invests up to $50,000 in in-kind patent and IP services for robotics, AI, and deep tech teams. That means real strategy and real filings, done with founders, not handed off. You can apply anytime here: https://www.tran.vc/apply-now-form/

IP Milestones That Unlock Pre-Seed and Seed Funding

Why this matters more than your pitch deck

Funding at pre-seed and seed rarely goes to the “best slide deck.” It goes to the team that feels easiest to believe. Investors are trying to answer one quiet question: if this works, can this team keep the win, or will a bigger company copy it and crush them?

Your job is not to sound smart. Your job is to reduce doubt. IP milestones do that because they turn your progress into something that can be owned, priced, and defended.

When you build IP the right way, you do not just “have patents.” You build a story that shows you are creating real value and protecting it with intent. That story can shift you from “interesting” to “fundable.”

The simple meaning of “defensible”

When investors say “defensible,” they are not asking for a legal lecture. They want to know whether your edge will still matter in 12 to 24 months, when competitors show up.

Defensibility can come from many places, like brand or distribution. But early on, most startups do not have those yet. What you do have is what you are inventing right now: your methods, your system design, your data flow, your training approach, your control loop, your sensor fusion, your architecture.

If those are unique, and if you can prove they are yours, you become harder to copy. That is what IP milestones are really about.

The investor’s risk map at pre-seed and seed

Early investors are not only judging your idea. They are judging the risks they cannot see. They know product plans change. They know markets shift. They know teams pivot.

So they focus on what survives change. A good IP foundation can survive a pivot because it protects the core method, not just the current product shape. That is why IP work can unlock funding even before revenue.

It also signals maturity. It tells investors you think beyond the next demo. You are building a company, not just shipping a feature.

Milestone 1: A Clear “Invention Thesis” That Fits in One Page

What an invention thesis is

An invention thesis is a short, clear explanation of what you are inventing and why it is different. It is not marketing. It is not a product pitch. It is a technical claim written in plain words.

Think of it as your “IP north star.” It keeps the team aligned on what must be protected, even if your roadmap changes.

A strong thesis usually covers three things: the problem in the real world, the approach you take that others do not, and the outcome your approach makes possible. When this is clear, the rest of your IP work becomes easier and faster.

Why this unlocks funding

When you cannot explain your invention simply, investors assume it is not real or not unique. Even if your tech is excellent, unclear words make it feel risky.

But when your invention thesis is tight, it gives investors a clean hook. It helps them retell your story to partners, committees, and other investors without losing the point.

That retelling matters. Funding decisions often happen when you are not in the room. Your invention thesis helps your deal travel.

How to build it without slowing down product work

Most teams think this takes weeks. It does not. The fastest way is to start from what you already built and ask a few sharp questions.

What part took the longest to get right? What part breaks when you remove it? What part would a competitor struggle to reproduce without months of trial and error?

The answers usually point to the real invention. Once you name it, you can shape it into a one-page thesis that becomes the base for patents, trade secrets, and investor messaging.

Milestone 2: Evidence That Your “Secret Sauce” Is Real

What counts as evidence in early-stage IP

At pre-seed, you do not need a perfect product. But you do need proof that your approach works better than a basic method.

Evidence can be small, but it must be honest and repeatable. It can be a benchmark, a test run, a set of before-and-after results, or a controlled comparison.

If you are building robotics, evidence might be better stability, better accuracy, lower power use, fewer failures, smoother motion, or faster learning. If you are building AI, it might be higher accuracy with less data, faster training, better reliability, or a way to reduce errors in hard edge cases.

Why investors care so much about this step

Patents are not magic if the invention is not real. Investors know that. They want to see that the thing you want to protect is not just a theory.

This milestone builds confidence that you are not filing for a “nice idea.” You are filing for a method that already shows advantage. That makes your IP feel valuable, not decorative.

It also helps with strategy. Evidence tells you what to patent first, what to keep secret, and what to publish later.

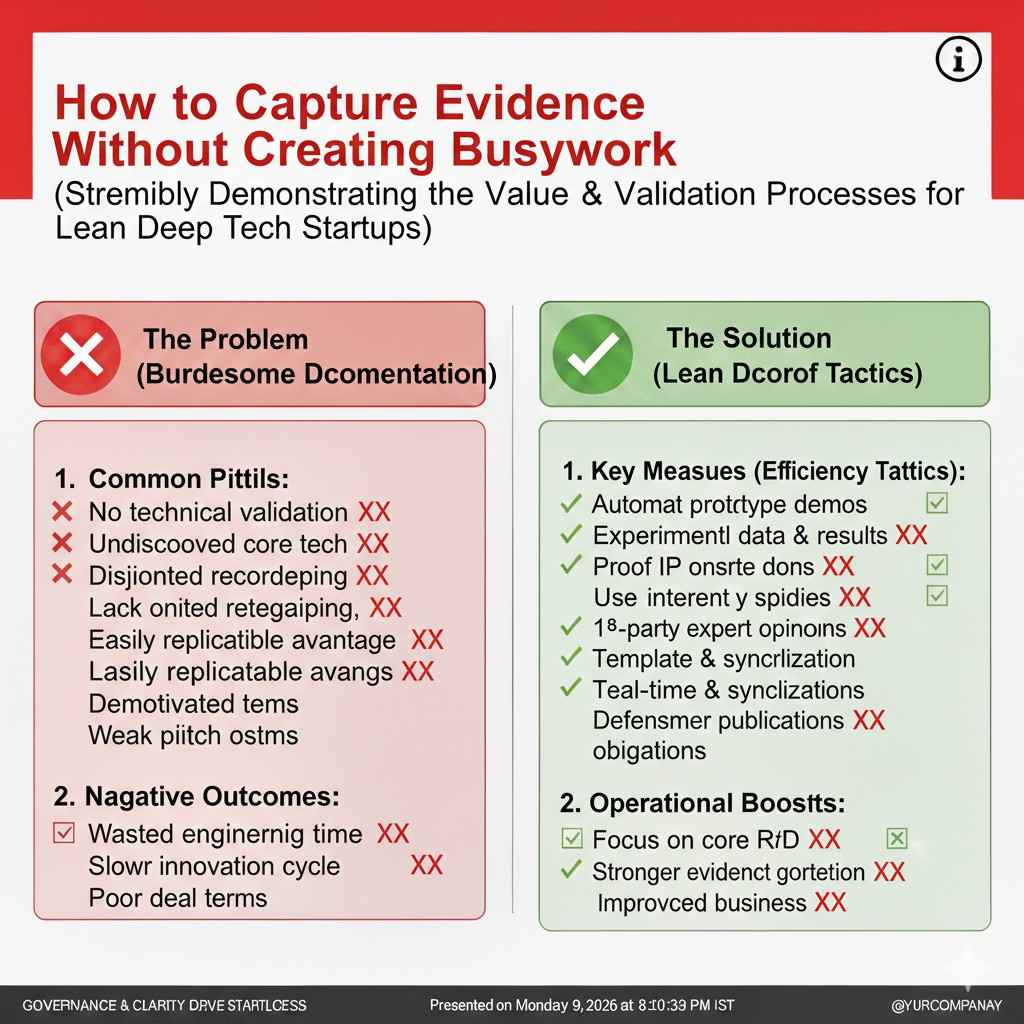

How to capture evidence without creating busywork

A simple approach is to treat evidence like part of your engineering routine. Each time the team solves a hard problem, write down what changed, why it changed, and what improved.

Do not aim for a large report. Aim for a clear record that an outsider can follow. In investor terms, you want them to feel, “This improvement did not happen by luck.”

That feeling is a funding lever. It reduces the fear that your demo will fall apart under pressure.

Milestone 3: A Prior Art Check That Stops You From Wasting Months

What “prior art” means in plain words

Prior art is anything already public that looks like what you are building. It includes patents, papers, blog posts, product docs, and even open-source code.

If prior art is too close, your patent claims may get rejected or narrowed. That does not mean you have no invention. It means you need to aim your IP at the truly unique parts.

A prior art check is not about fear. It is about direction.

Why this milestone makes investors more comfortable

Investors have seen founders spend money on patents that do not hold up. They have also seen founders avoid patents completely and lose leverage later.

A prior art check shows you are doing neither. You are being smart. You are confirming what is new, and you are shaping your claims around the parts you can truly own.

That lowers legal risk and increases deal confidence. It signals that your IP plan is not guesswork.

How to do this without drowning in documents

You do not need to read hundreds of patents. The goal is to find the closest matches and understand the key differences.

If you can summarize the top three closest public items and explain how your approach differs, you are already ahead of most teams. It becomes easier to write claims, easier to talk to investors, and easier to avoid weak filings.

This is one area where a strong partner saves time. Tran.vc helps teams do this early so you do not build your moat on sand. If that is useful, you can apply anytime at https://www.tran.vc/apply-now-form/

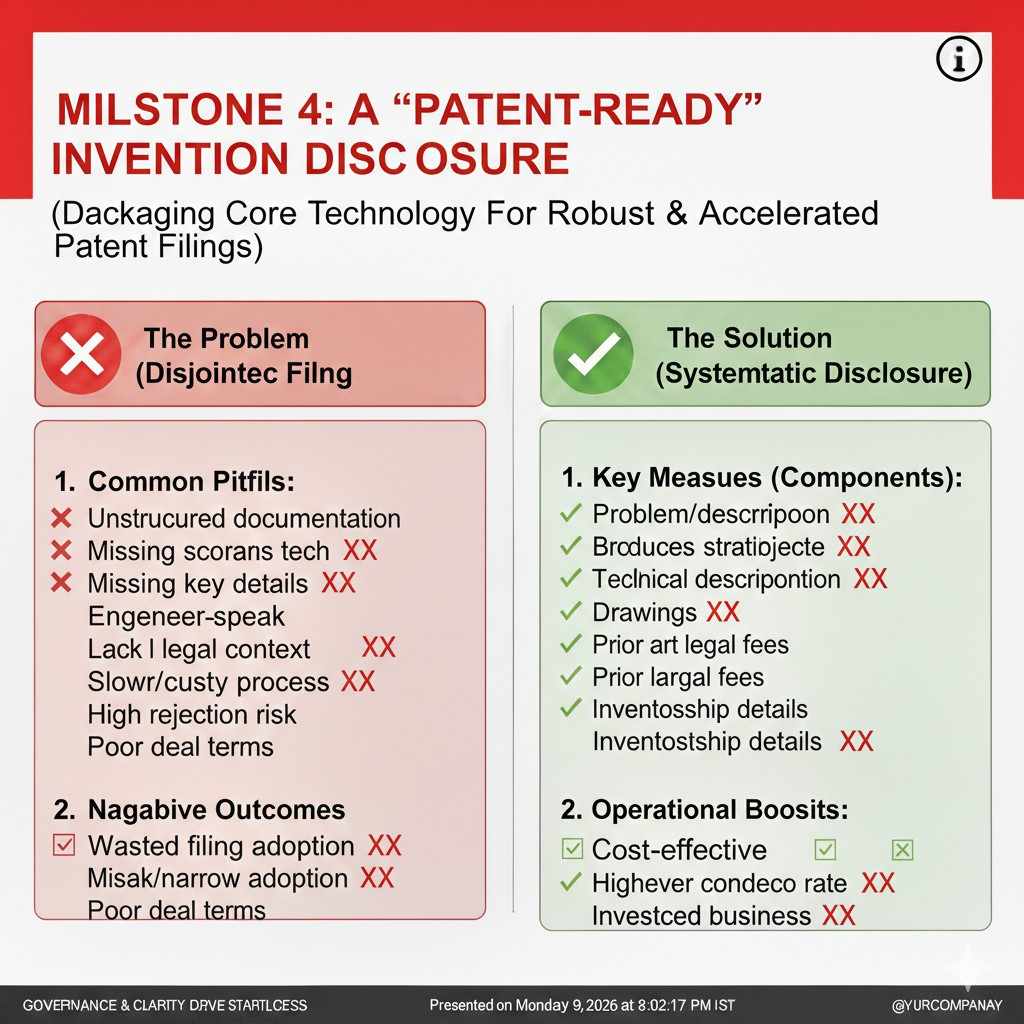

Milestone 4: A “Patent-Ready” Invention Disclosure

What an invention disclosure really is

An invention disclosure is the bridge between engineering and a patent filing. It is a structured write-up that captures the invention clearly enough for a patent attorney to draft strong claims.

It includes the problem, the solution, the system parts, the steps, and the variations. Variations matter because they stop competitors from copying you with small changes.

A good disclosure also captures what makes your approach better. That “why it works” part often becomes the heart of your patent.

Why this changes how investors see your company

Most startups tell investors, “We plan to file patents.” That is a weak signal because plans are easy.

A patent-ready disclosure is stronger because it means you already did the hard thinking. It also means you can move fast when timing matters, like when a big customer asks for details or when you are about to launch publicly.

Investors like momentum. They like readiness. A disclosure shows you can turn innovation into protection without chaos.

How to build disclosures in a founder-friendly way

The best disclosure process feels like a guided interview, not homework. You talk through the invention, the attorney asks sharp questions, and the disclosure becomes a clean record of what you built.

If you try to do it alone, it often becomes too vague or too technical in the wrong places. The goal is clarity, not density.

This is exactly the kind of work Tran.vc supports: turning real engineering into clean IP artifacts without dragging the team down. Apply anytime at https://www.tran.vc/apply-now-form/

Milestone 5: Filing Your First Provisional Patent the Right Way

What a provisional is, and what it is not

A provisional patent application is often the first filing step. It can lock in an early date for your invention.

But a provisional is only helpful if it is done well. A weak provisional can create false comfort. If it does not fully describe the invention and key variations, it may not protect you later.

Think of a good provisional as a detailed snapshot of your invention at a point in time. It is not a placeholder. It is not a one-page summary.

Why a strong provisional can unlock a check

A filed provisional gives investors a clear milestone: you took action to protect what matters.

It can also remove a common objection in diligence. Investors often ask, “Is this protectable?” A strong provisional does not answer everything, but it shows you are already building a defense.

In some deals, that is enough to move you from “maybe later” to “let’s do it now,” especially when another investor is circling.

What founders should avoid when filing

Many founders rush to file right before a demo day or launch. The filing becomes rushed, thin, and missing key details. Later, when you try to convert to a full patent, you realize the early filing did not cover what you actually shipped.

The better path is to file when the invention is clear and tested, even if the product is still early. You want the filing to capture the real method, not the first rough draft.

Milestone 6: Building an IP Map That Matches Your Roadmap

What an IP map looks like in real life

An IP map is a simple view of what you will protect over time. It connects your roadmap to your IP plan.

It might show the core invention you file first, then the next layer of improvements, then system-level claims, then use-case claims, then defensive filings. It keeps you from filing random patents that do not add up.

The goal is coverage that grows as the company grows, without wasting effort.

Why investors respond to an IP map

An IP map tells investors you are building a moat on purpose.

It also gives them comfort that you will not stop after one filing. Investors worry about “one patent theater,” where a company files one patent and calls it a moat.

A map shows a pipeline of protectable value, which supports a higher valuation and stronger negotiating position.

How to build this without making it complicated

You do not need a fancy chart. You need a clear narrative.

What is the core method you own? What are the next two improvements that create a step-change? What parts of your system are unique enough to protect as the product scales?

If you can answer those in plain words, you can build an IP map that investors understand and respect.

Milestone 7: A Trade Secret Plan for What You Should Not Patent

When trade secrets are the better choice

Not every advantage should be patented. Some parts are better kept secret, especially if they are hard to reverse engineer.

Examples can include data pipelines, labeling methods, test harnesses, calibration techniques, internal tooling, and certain model tuning steps. If revealing them in a patent would help others more than it helps you, secrecy may be smarter.

The key is not to guess. The key is to decide with intent.

Why investors care that you can keep secrets

Investors know that patents take time and that enforcement is not always simple. They also know that trade secrets can be powerful if managed well.

A trade secret plan shows discipline. It tells investors your team understands what should be public, what should be protected, and what should stay inside the company.

This matters even more in AI, where small process advantages can create large performance gains.

What a simple trade secret plan includes

A trade secret plan can be basic and still work. It should cover who has access, how key materials are stored, how you handle contractors, and what you share with partners.

It should also include a rule for external talks: what can be said, what cannot, and how to handle demos. This reduces accidental leaks that kill leverage.

Milestone 8: “Diligence-Ready” IP Documentation

What diligence looks like at seed

Seed diligence is often lighter than later rounds, but it still includes key IP questions.

Investors may ask who owns the code, who wrote the core parts, whether contractors assigned rights, whether any university claims exist, whether open-source is used safely, and whether any patents are filed or planned.

If you cannot answer cleanly, the deal slows down.

Why being ready speeds up closing

When a company is diligence-ready, investors feel less friction. They do not need to chase missing files or worry about hidden ownership issues.

Speed matters in early funding. Deals often close when momentum stays high.

If your documentation is clean, you shorten the time from “yes” to “wired funds,” which can change your survival odds.

What “clean” means in a practical sense

Clean means you can show basic assignments, clarify who contributed what, and present your filings and strategy in plain terms.

It also means you can explain your IP milestones without overpromising. Investors do not want hype. They want clarity.

A well-prepared founder sounds steady. That steadiness is persuasive.

Milestone 9: A Founder-Friendly Way to Talk About IP in the Pitch

Why most IP slides fail

Many founders add an “IP” slide that says, “Patents pending.” It often does nothing.

Investors either ignore it or assume it is thin. That happens because the slide does not explain what is protected and why it matters.

Your IP story must connect to business outcomes: lower costs, better reliability, safer performance, faster deployment, better accuracy, easier scaling, and lower risk.

How to explain IP in simple words

The best IP explanation is short and specific.

You can say what the invention is, what it improves, and why a competitor would struggle to copy it without the same work. Then you explain how you are protecting it: patents for the parts that can be seen, trade secrets for the parts that should stay hidden.

This makes investors feel you are both technical and practical.

How Tran.vc helps founders make this story real

Tran.vc works with technical teams to identify what is truly protectable and turn it into filings and strategy early.

This is not a generic service. It is built for robotics, AI, and deep tech where the invention often sits inside methods and systems, not just visible features.

Tran.vc invests up to $50,000 in in-kind patent and IP services, and helps you build the milestones investors care about. You can apply anytime at https://www.tran.vc/apply-now-form/