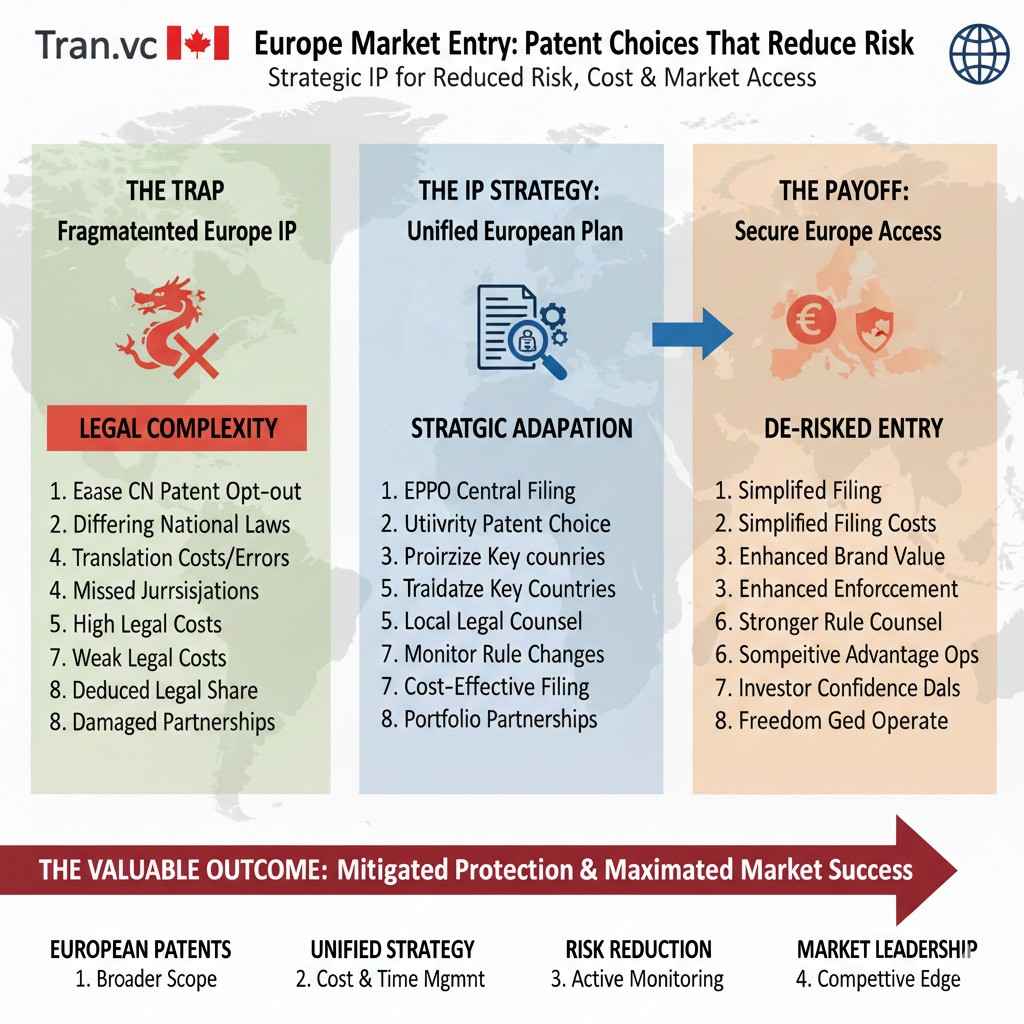

Europe Market Entry: Patent Choices That Reduce Risk

When founders plan a Europe launch, they usually think about sales first. New users. New partners. New hires. Maybe a small office in Berlin, Paris, or Amsterdam. But Europe has its own rules for copying and competition. And if you enter with weak patent choices, you can lose time, money, and leverage—right when you need […]

Europe Market Entry: Patent Choices That Reduce Risk Read More »