Most founders don’t lose investors because their product is bad. They lose them because they talk about product-market fit in a way that sounds fuzzy.

VCs hear “we have traction” all day. They hear “people love it” every hour. They hear “we’re close to PMF” from almost everyone.

So your job is simple (but not easy): make product-market fit feel real, provable, and inevitable—without sounding like you are trying too hard.

And if you are building in robotics, AI, or deep tech, you have one extra job: show that your advantage can’t be copied, because the best traction in the world is fragile if anyone can clone your core tech.

That’s exactly why Tran.vc exists. If you want help turning your invention into a real moat—patents, strategy, filings, and clean IP story for investors—you can apply anytime here: https://www.tran.vc/apply-now-form/

How to Talk About Product-Market Fit to VCs

Why this topic decides your round

Most VC meetings do not fail because the investor “did not get it.” They fail because the founder did not make the story feel solid. Product-market fit is the fastest shortcut investors use to judge risk. If you explain it well, the meeting moves forward. If you explain it badly, they start looking for reasons to say no.

This is even more true in AI and robotics. These markets can look exciting on the surface, but VCs worry about long build times, hard sales cycles, and copycats. Your job is to show clear demand, clear use, and a clear reason you will keep winning.

If you want help turning your core invention into an investor-ready moat, Tran.vc can support you with up to $50,000 in-kind IP and patent services. You can apply anytime at https://www.tran.vc/apply-now-form/

What VCs Actually Mean by Product-Market Fit

PMF is not a feeling, it is buyer behavior

Many founders talk about PMF like it is an emotion: “people love it” or “we get great feedback.” A VC hears that and thinks, “That’s nice, but will they pay and stay?” Investors do not fund excitement. They fund repeatable buying and repeatable results.

When you speak about fit, talk about what buyers do, not what they say. Do they sign quickly? Do they use the product often? Do they renew? Do they expand? Those actions are the closest thing to proof you have in early stage.

PMF is always specific, never general

Product-market fit is not “the market needs this.” That is too wide. Fit lives in one narrow place first. It starts with a type of buyer, in a certain situation, with a certain pain, and a certain budget. If you speak in broad terms, you sound like you are guessing.

The strongest founders can say, with calm certainty, who the buyer is right now. They can also say who is not the buyer yet. That clarity signals discipline, and discipline signals a higher chance of success.

PMF has levels, and VCs listen for the level you are at

Many founders think PMF is either “yes” or “no.” In reality, there are stages. Early on, you may have fit in one small use case. Later, you may have fit in one vertical. Later still, you may have fit across a wider market.

You do not need to pretend you are at the final stage. You need to be honest about your stage, and show momentum toward the next stage. That is how you sound credible without sounding small.

The Big Mistake Founders Make When Talking About PMF

Talking like PMF is in the future

When a founder says, “We are looking for product-market fit,” the VC hears, “We still do not know if this is real.” That can be true, but you do not want to frame it that way. Even very early companies can show early signs of fit.

A better way to speak is to say you have fit in a narrow corner, and you are expanding outward. This sounds grounded. It also gives the investor a clear mental model: you have a wedge, and you are widening it.

Using vague words that hide the truth

Words like “traction,” “interest,” and “pipeline” are weak because they mean different things to different people. One founder says “traction” and means “we have a waitlist.” Another means “we have paid customers.” A VC cannot tell what you mean unless you explain it plainly.

In your meeting, remove labels and replace them with facts. Say what is happening, how often it happens, and why it is happening. That creates trust fast.

Over-selling instead of explaining

Some founders fear that if they speak calmly, they will sound less exciting. So they push hard. They say, “We are the next big thing,” or “this is unstoppable.” That usually backfires. VCs have heard it too many times.

The best tone is simple and direct. You are not trying to win a debate. You are helping the investor see reality through clean examples.

A Definition of PMF That Works in VC Conversations

The investor-grade definition

A definition that works well in meetings is this: product-market fit is when a specific buyer has a painful problem, they choose your product without endless pushing, they keep using it, they keep paying, and results improve as you repeat the sale.

This definition is useful because it naturally forces you to speak about proof. It pulls you away from opinions and pulls you into observable behavior.

What this definition forces you to show

If you use this definition, you will talk about your buyer, your deal flow, your usage, your renewals, and your repeatability. This is exactly what investors are trying to understand, even if they do not ask for it directly.

It also protects you from the trap of “big market talk.” Yes, your market may be huge. But if buyers are not behaving like they need your product, the market size does not matter yet.

Why this matters even more in AI and robotics

Deep tech often has strong demos. But a strong demo is not fit. Fit is when a buyer changes their workflow and keeps it changed. In robotics, it can be hard because deployments take time. In AI, it can be hard because switching costs can be low.

That means you must prove stickiness and expansion. If your product becomes part of daily work, it becomes harder to replace. That is the kind of fit investors can believe.

How to Stop Saying “We Have Traction” and Start Sounding Real

Replace general claims with one clear movement

Instead of saying “we have traction,” pick one movement that is true and important. For example, you can talk about usage rising inside paid accounts, or renewals staying strong, or pilots converting to contracts faster over time.

One solid movement is better than five vague claims. It gives the investor a clear hook. It also gives them a reason to ask deeper questions, which is what you want.

Explain the movement like a field report

The most persuasive way to speak is to sound like you are reporting what you saw. Tell the investor what happened, in what order, and what you learned. This style feels human and grounded.

For example, you can explain how a customer started small, then expanded, and then referred another team. That is a story, but it is also data, because it is based on actions.

Show what changed because of your product

VCs care less about your features and more about the change you create. If you can say, “Before us, this took two hours and had many errors; now it takes twenty minutes with fewer errors,” you make the value concrete.

When you make value concrete, price and renewals make more sense. It becomes easier for the VC to imagine why the buyer will keep paying.

The Simple Structure That Makes PMF Easy to Understand

Start with the buyer and the pain

You should be able to name the buyer in one simple phrase. Then name the pain in one simple phrase. This creates instant clarity. The VC should not have to guess who cares.

If you sell to manufacturing, do not say “industry.” Say “plant managers” or “quality leads.” If you sell to hospitals, do not say “healthcare.” Say “radiology directors” or “billing teams.” Specific words signal real learning.

Say what they tried before you, and why it failed

This step matters because it shows the pain is real. If the buyer already tried to solve the problem, it means the problem is worth solving. It also shows why your approach is different.

For AI and robotics, this is where you explain why a normal software tool, or a manual process, or a simple rule-based system did not work. Keep it plain. Avoid long technical detail. You want the investor to understand the “why,” not the math.

Show the proof in what they do next

The best proof is what happens after first use. Do they ask to expand? Do they add users? Do they connect more data sources? Do they push you for enterprise terms? Do they ask for a longer contract?

Those actions are the strongest signs that the buyer is pulling the product. That pull is what investors are hunting for.

How to Talk About Product-Market Fit to VCs

The VC question behind the VC question

When a VC asks about product-market fit, they are rarely asking for a definition. They are trying to learn if your business is becoming predictable. Predictable does not mean boring. It means repeatable. It means the same story happens again and again with different customers, and each cycle teaches you something that makes the next cycle easier.

So in the next part, I will show you how to answer the most common questions VCs ask about fit, without over-selling, and without getting trapped in long explanations. The goal is to sound clear, steady, and real.

If you want Tran.vc’s help building the IP story that makes your fit stronger and harder to copy, you can apply anytime at https://www.tran.vc/apply-now-form/

How to Answer VC Questions About PMF Without Getting Cornered

“Who is the buyer, exactly?”

This question is not about job titles. It is about focus. The VC is trying to see if you are aiming at one clear person with one clear reason to buy, or if you are casting a wide net and hoping someone bites.

A strong answer sounds like a clean snapshot. You name the role, the setting, and the moment when the pain becomes urgent. For example, instead of saying, “We sell to logistics,” you might say, “We sell to warehouse ops leads at mid-size 3PLs when picking errors start causing late shipments and chargebacks.” That single line makes your market feel real because it describes a situation, not just a sector.

If you are in AI, do not say “data teams” unless you truly sell to them. Many AI products are bought by business owners, not data people. If you are in robotics, do not say “manufacturing” unless you can name the plant-level person who owns the budget and the deadline. Investors know that unclear buyers create long sales cycles, and long sales cycles kill early startups.

“What problem is so painful that they must act now?”

VCs ask this because many products are “nice to have.” Nice-to-have products can still become big, but they take longer, and they churn more. Early stage investors prefer pain that creates urgency.

You do not need to use dramatic language. You need to show what the pain costs. Costs can be money, time, risk, safety, or missed revenue. The best answers are simple and measured. You can say, “This leads to rework and overtime,” or “This causes compliance risk,” or “This creates downtime that stops revenue.”

In robotics, urgency often comes from safety, labor gaps, and downtime. In AI, urgency often comes from speed, accuracy, and the cost of manual review. Name the cost in plain terms. If you have even a rough estimate, share it and explain where it came from. Honest ranges sound better than fake precision.

“Why do they choose you instead of doing nothing?”

This is a hard question because “doing nothing” is the most common competitor. People stick with old workflows even when they are bad. So you need to show what pushes them over the edge.

A helpful way to answer is to describe the breaking point. Maybe they hire more people, but it still does not fix the issue. Maybe errors rise as volume grows. Maybe a new rule forces them to change. Maybe the current vendor fails at a key moment. That is the moment when they stop tolerating the pain.

Then you explain why your product becomes the easiest path. In this part, avoid long feature lists. Focus on the one or two reasons adoption is easier with you. It might be “fast install,” “works with their current tools,” or “gives results in week one.” VCs want to see that the buyer can say yes without fear.

How to Describe Your Traction in a Way That VCs Trust

Use one customer story, then show it repeats

Many founders dump numbers too early. Numbers matter, but without context they can feel thin. A strong approach is to start with one real customer story, told cleanly, and then show how many times that story has happened.

You can describe how you found the customer, what they were using before, what changed after they started, and what they did next that proves value. Then you say, “We have now seen this pattern with X other customers in the same profile.” That makes the story feel repeatable.

Repeatable is the bridge from “interesting” to “investable.” Even if your numbers are small, repetition in a narrow segment is a powerful signal.

Speak in trends, not vanity points

In early stage, a VC cares more about direction than absolute scale. They want to know if you are learning fast and getting stronger. So talk about trends that show improvement over time.

For example, you might explain that pilots are turning into paid contracts faster than before, or onboarding time has dropped, or usage inside accounts is growing without extra selling. Trends show that your machine is forming.

Avoid vanity points that do not show learning. A large waitlist, social buzz, or “we talked to many people” can be fine, but none of these are proof of fit. They are only useful if they lead to real usage and real payment.

Do not hide bad news, frame it like a lesson

If churn exists, or deals stall, a VC will eventually find out. The fastest way to build trust is to address it calmly and show what you learned. The key is to separate the “who” from the “why.”

For example, you can say, “We saw churn mostly in teams that did not have a clear owner,” or “We lost deals when we sold too broadly.” Then you explain what you changed. This makes you sound like a builder, not a dreamer.

Investors do not expect perfection. They expect honesty plus improvement. That combination is rare, and it stands out.

How to Answer “Do You Have PMF Yet?” Without Sounding Weak

Avoid the yes-or-no trap

Some founders panic and answer “yes” with no proof, or “no” with no hope. Both answers create problems. If you say yes too early, you sound naive. If you say no too bluntly, you sound like a research project.

A better approach is to answer with your current scope. You can say, “We have strong fit in a narrow use case with this type of buyer, and we are expanding into the next adjacent use case.” That is honest and confident at the same time.

This answer also invites the VC to ask good follow-up questions. It gives them a map. VCs like maps.

Define what “fit” means in your business

Fit looks different in different categories. In some SaaS products, fit shows up as self-serve signups and fast activation. In robotics, fit may show up as repeat deployments and multi-site rollouts. In AI, it may show up as high retention and expanding usage across workflows.

So explain your fit signals in business terms. You can say, “For us, fit means a deployment that leads to a second deployment,” or “fit means a pilot that converts to annual spend,” or “fit means customers expand usage without heavy support.” When you define fit clearly, you control the frame of the discussion.

Make your next milestone feel near and measurable

Investors also want to know what comes next. So after you describe your current level of fit, describe the next proof you are chasing. Keep it measurable.

For example, you might explain that the next milestone is a certain conversion rate from pilot to contract, or a certain expansion rate inside accounts, or repeat orders from the same buyer type. You are not begging for belief. You are showing a clear path to stronger proof.

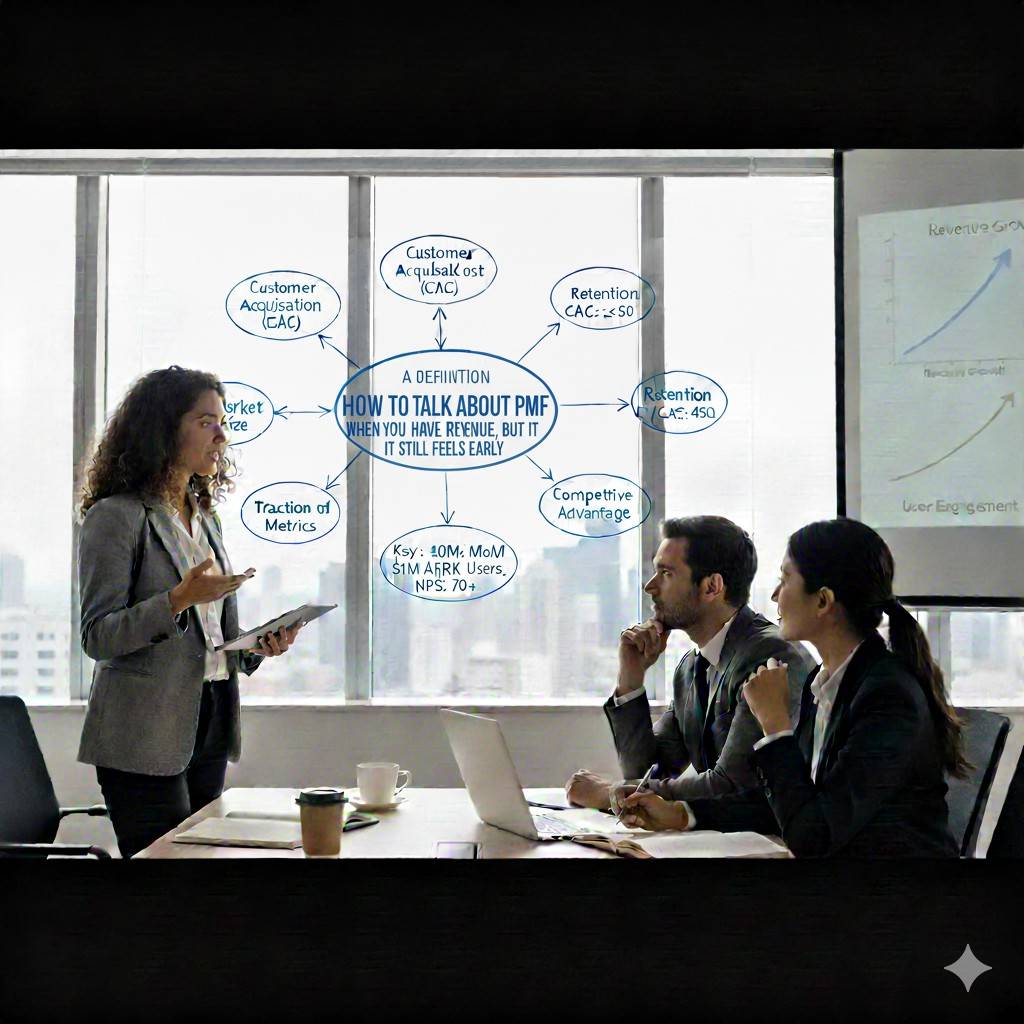

How to Talk About PMF When You Have Revenue, But It Still Feels Early

Explain what revenue means in your world

In some markets, a small amount of revenue can be extremely meaningful. In other markets, it can be misleading. A VC wants to know which one applies to you.

If your contracts are large and slow, even one paid customer can be a strong signal. But you must explain why that customer is not a one-off. You can describe how many similar buyers exist, and what makes this customer typical.

If your revenue is small but growing, explain the growth drivers. Talk about why new accounts close, and why existing accounts expand. The key is to make revenue feel like the result of demand, not the result of a heroic founder pushing every deal uphill.

Separate paid proof from paid testing

VCs also know that some customers pay for experiments. They will pay small amounts to “try” new tech, then stop. That is not fit, it is curiosity.

So you should show signs that the customer is building you into their real work. Examples include adding more users, connecting more systems, requesting security review, asking for uptime terms, or shifting budget from an old tool to yours. These actions show commitment.

When you describe revenue, always add one line about the customer’s behavior after payment. That is what turns money into proof.

Show what becomes easier over time

If your sales process is getting easier, you are moving toward fit. If it stays hard, you might be stuck. So talk about what is getting easier.

Maybe your pitch is clearer. Maybe the buyer’s objections are fewer. Maybe installs are faster. Maybe procurement becomes smoother because you now have the right documents and security posture.

This matters a lot in robotics and AI, where friction can be high. A VC wants to know if you are lowering friction each month. Lower friction is a quiet form of momentum.