Patents can make a pitch deck feel “real” fast. They show you are not just building a product. You are building an asset. But patents can also hurt you if you talk about them the wrong way. One bold line like “We own this market” or “Competitors can’t touch us” can trigger investor doubt in seconds.

This guide will show you how to put patents in your deck in a clean, honest way that builds trust. You will learn what to say, what not to say, and how to frame your IP so it helps your story instead of creating risk. If you want expert help turning your invention into strong, fundable IP, you can apply anytime at https://www.tran.vc/apply-now-form/

How to Use Patents in Your Pitch Deck Without Overclaiming

What this article will help you do

Patents can be one of the strongest “proof points” in a pitch deck. They can also be one of the fastest ways to lose trust if you sound like you are making legal promises you cannot back up. Investors have seen both. Many have also seen founders get trapped in messy claims that later show up in diligence.

This article helps you talk about patents with confidence and care. You will learn how to show real progress, real thinking, and real protection, without turning your deck into a legal pitch. If you want help shaping a patent plan that fits your product and your stage, you can apply anytime at https://www.tran.vc/apply-now-form/

Why patents help in a pitch deck

Patents are a signal, not a trophy

Most investors do not fund you because you filed a patent. They fund you because you are building something hard to copy, and you can keep improving it. A patent can support that story, but it cannot replace it.

So the goal is not to “show patents.” The goal is to show a moat that is forming. Patents are one part of that moat, along with speed, data, know-how, and customer pull. When you treat patents as proof of thoughtful building, investors lean in.

Patents reduce fear around copycats

In deep tech, AI, and robotics, many ideas sound similar at first. The details matter, but the deck is short. A patent story gives investors a reason to believe your details are real and have been thought through.

It can also calm a common fear: “If this works, bigger players will copy it.” You should never say they cannot copy it. But you can show you are making it costly, slow, and risky to copy you.

Patents show discipline and long-term thinking

A strong patent section tells investors you plan ahead. It says you are not only chasing a demo. You are building a company that can defend its position later, when the market is larger and the stakes are higher.

This matters even more if you are raising early. At seed, investors often bet on your ability to build leverage. IP is a form of leverage when it is done with care. If you want Tran.vc to help you build that leverage from day one, you can apply anytime at https://www.tran.vc/apply-now-form/

Why overclaiming hurts more than silence

Overclaiming makes investors doubt everything else

Investors hear bold claims every day. They expect ambition. But there is a difference between business ambition and legal certainty. When you blur that line, you create a red flag.

If you say “We are patented,” but you only filed a provisional, an investor may wonder what else is being stretched. If you say “We have protection,” but the claims are not even drafted yet, it can feel like marketing. Once trust drops, it rarely comes back in the same meeting.

Patents are nuanced, and investors know it

A patent is not a magic shield. A granted patent can still be challenged. A pending application can be rejected or narrowed. A provisional is not examined at all. Investors understand these basics, and many have legal teams who understand them very well.

So your job is simple: speak in plain truth. Tell them what you did, what you filed, what you are planning, and why it matters. Avoid absolute words like “guarantee,” “cannot,” “blocked,” or “own.”

Overclaiming creates diligence problems later

Diligence is where decks meet documents. If your deck says you have two patents granted, but you really have two applications filed, it becomes a credibility issue. Even if the mistake was accidental, it becomes “a thing.” It adds delay, extra calls, and extra doubt.

A clean IP story saves time later. It also makes you look like a steady operator. That steadiness is a quiet advantage in fundraising.

The simple rule: be exact, then be useful

Exact means you name the status clearly

Instead of saying “patented,” say “patent pending,” or “provisional filed,” or “non-provisional filed,” or “granted.” Use the right words, and do it every time. This is not about being fancy. It is about being accurate.

When you are accurate, investors relax. They stop trying to decode your wording. Then they can focus on what you are building.

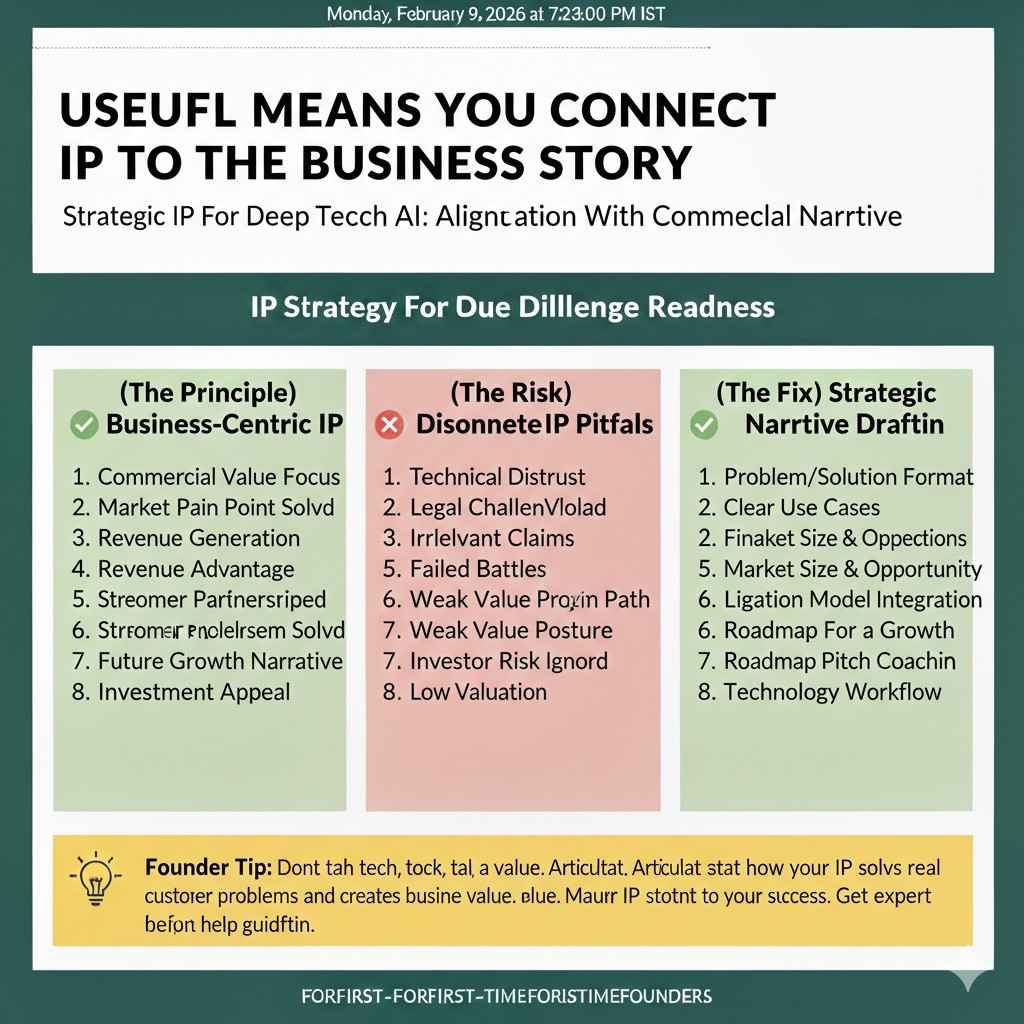

Useful means you connect IP to the business story

An investor does not want a list of filings. They want to know what the filings protect and why that matters. If you protect a key method, say what it protects in simple terms. If you protect a hardware design choice, connect it to cost, speed, safety, or reliability.

You can be useful without showing secrets. You can explain the boundary of your invention without giving away the recipe.

Where patents belong in a deck

Place them where they support belief, not where they distract

Most decks do best when IP appears after you show the problem, your product, and why you win. That way, the investor already understands what the invention does. Then the IP slide acts like reinforcement.

If you lead with patents too early, it can feel like you are hiding behind paperwork. The deck should still be a business story first. Patents are evidence, not the headline.

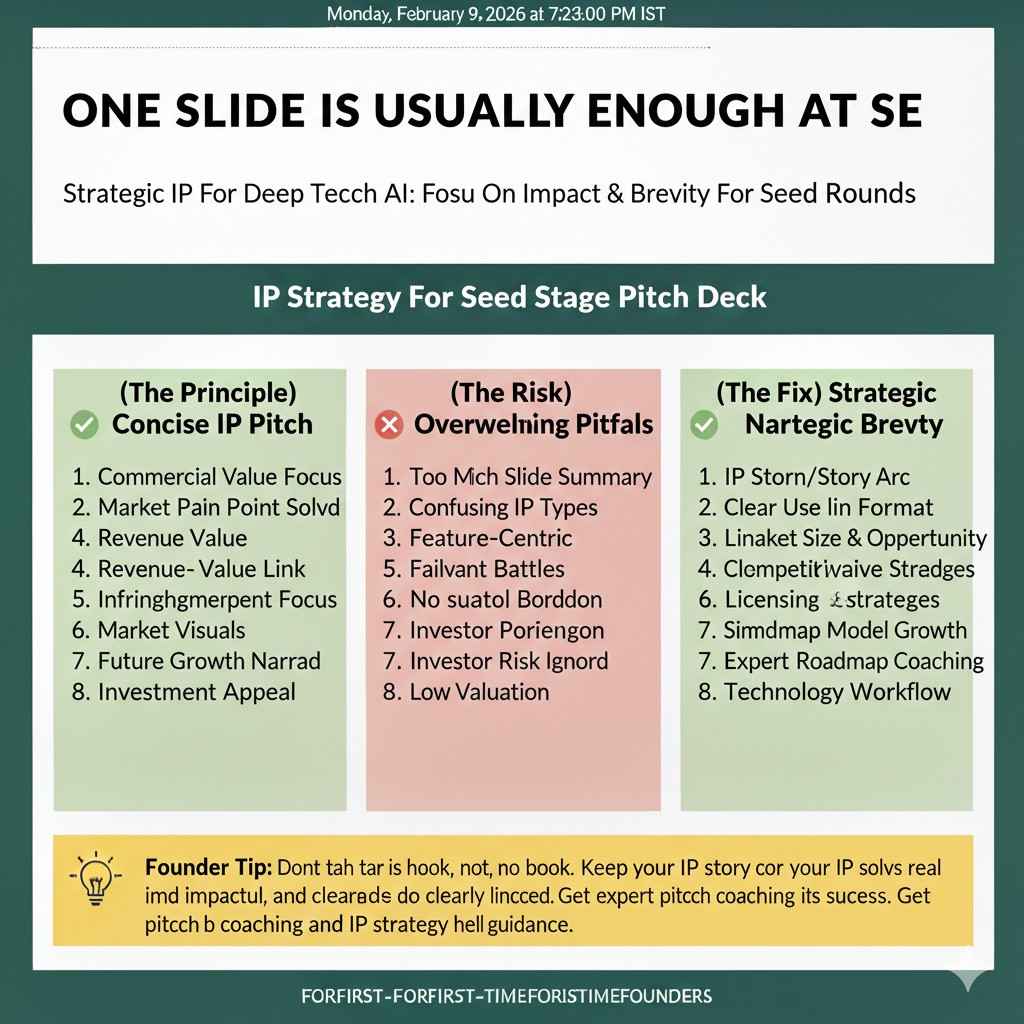

One slide is usually enough at seed

Early-stage decks should stay light. A single “IP Strategy” or “Defensibility” slide is often enough. You can go deeper in an appendix or in a follow-up doc.

The slide should be clean and simple. It should make one clear point: “We know what to protect, and we are protecting it in the right way.” If you want help drafting that slide and backing it with a real filing plan, you can apply anytime at https://www.tran.vc/apply-now-form/

How to talk about patent status without missteps

Understand the words investors expect

If you filed a provisional application, you can say “provisional filed” and include the month and year. You should not call it “patent pending” unless you are comfortable with how that phrase is used in your region and how investors will interpret it. Many investors treat “patent pending” as meaning a non-provisional has been filed. If you use the phrase, be clear.

If you filed a non-provisional application, “patent pending” is usually a clean way to say it. If you have a PCT filing, say “PCT filed” and clarify the purpose: buying time and keeping options open in more countries.

If something is granted, say “granted” and name the country. A US grant and a German grant are not the same thing, and investors know that.

Write dates like a grown-up company

Dates are a trust tool. A simple “Filed: Oct 2025” tells investors you are organized. It also shows momentum. You do not need to share application numbers on the slide, but having them ready for diligence is wise.

If you have multiple filings, you can group them by theme instead of listing every item. The point is clarity, not volume.

Do not pretend breadth you do not have

A common mistake is to imply your patent covers the whole product category. In reality, patents cover specific claims. Sometimes those claims are narrow. Sometimes they are broad. Until examination happens, you often do not know where you will land.

So avoid language like “covers our entire platform” or “protects our whole stack.” Instead, say what you are aiming to protect, and why it matters.

Example: “We filed to protect our method for real-time calibration that reduces drift in field conditions.” That is clear, and it does not promise a legal outcome.

The best way to show value: describe the “protected wedge”

Patents work best when they protect a wedge, not everything

A strong patent story often focuses on one wedge: the part of the system that makes the whole system work. It might be a control loop, a sensor fusion method, a data pipeline trick, or a mechanical design that unlocks cost and reliability.

If you can explain that wedge simply, the investor understands what is special. Then the patent feels like a natural next step, not a random badge.

Show what happens if someone tries to copy that wedge

You cannot say “they cannot copy us.” But you can say, in plain business language, why copying becomes harder.

For example, “A competitor could build a similar robot shell, but without our calibration method they see higher failure rates in real sites.” This frames defensibility as a real-world outcome, not a courtroom fantasy.

Tie the wedge to a business metric

This is where many founders miss an easy win. Investors love when IP connects to a metric that matters.

If the wedge lowers cost, say how. If it improves safety, say how. If it increases uptime, say how. You do not need exact numbers on the slide, but you should show the direction and why it is meaningful.

If you want Tran.vc to help you turn your wedge into a clean filing plan and a strong story, apply anytime at https://www.tran.vc/apply-now-form/

What not to do on an IP slide

Do not paste a patent abstract

Patent writing is not deck writing. Abstracts are dense, formal, and hard to read. They also reveal more than you think. Investors will not thank you for it, and you will not get credit for it.

Use plain words. Explain what you protect in one short paragraph. If you need a second paragraph, keep it focused on why it matters.

Do not show too many technical diagrams

A complex diagram can confuse more than it helps. If you use a diagram, it should be simple and labeled clearly. The goal is not to show your full system. The goal is to show the part you are protecting and why it is central.

If you have a deep technical figure that matters, put it in the appendix and use it when an investor asks.

Do not make legal threats in your deck

Language like “we will sue” or “we will enforce aggressively” is usually a turn-off. It signals you are thinking about fights before you have customers.

Enforcement is real, but it is not a seed pitch story. At seed, the smarter signal is that you are building protection early so you can choose your battles later.

A clean structure for your patent story

Start with what you are building, then what you are protecting

A simple flow works well. First, remind the investor what the core invention is. Then explain what part you are protecting through filings. Then share your plan for the next steps.

This keeps the slide grounded. It also makes your IP feel like part of a roadmap, not a side quest.

Make the “plan” sound like a plan, not a wish

Instead of “We plan to file patents,” say “We are preparing two filings over the next 90 days: one on the sensing method and one on the deployment workflow.” That sounds like a real plan.

Even if you are early, you can still show discipline. You can show you are choosing what to protect first, and why.

Show you are not wasting money on noise

Investors hate waste. Many have seen startups file too many weak patents just to sound big. If you show you are focused on the few filings that matter, you stand out.

A simple line like “We are filing around the core method that drives performance, not around cosmetic features” can make you sound mature. It also sets expectations that you will spend wisely.

How Tran.vc fits into this

Patents are not paperwork, they are leverage

Tran.vc helps technical founders turn inventions into assets that investors respect. The goal is not to file for the sake of filing. The goal is to build leverage so you can raise on better terms, later, with less pressure.

Tran.vc invests up to $50,000 in in-kind patent and IP services. That means strategy, filings, and support from real experts who know early-stage tech. If you want to build your moat early without burning cash, you can apply anytime at https://www.tran.vc/apply-now-form/

The pitch deck becomes easier when the foundation is real

When your IP plan is real, your deck becomes simpler. You do not need hype. You can speak plainly about what you are protecting and why. Investors feel the difference.

You also avoid the trap of overclaiming because you have guidance on the right words and the right framing.