Cross-border fundraising sounds fancy. In real life, it often feels like this: you built something strong, you have early users or pilots, and you suddenly realize the best investors for your kind of company may not live in your country. Maybe the top AI funds are in the U.S., maybe the best robotics angels are in Japan, maybe your first big customer is in Europe, and the investor who understands that market is right there with them. So you look outside your border.

That is smart. It is also different.

When money crosses borders, the “deal” is no longer just about price and ownership. It becomes about structure, rules, paper trails, and trust. The investor is thinking: “If I invest from here into a company there, can I wire money safely? Can I own shares cleanly? Can I get updates in a way I can rely on? Can I exit later without a legal mess?” And you, as the founder, are thinking: “How do I take the money without breaking local laws, without getting stuck in tax trouble, and without giving away too much control too early?”

This guide is written to help you answer those questions in a calm and practical way. Not with theory. With real steps you can take before you start pitching, while you are pitching, and right before you sign.

There is one more reason cross-border fundraising matters right now. Many technical founders do not raise “because it is trendy.” They raise because the work is expensive. Robotics takes time. AI needs data, compute, and deep talent. And deep tech investors often care a lot about defensibility. They want to see that you are not just building a product. You are building a moat. That is one reason Tran.vc exists. Tran.vc supports robotics, AI, and other technical teams with up to $50,000 of in-kind patent and IP services, so your core work becomes a real asset—something investors can value, and competitors cannot copy easily. If you want to talk about that now or later, you can apply anytime at https://www.tran.vc/apply-now-form/.

One important note before we go deeper: cross-border fundraising is not a single playbook. A company in India raising from U.S. angels faces different rules than a company in Germany raising from Singapore funds. A Delaware C-Corp with a team in Vietnam is different from a UK Ltd with a U.S. SAFE. So instead of pretending there is one perfect path, this article will teach you how to think. It will help you choose a clean path for your case, and it will show you where founders usually get hurt.

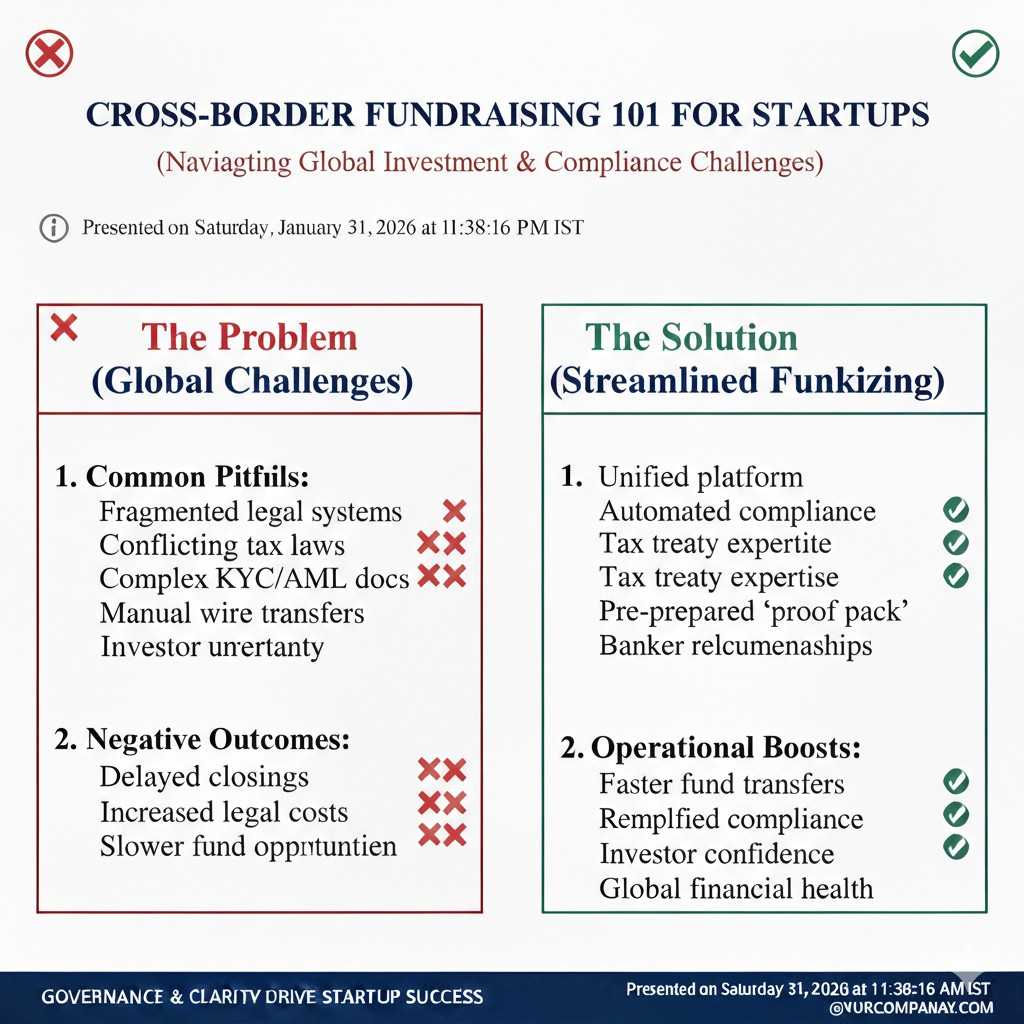

Cross-Border Fundraising 101 for Startups

What cross-border fundraising really means

Cross-border fundraising is simple in one way and complex in another. It is simple because it is just an investor in one country sending money to a company that has a legal life in another country. It is complex because each side has rules that shape what is allowed, what paperwork is needed, and how fast the deal can close.

It also changes how trust is built. When an investor cannot easily visit your office, meet your whole team, or talk to local customers in their own language, they lean more on proof. They want clean records, clear ownership, and clear plans. They want to feel that nothing is hidden and nothing is “kind of okay.”

If you treat cross-border fundraising like normal fundraising with a few extra steps, you will feel surprised later. If you treat it as a separate skill, you will move faster and look more professional in every call. That difference often decides whether the investor leans in or drifts away.

Why startups raise outside their home country

Many founders start locally because it is easier. You know the norms, you know the legal setup, and you have some shared context with local investors. But deep tech and frontier work often has a smaller pool of local backers who truly understand the risk and the time needed.

When you raise across borders, you are often chasing the right fit, not just the highest check. You may want investors who have funded robotics before, who know how long certification can take, or who understand why patents matter for long cycles. You may also want access to partners, labs, talent, and customers that sit in another market.

There is also a signaling effect. A respected investor from a major ecosystem can make other investors take you more seriously. That is not about hype. It is about reducing doubt for people who do not yet know you.

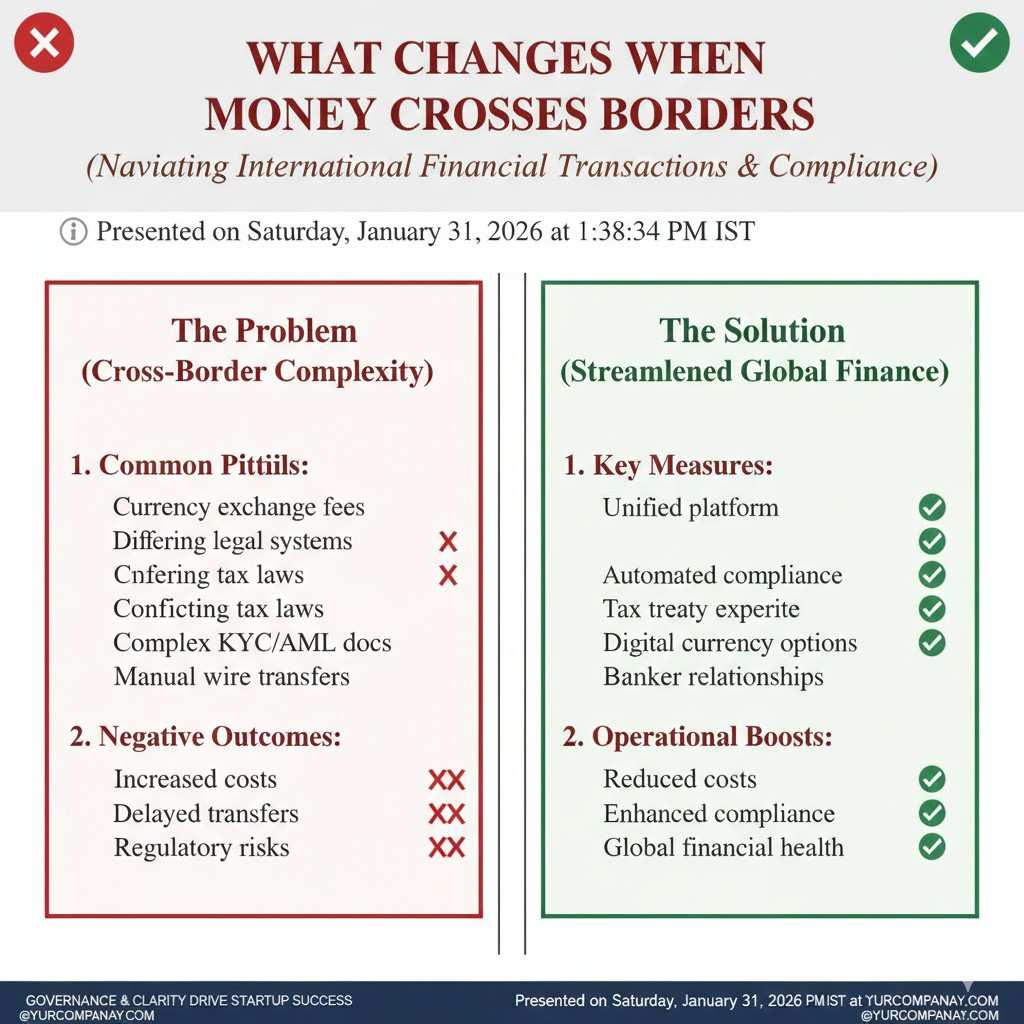

What changes when money crosses borders

In local fundraising, many things are assumed. People assume your company papers follow local norms. They assume the tax path will be manageable. They assume the legal system is familiar. In cross-border deals, those assumptions vanish.

The investor will ask questions that feel “extra,” but they are normal in this context. They want to know where your company is incorporated, where your founders live, where your team works, and where your intellectual property is owned. They will also ask how cash moves from investors to the company and how shares are issued.

Most importantly, cross-border deals increase the cost of confusion. If your structure is unclear, the investor may walk away even if they like you. They may not have the time or patience to fix basic setup issues for you, especially in early stages.

The hidden goal of this whole process

Most founders think fundraising is the goal. In reality, the goal is to build a strong company that can keep operating even when things get hard. Cross-border fundraising should support that goal, not distract from it.

A clean cross-border setup helps you hire in different countries, sell to global customers, and raise future rounds without redoing everything. A messy setup can trap you later, when you are moving fast and do not have time to fix old mistakes.

If you are building AI, robotics, or deep tech, this matters even more. Investors in these areas often care about defensibility. They want to see that your core invention is protected and owned by the right entity. Tran.vc supports founders by investing up to $50,000 in in-kind patent and IP services to build that foundation early. You can apply anytime at https://www.tran.vc/apply-now-form/.

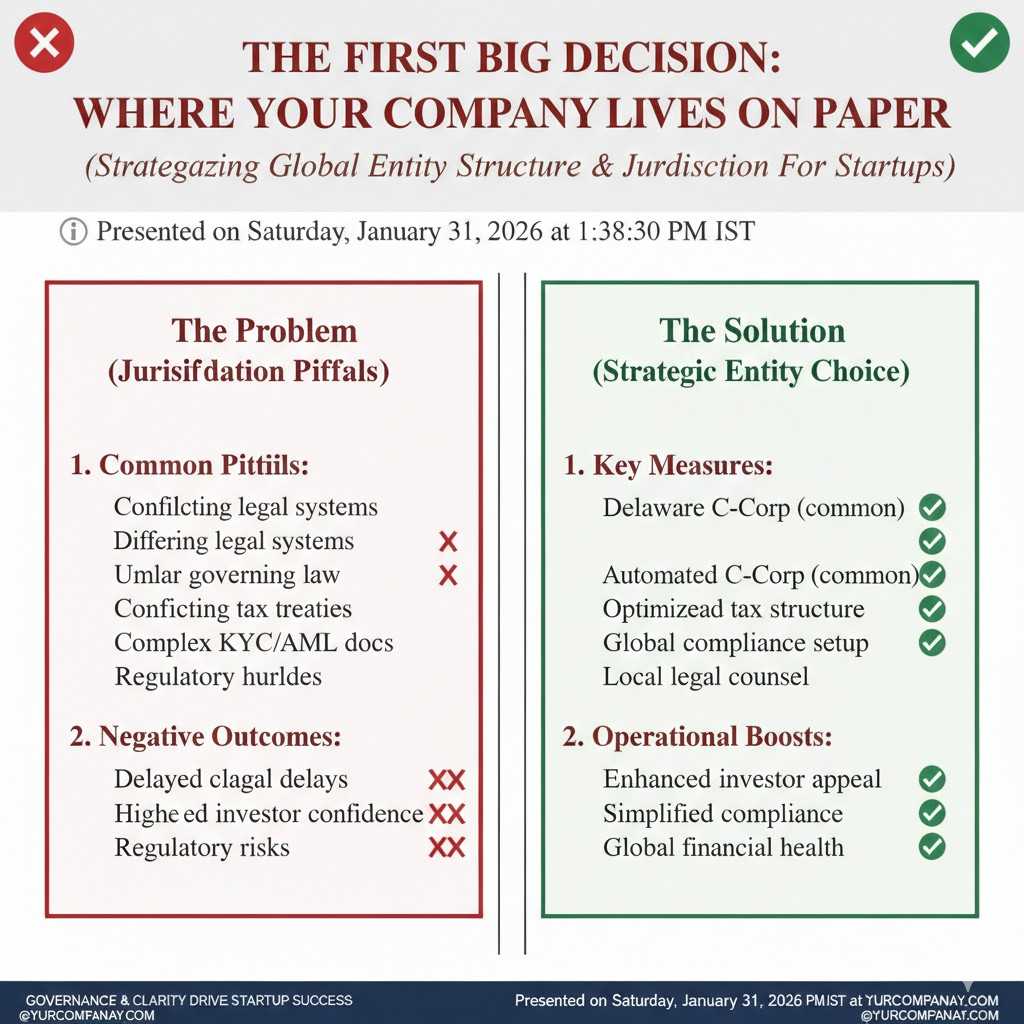

The first big decision: where your company lives on paper

Why investors care about your legal “home”

A company’s legal home is not where the team sits. It is where the company is incorporated. That choice affects investor rights, taxes, reporting, and how easy it is to do future rounds. For many investors, it also affects their ability to invest at all.

Some funds have strict rules. They may only invest in certain jurisdictions. Others can invest anywhere, but prefer structures they already know. This is not always about fairness. It is about speed, cost, and risk. If they have done ten deals in one setup, they know where the landmines are.

As a founder, you do not need to please every investor. You do need to make it easy for the right investor to say yes. Your legal home is one of the fastest ways to remove friction.

The most common paths founders choose

There are a few common patterns you will see across markets. One pattern is raising locally through a local company, where foreign investors invest directly into that local entity. Another pattern is setting up a parent company in a common startup jurisdiction and keeping operations in the home country as a subsidiary.

Each path has trade-offs. The local-only path can be easier for compliance and taxes in your home country, but it may reduce the pool of foreign investors who can participate. The parent-company path may open more doors, but it can add setup cost and ongoing admin work.

The right answer depends on your goals and your stage. If you are pre-seed and still testing the market, moving too early into a complex structure can waste time. If you already have strong global pull and clear investor interest, waiting too long can slow a round later.

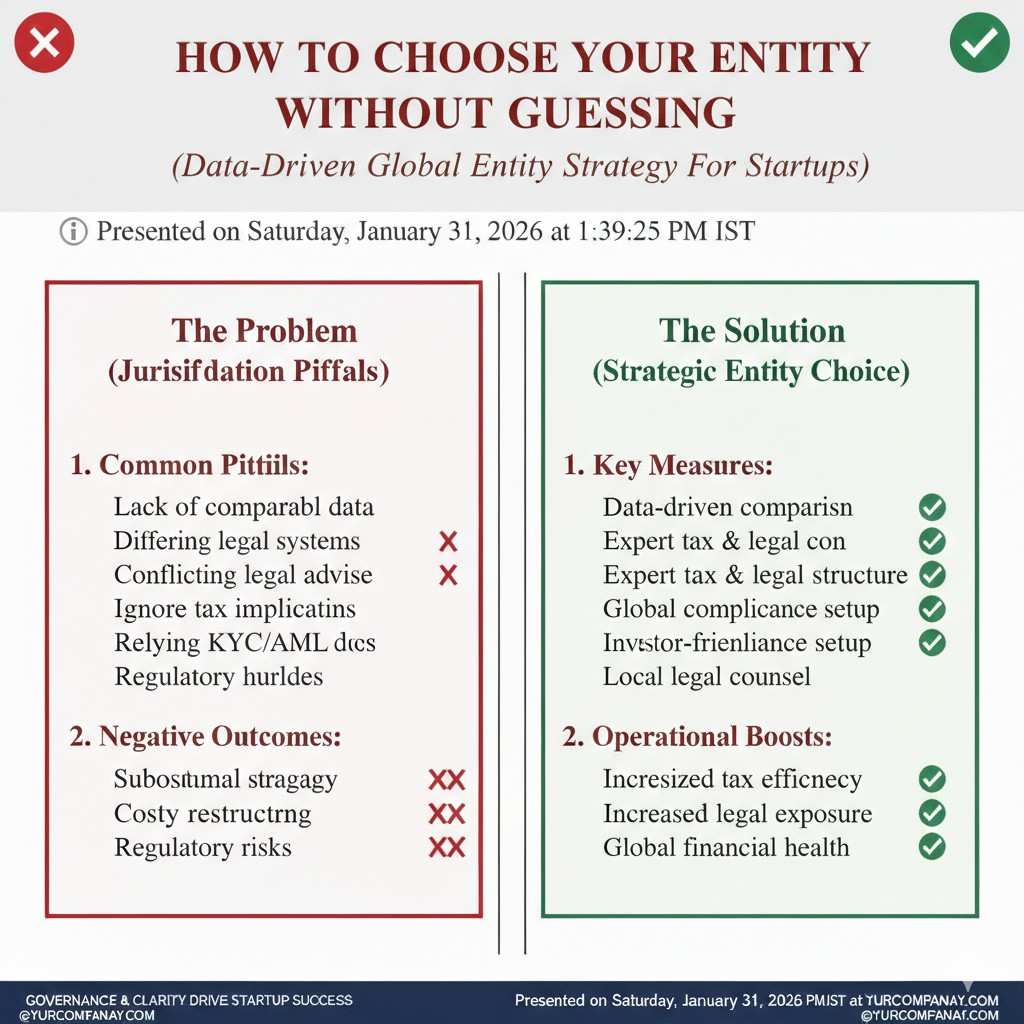

How to choose without guessing

The cleanest way to decide is to work backward from three facts. First, where are the investors you expect to raise from over the next two rounds. Second, where are your largest customers likely to be. Third, where does your core work happen, especially the invention work that creates your moat.

If your next two rounds are likely to come from a specific market, you should seriously consider a structure that those investors are comfortable with. If your customers will be global, you should choose a setup that supports cross-border contracting and payments. If your invention work is your edge, you must ensure the right entity owns it.

This is where IP strategy becomes part of fundraising strategy. A strong IP plan can reduce investor fear and increase valuation confidence. Tran.vc focuses on this early, by providing up to $50,000 in in-kind patent and IP services that help founders build a real moat before they are forced to negotiate from weakness. Apply anytime at https://www.tran.vc/apply-now-form/.

A practical warning about “quick flips”

Some founders hear that they should “just incorporate in X country” and they rush. That can backfire. If you move your structure without thinking through local rules, you can create compliance problems. If you move without aligning IP ownership, you can create legal gaps.

Investors can spot rushed setups. They may not say it directly, but it shows up as delays, more questions, and requests for special protections. The goal is not to choose the most popular structure. The goal is to choose the structure that is clean, legal, and aligned with your real plan.

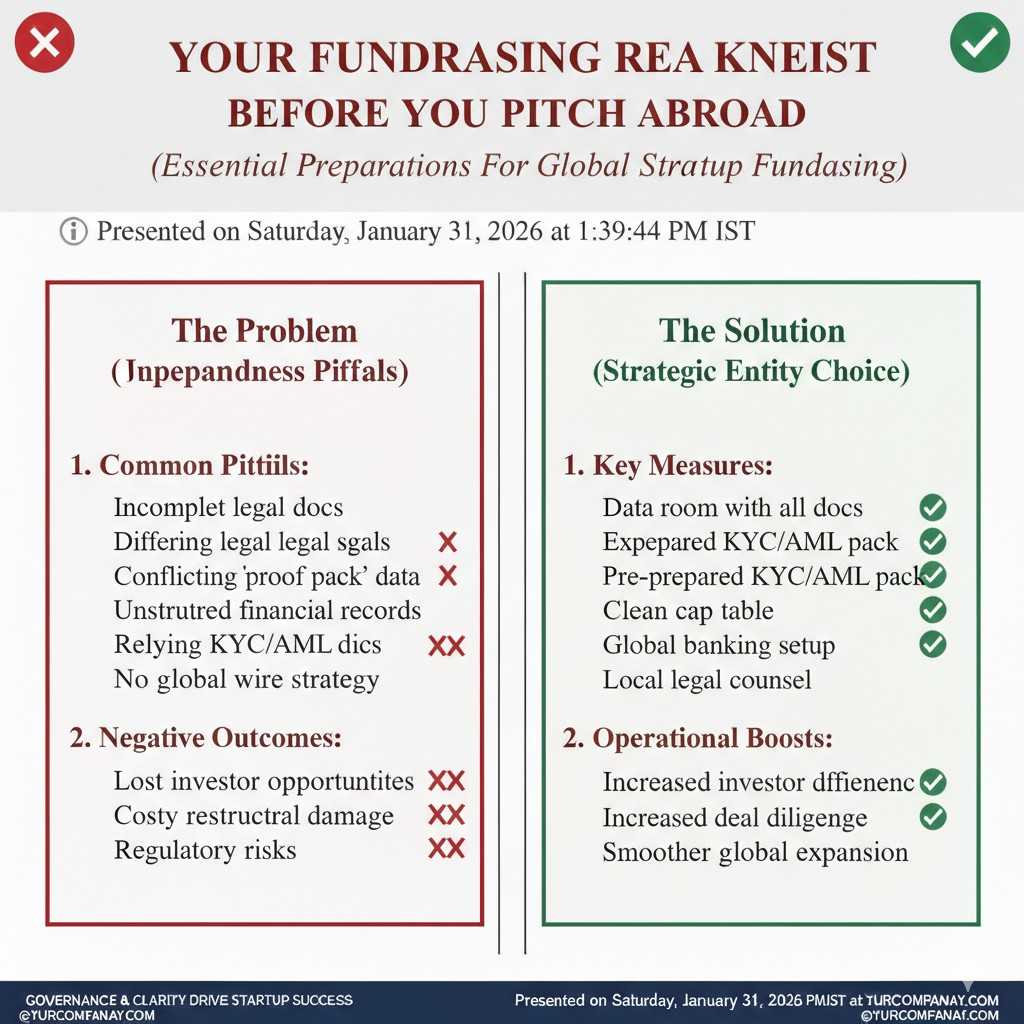

Your fundraising readiness checklist before you pitch abroad

Why preparation matters more in cross-border rounds

In local fundraising, you can sometimes patch issues as you go. In cross-border fundraising, patching is harder because each fix may require lawyers in two countries, extra documents, and more time. Delays can kill momentum, and momentum is what turns interest into a signed term sheet.

Investors abroad also compare you to founders they see every week. If you show up unprepared, you do not just look early. You look risky. The good news is that preparation is not about fancy documents. It is about clarity and consistency.

The minimum set of company documents you should have

At a basic level, you need clean incorporation documents, a clear cap table, and founder agreements that match reality. You also need proof that anyone who built the product actually assigned their work to the company. This includes co-founders, employees, contractors, and sometimes even advisors.

If you have any paid pilots or revenue, you should have signed contracts or at least signed statements that confirm the relationship. If you do not have revenue yet, you should have proof of demand such as letters of intent, pilot plans, or customer emails that show serious intent.

None of this needs to be long. It needs to be real. Investors do not require perfection at pre-seed. They do require that you are not guessing about what you own and what you have promised.

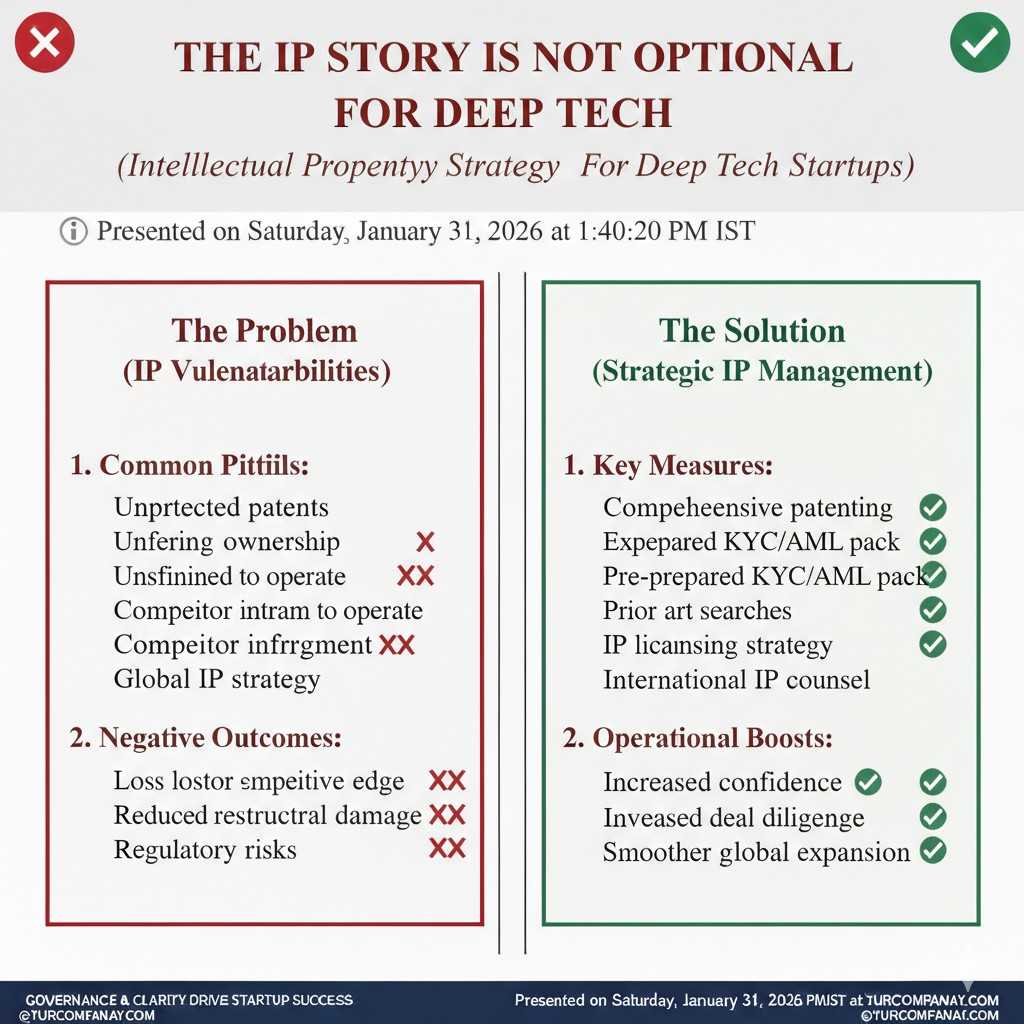

The IP story is not optional for deep tech

If you are building AI, robotics, or other hard tech, you need to explain what is defensible and why. That does not mean you must have patents granted before raising. It means you should show that you understand what should be protected and what should stay as trade secrets.

A strong IP story includes a simple map of what is new, what is hard to copy, and what you are doing to protect it. It also includes ownership clarity, so investors know the company owns the core invention. This is often a key reason investors choose one technical startup over another.

Tran.vc helps founders build this early with patent strategy and filings as in-kind support, up to $50,000. It is designed to turn technical work into real assets that investors can respect. If that would help your round, apply anytime at https://www.tran.vc/apply-now-form/.

A clean data room is your silent sales tool

A data room is not just storage. It is a signal. When an investor asks for something and you share it quickly, you show competence. When you share it in a clear folder with simple names, you show that you run a tight ship.

You do not need twenty folders. You need the right few items that answer the investor’s core fear: ownership, legality, traction proof, and team credibility. The more you reduce investor effort, the faster they move.

Understanding investor types across borders

How foreign angels think differently

Angel investors abroad may move fast, but they often rely on trust and references. They may not have time to study local rules, so they prefer deals that feel standard. They also like founders who can explain the structure in plain words without hiding behind legal terms.

A foreign angel is also thinking about follow-on rounds. They do not want to be stuck in a structure that future investors hate. So even if they love you, they may push you toward a setup that makes later fundraising easier.

How funds make decisions when the company is far away

Funds are built to manage risk. When a company is in another country, funds often add extra steps. They may involve counsel earlier. They may ask for deeper diligence on ownership and compliance. They may require certain clauses that they do not always ask for locally.

This does not mean they distrust you. It means they have a duty to their own investors. If something goes wrong, they must show they did the right checks. Your job is to make those checks simple, fast, and boring. Boring is good in diligence.

Strategic investors and corporate partners

If a corporate investor is from another country, they may care more about commercial access than financial returns. They might want distribution rights, exclusivity, or first access to new features. These terms can look attractive in the moment, but they can hurt you later if they block other customers or investors.

If you take corporate money across borders, you must be extra careful about contracts and IP. You do not want to give away rights that make your invention less valuable. This is another reason to have an IP plan early, so you know what you can share and what you must protect.

How cross-border deal terms quietly change

Why “standard” terms stop being standard

Many founders hear phrases like “this is market standard” and relax. In cross-border fundraising, that phrase can be misleading. What is standard in one country may be rare or even risky in another. Investors often use templates built for their home market, and those templates may not fully fit your setup.

This does not mean the investor is trying to take advantage of you. It usually means they are moving fast with tools they know. Your job is to understand how each term behaves when applied across borders, especially when enforcement, taxes, and future rounds are involved.

Small wording changes can have big effects later. A clause that feels harmless now can create pain when you raise again or when you try to exit.

Valuation feels different when currencies are involved

When investors invest from another country, they think in their own currency. You think in yours. This can create confusion around valuation, ownership, and expectations. A valuation that feels fair to you may feel expensive or cheap to them once currency risk is considered.

Some investors mentally discount valuations in volatile currencies. Others build currency risk into the terms, such as asking for stronger protections. If you understand this early, you can frame the conversation better and avoid frustration on both sides.

Clear communication helps here. Talk openly about how you think about valuation, growth, and future rounds. When expectations are aligned, deals move faster and feel fairer.

Control terms matter more when distance exists

When an investor is far away, they sometimes ask for more control rights. This can include stronger information rights, approval rights, or board observer roles. Their logic is simple. They cannot drop by your office, so they want formal ways to stay informed.

Not all control terms are bad. Some can actually help you by bringing structure and discipline. The risk comes when control rights pile up and limit your ability to operate freely or raise later rounds.

This is where early judgment matters. You do not need to say yes to everything to close a deal. Calm explanations and reasonable alternatives often work better than emotional pushback.

Taxes and compliance: the quiet deal killers

Why founders underestimate tax impact

Taxes are rarely exciting, so many founders ignore them until the last minute. In cross-border fundraising, that is dangerous. A poorly planned structure can lead to double taxation, unexpected withholding, or reporting duties you did not plan for.

Investors care about this too. If they suspect tax trouble, they may pause the deal. Not because they fear taxes themselves, but because tax issues signal deeper structural problems.

You do not need to become a tax expert. You do need to know where the risks are and who to talk to before you sign anything.

Where problems usually show up

Common trouble spots include money moving between parent and subsidiary, founders living in one country while being paid by another, and IP being developed in one place but owned in another. Each of these can trigger tax questions.

Another issue is grants or incentives from local governments. These often come with strings attached, especially around ownership or relocation. If you accept foreign investment without checking those rules, you may be forced to repay grants or lose benefits.

The solution is not to avoid foreign money. The solution is to plan before you take it. A short conversation with the right advisor early can save months of pain later.

How clean IP ownership reduces tax risk

IP ownership is not just about defense against competitors. It also affects taxes. Where IP is owned, licensed, or transferred can trigger tax events. Investors are very sensitive to this because mistakes can be expensive and hard to fix.

When your IP story is clean and intentional, tax planning becomes easier. When it is messy, every new investor adds pressure. This is why Tran.vc emphasizes early IP strategy as part of company building, not as an afterthought. Their in-kind investment of up to $50,000 in patent and IP services helps founders set this up correctly from day one. You can apply anytime at https://www.tran.vc/apply-now-form/.

Communication and trust across borders

Why silence kills cross-border deals

In local fundraising, silence can be awkward. In cross-border fundraising, it can be fatal. When time zones, cultures, and distance exist, investors often assume the worst if they hear nothing. They may think the deal is dead, or that you are disorganized.

Clear and regular updates keep deals alive. Even a short message saying “we are waiting on one document and will update you Friday” builds confidence. It shows respect for the investor’s time and attention.

You do not need to overshare. You need to be predictable. Predictability builds trust faster than charm.

Cultural differences you should respect

Different regions have different communication styles. Some investors prefer direct and fast answers. Others value context and relationship-building. Some expect formal updates. Others prefer casual check-ins.

You do not need to change who you are. You do need to notice how the investor communicates and meet them halfway. Small adjustments can make conversations smoother and reduce misunderstandings.

When in doubt, clarity wins. Simple words, clear timelines, and honest answers travel well across cultures.

Time zones and deal momentum

Time zones slow everything down. A one-day delay in replies can turn into a week-long gap. This is why you should plan your fundraising calendar with extra buffer when raising across borders.

If possible, cluster meetings and decisions. If an investor asks for documents, send them all at once rather than piecemeal. If legal review is coming, warn everyone early. Momentum is fragile, and distance makes it more fragile.

Closing the round without last-minute surprises

Why the last mile is the hardest

Many cross-border rounds fall apart at the very end. Terms are agreed. Everyone is excited. Then lawyers start talking, and new issues appear. This is usually not bad faith. It is late discovery.

Late discovery happens when structure, IP, or compliance issues were not addressed early. The fix is not to rush the close. The fix is to surface these topics earlier in the process.

When you bring up hard topics before the term sheet, you look mature. When they appear after, you look unprepared.

Documents you should expect at closing

Cross-border deals often involve more documents than local ones. This can include investment agreements, shareholder agreements, side letters, and sometimes local filings. Each document adds time.

You should read every document, even if you trust the investor. You do not need to understand every legal word, but you should understand what changes control, economics, and future flexibility. If something feels unclear, ask.

Asking questions does not make you look weak. It makes you look serious.

Keeping your future self in mind

The deal you sign today shapes your options tomorrow. A clause that seems small now can block a future investor. A rushed structure can slow your next round. A messy IP setup can lower your leverage when things are going well.

Good founders think two steps ahead. They choose paths that keep doors open. That is especially important in cross-border fundraising, where fixes are harder and slower.

This is why early support matters. Tran.vc works with technical founders before pressure hits, helping them build IP-backed foundations that support global fundraising. Their in-kind investment of up to $50,000 in patent and IP services is designed to give you leverage, not lock you in. Apply anytime at https://www.tran.vc/apply-now-form/.

Final thoughts before you go global

Cross-border fundraising is a skill, not a gamble

Raising across borders is not about luck. It is about preparation, clarity, and respect for complexity. When you treat it as a skill, you gain confidence. When you treat it as a gamble, you feel stressed and reactive.

Founders who do well here are not the loudest. They are the most intentional. They know what they own, why it matters, and how it fits into a global story.

Build assets, not just stories

Investors across borders look for substance. They want to see that your work creates lasting value. In deep tech, that often means strong IP, clear ownership, and a long-term view.

If you build assets early, fundraising becomes easier everywhere. Conversations shift from “can this work” to “how big can this get.” That shift changes everything.