Most seed rounds feel like this: you show a deck, tell a story, and hope the terms are “fair.”

But founders who treat their ideas like property—real, protected property—often walk into the same room with more leverage. Not because they are louder. Because they are safer to back, harder to copy, and easier to price with confidence.

That is what strong IP does in a seed round. It turns “trust me” into “here is what we own.”

At Tran.vc, we help technical founders do this early—before the seed—by investing up to $50,000 in in-kind patent and IP work, so your tech becomes an asset that can actually improve your deal. If you want to build that kind of leverage, you can apply anytime at https://www.tran.vc/apply-now-form/.

Here’s the key idea for this article: IP is not a trophy. It is a negotiation tool. And like any tool, it only works if you know how to use it.

Before we go into the tactics, I want to set expectations in plain words. A patent does not magically force investors to pay more. And filing “something” just to say you filed can even hurt you. Investors are sharp. They can smell weak IP from far away. The goal is not to collect paperwork. The goal is to protect what matters, prove it is protectable, and show that protection links to money.

That is where better terms come from.

In a seed round, investors are taking a bet on three things: the team, the market, and the risk. You can’t remove all risk. But you can reduce one big bucket of it: “Will someone copy this and beat you?” Or the cousin of that fear: “Is this even yours to sell?” If you can answer those clearly, you change the tone of the room. You move from defending yourself to choosing your partner.

That shift shows up in terms.

Sometimes it shows up as a higher valuation. But more often, it shows up in the parts of the term sheet that matter just as much: less investor control, fewer special rights, cleaner liquidation terms, lighter protective clauses, and less pressure to accept a heavy hand on your board.

So in this blog, we are going to talk about how to use IP to negotiate better seed round terms without acting like a lawyer, without stuffing your pitch with jargon, and without turning your company into a legal project.

We will cover how to pick the right inventions to protect, how to time filings around fundraising, how to talk about IP so investors lean in instead of tuning out, and how to connect your IP to real business value. We will also cover common traps—because a few small mistakes can weaken your leverage more than having no IP at all.

And because this is meant to be practical, I’ll keep the language simple and the advice direct. If at any point you want help building an IP plan that actually supports your seed round, that is exactly what Tran.vc does. You can apply anytime at https://www.tran.vc/apply-now-form/.

Before we move on, one more quick point that founders often miss: IP is not just patents. Trade secrets, copyrights, data rights, and smart contracts can matter too. But in seed negotiations, patents and patent strategy are usually the strongest “signal” because they are easier for outsiders to evaluate quickly. They can see dates. They can see claims. They can see that you took action early. They can see that you are building a moat on purpose.

Now, let’s start with the first thing you need to understand if you want IP to improve your seed terms: what investors actually hear when you say the word “patent.”

What Investors Really Hear When You Say “IP”

The quiet question in their head: “Is this defensible?”

When you say “we have IP,” most investors do not think about legal documents. They think about risk.

They are asking, in a very simple way, “Can someone copy this and win?” If the answer feels like “yes,” they will protect themselves with tougher terms. They may ask for more control, more rights, and more downside protection.

If the answer feels like “no,” they relax. And relaxed investors negotiate differently.

Why IP changes the tone of a seed round

Seed is still early. You usually do not have long revenue history. Your product may be in beta. Your team may be small.

So investors rely on signals. Strong IP is one of the clearest signals that you are building something real, and that you are building it with intention.

It tells them you are not just shipping features. You are creating an asset. Assets can be priced, defended, and sold. That is why IP can improve terms.

“We filed a patent” is not enough

Many founders say “we filed” like it is a badge.

But investors will quickly ask, “Filed what?” They want to know if your filing protects the core value, or just a small detail.

A weak filing can backfire. It can make you look careless, or like you do not understand what is actually valuable in your tech.

The investor’s second question: “Is it clean?”

Even strong tech becomes messy if ownership is unclear.

If your cofounder built the first version at a past job, investors worry. If contractors wrote key code without proper assignment, investors worry. If you used open-source in risky ways, investors worry.

Clean IP makes diligence smooth. Smooth diligence often leads to faster closes and fewer “special clauses” added out of fear.

The investor’s third question: “Does it matter for the business?”

Some patents are interesting but not useful.

Investors want to see that your IP connects to a product edge, a cost edge, a data edge, or a go-to-market edge. They want to see how your protection changes outcomes, not just how it sounds on paper.

When you link IP to business impact, you stop being “a science project.” You become “a company.”

Which Seed Terms IP Can Improve

Valuation is only one lever

Founders often think “better terms” means “higher valuation.”

Valuation matters, but seed terms are more than that. A slightly lower valuation with clean, founder-friendly terms can be a better deal than a higher valuation with heavy control rights.

IP can influence both, but it often has the biggest impact on the control and risk parts of the term sheet.

Control terms: when investors ask for extra power

If investors feel the business is easy to copy, they may push for more control. That can show up as stronger protective provisions, tighter veto rights, or heavier board influence.

When you have a clear moat, the need for control drops. They can back your execution without trying to “steer the ship” too early.

IP does not remove the need for trust, but it lowers the fear that they are funding a commodity.

Economic terms: liquidation preferences and downside protection

When risk feels high, investors try to protect their downside.

That can appear as stronger liquidation preferences, participating preferences, or other structures that tilt outcomes away from founders in common exit cases.

A credible IP position can reduce perceived risk. That does not guarantee softer economics, but it gives you a real reason to negotiate for cleaner structures.

Future financing terms: pro rata, pay-to-play, and other hooks

Seed investors often want rights that shape later rounds.

Sometimes that is fair. But sometimes it becomes a set of hooks that make your next round harder, especially if your new lead investor wants a cleaner cap table and simpler rights.

If you can show you have protected core inventions early, you can make the case that the company will be more attractive later, which reduces the need for heavy early hooks.

Closing speed and diligence friction

Better terms also means fewer delays.

IP that is organized and documented helps you move faster. Speed matters because a slow seed round drains morale, distracts the team, and increases the odds you accept bad terms just to end the pain.

A clean IP story can help you close while you still have negotiating energy.

The Real Goal: Turn IP Into Leverage, Not Paper

Leverage comes from clarity

A patent filing is not leverage by itself.

Leverage is when the other side believes your position changes the outcome. They believe you are harder to replace, harder to copy, or more likely to win.

That belief comes from clarity. Clear invention boundaries. Clear ownership. Clear story. Clear tie to money.

Leverage is strongest when you protect the “must-have” part

If your startup builds robotics, AI, or deep tech, you probably have many clever parts.

But only some parts truly matter. The goal is to protect the part that makes your product work better, cheaper, faster, or safer than alternatives.

When you protect the must-have part, investors feel they are buying into something unique, not something that can be rebuilt by a competitor in six months.

Leverage improves when you file before the pitch gets loud

Fundraising forces you to talk. Talking creates risk.

If you pitch widely before you file, you can lose rights in some countries. You can also accidentally teach the market how you work, while having nothing protected.

Filing before broad outreach gives you confidence. It lets you share enough to sell the vision without feeling like you are handing away your edge.

Tran.vc’s role in this stage

This is exactly the gap Tran.vc fills.

We invest up to $50,000 in in-kind patent and IP services so technical founders can protect core inventions early, and walk into seed conversations with a stronger hand.

If that is what you need, apply anytime at https://www.tran.vc/apply-now-form/.

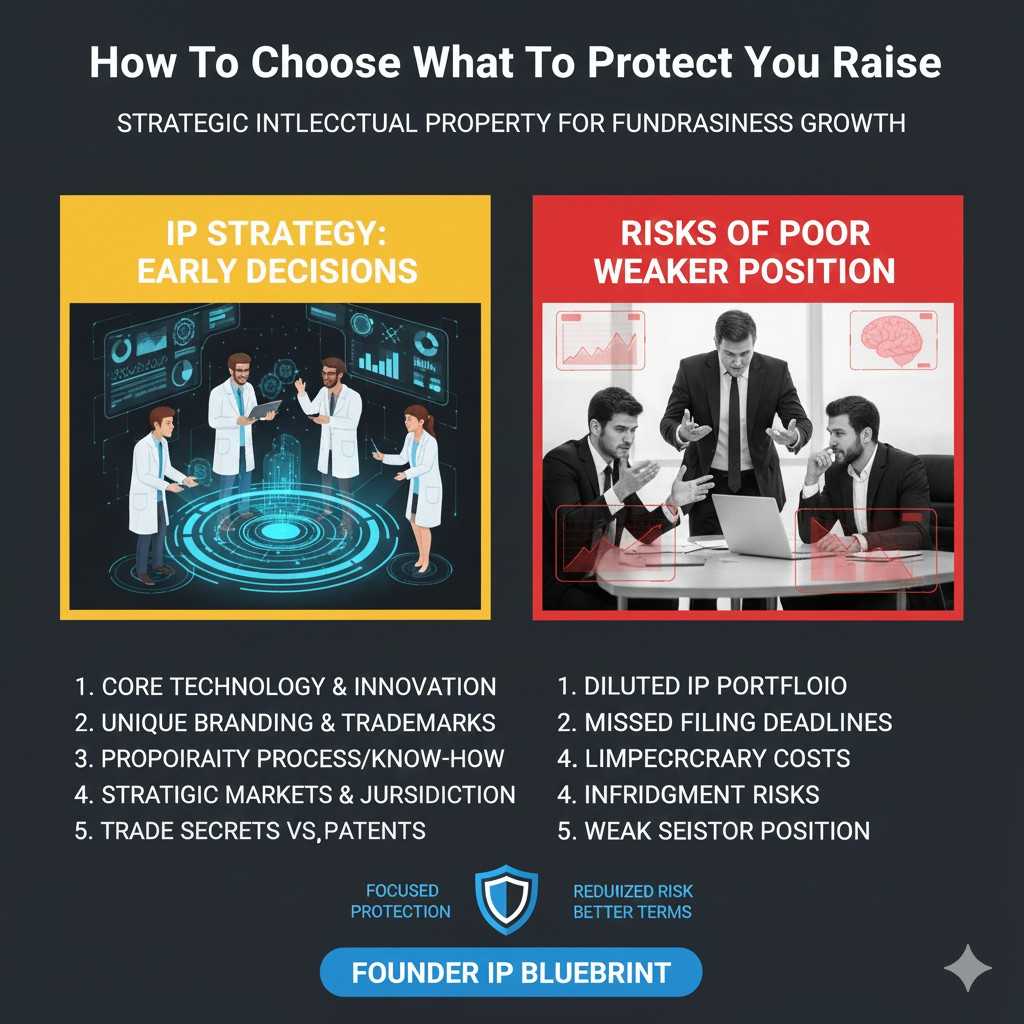

How to Choose What to Protect Before You Raise

Start with one question: “What would kill us if copied?”

Forget the full product for a moment.

Ask, “If a strong team copied one piece of our system, what piece would let them compete with us fastest?”

That piece is often your first IP target. It may be an algorithm detail, a control loop, a robotics sensing method, a training pipeline, a data labeling trick, or a hardware-software integration pattern.

You are not hunting for “cool.” You are hunting for “critical.”

Protect the mechanism, not the marketing

Founders sometimes try to patent the tagline version of their product.

Investors do not care about slogans. Patents also do not work well as slogans. A good protection plan focuses on the mechanism that creates the result.

For example, “we reduce compute costs” is not the invention. The invention is the method that reduces compute costs, and the setup that makes the method work.

When you protect the mechanism, the result becomes more believable too.

Think in terms of “copy effort”

A helpful way to pick inventions is to think about how hard they are to copy.

Some things are hard because they require rare data. Some are hard because they require deep domain skills. Some are hard because they require many small pieces to fit together.

Your IP should increase copy effort even more. It should turn “hard to copy” into “risky to copy.”

That is where negotiation power comes from.

Avoid wasting your early filings

Early filings are precious.

If you spend your first filing on a minor feature, you lose time and budget for the core. You also create an IP story that feels scattered.

A tight story wins. One or two strong filings that map to the heart of the business can be better than five weak ones that protect the edges.

The simplest working approach for most seed-stage teams

Most teams do well with a focused plan.

First, identify the one core invention that drives the main value. Next, identify a second invention that supports it, like a key training method, safety system, or deployment technique.

You do not need to patent every line of code. You need to protect the parts that shape your advantage.

If you want expert help making those calls, Tran.vc can guide the strategy and filings as part of our in-kind investment. Apply anytime at https://www.tran.vc/apply-now-form/.

Timing IP Around Your Seed Raise

Why timing matters more than most founders think

Many founders treat IP as something to “do later.”

Later feels safer because you want more clarity, more traction, more proof. But in seed fundraising, waiting too long often weakens your position instead of strengthening it.

The goal is not to finish everything early. The goal is to have enough protection in place at the moment investors start forming opinions about your company.

The danger zone: talking before protecting

Seed fundraising forces you to explain how things work.

You explain your model. You explain your system. You explain what makes it better. Each explanation reveals small details. Over time, those details add up.

If you have not filed before these conversations, you create risk. In some regions, public disclosure can block future rights. Even where it does not, you still give competitors a head start.

Smart timing lets you talk with confidence instead of caution.

The ideal window for most technical startups

For many AI, robotics, and deep tech teams, the best time to file is when the core approach is clear, but before broad investor outreach.

You may still be iterating. That is normal. A good filing can cover the core concept while leaving room for refinement.

This gives you a priority date. That date matters more than most founders realize. It anchors your claim to the invention in time.

Filing does not mean freezing innovation

A common fear is that filing too early locks you in.

That is not how good IP strategy works. Early filings can be written to cover the main idea, while later filings build on improvements and variations.

Investors like seeing this path. It shows you are thinking long-term, not just checking a box.

Using provisional filings wisely

Provisional filings are often misunderstood.

They are not “fake patents,” but they are also not magic shields. Their value depends on quality. A rushed, vague provisional may give a false sense of safety.

A strong provisional can support fundraising, protect your place in line, and buy time to refine claims. But it must be written with care and intention.

This is one of the areas where expert help makes a real difference.

How to Talk About IP Without Sounding Like a Lawyer

Lead with the problem, not the document

When founders talk about IP, they often start with the filing.

Investors do not care about the filing first. They care about the problem you solved and why it was hard.

Start there. Explain the challenge. Explain why existing approaches fail. Then explain what you built that works differently.

Only then does the IP make sense.

Explain what is protected in plain language

Avoid claim language. Avoid legal terms.

Instead, say things like: “We protect the way the system adapts in real time,” or “We protect how the robot senses and corrects under uncertainty.”

Simple language signals confidence. It shows you understand your own invention deeply.

Connect protection to outcomes investors care about

After explaining what is protected, explain why that protection matters.

Does it slow competitors? Does it raise their costs? Does it force them to license or redesign? Does it protect your margins?

When investors can see the business effect, they stop treating IP as a side note.

Show that IP supports, not replaces, execution

Strong IP does not mean you stop competing.

Make it clear that your moat includes execution, speed, and learning. IP strengthens those advantages. It does not replace them.

This balance matters. Investors want ambition, not complacency.

Be ready for simple follow-up questions

You do not need to memorize legal details.

But you should be ready to answer simple questions like: “What part is hardest to copy?” and “What happens if someone tries anyway?”

Clear answers build trust. Vague answers weaken it.

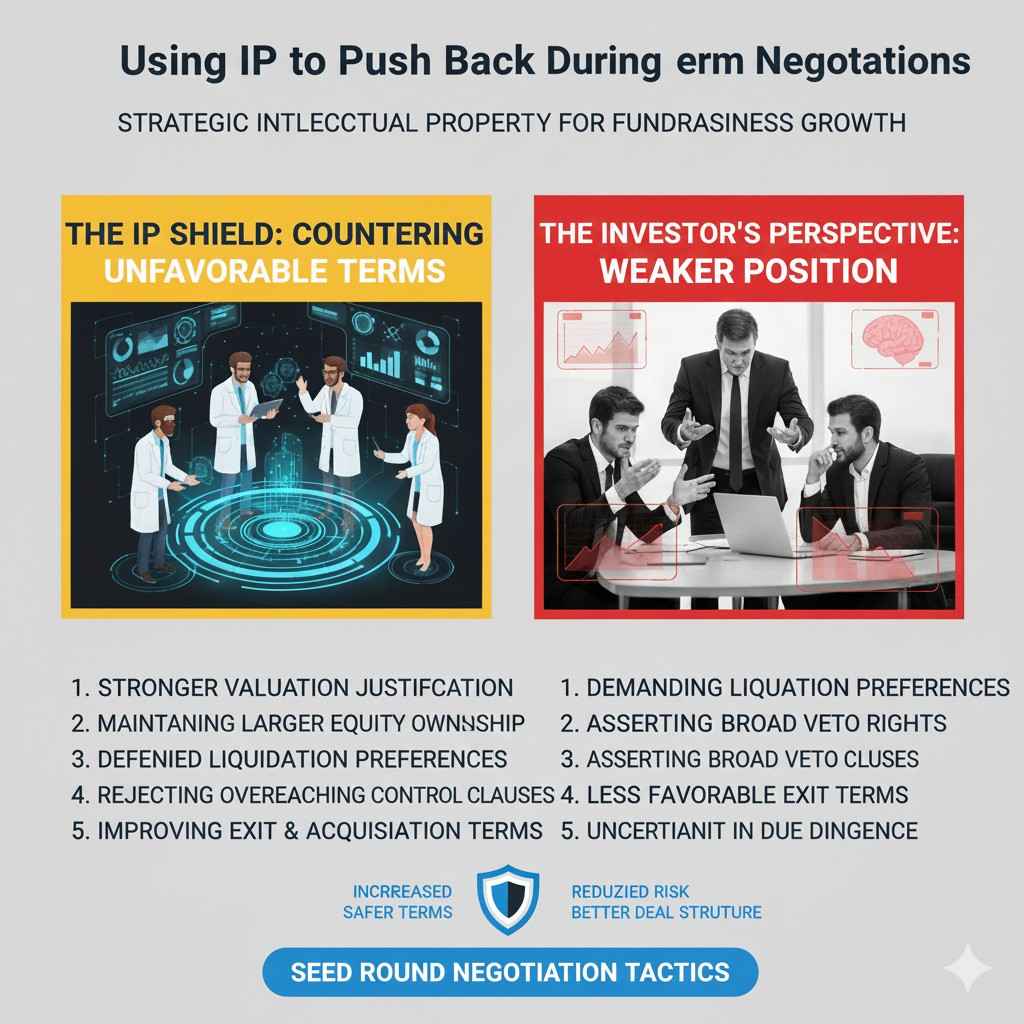

Using IP to Push Back During Term Negotiations

When investors ask for stronger control

Sometimes an investor will ask for extra control “because it is early.”

That may be true. But it is still a negotiation.

If you have protected core technology, you can point to reduced risk. You can explain that the company is not just an idea, but an owned system.

This gives you a reason to push back, calmly and professionally.

When valuation pressure shows up

If an investor pushes valuation down, they often cite uncertainty.

IP helps narrow that uncertainty. It does not remove all doubt, but it gives a floor to the value of what you are building.

You can frame the valuation discussion around assets created, not just future hopes.

When investors want heavy downside protection

Heavy downside terms usually come from fear.

IP gives you a way to address that fear directly. You can explain how protection supports exit value even in conservative scenarios.

This does not guarantee agreement, but it strengthens your case for cleaner structures.

When future rights become a sticking point

Some investors ask for rights that shape later rounds.

If your IP story is strong, you can argue that future investors will see value quickly, reducing the need for heavy early rights.

This can help keep your cap table flexible and your options open.

Common IP Mistakes That Weaken Your Negotiating Power

Filing without strategy

Random filings confuse investors.

They suggest you are collecting paperwork instead of building a moat. A focused plan is always stronger than scattered activity.

Overclaiming or overselling protection

If you claim your IP blocks everyone, investors will test that claim.

If it does not hold up, trust drops. Honest framing builds more credibility than bold promises.

Ignoring ownership and assignment details

Even great patents lose value if ownership is messy.

Clean assignments from founders, employees, and contractors matter. Investors notice when this is handled well.

Waiting until diligence to organize

Scrambling during diligence signals risk.

Organized IP from the start makes the process smoother and keeps momentum on your side.

How Tran.vc Helps Founders Use IP for Better Terms

Built for technical founders, not paperwork

Tran.vc was built by operators and engineers who have filed patents themselves.

We focus on protecting what matters, not maximizing page counts or legal complexity.

In-kind investment that builds real leverage

We invest up to $50,000 in patent and IP services so founders can enter seed rounds stronger.

This is not advice from the sidelines. It is hands-on work that creates assets.

Strategy first, filings second

We help founders decide what to protect, when to file, and how to talk about it.

This ensures IP supports fundraising instead of distracting from it.

Designed to support founder-friendly outcomes

Our goal is simple: help you raise with leverage, not desperation.

If you want to build an IP-backed foundation that improves your seed terms, you can apply anytime at https://www.tran.vc/apply-now-form/.