Most AI and robotics founders treat patents like a checkbox: file something, show a number in the deck, move on.

Investors do the opposite. They read a patent portfolio like a map. It tells them what you truly built, how hard it is to copy, and whether your edge will still matter when a bigger team with more money tries to chase you.

That is why the strongest portfolios do not look “big.” They look sharp.

They show clear ownership of the parts that create unfair advantage. They match the product plan. They match the go-to-market plan. They match the risks in the category. And they leave less room for a competitor to slide around your work with one small tweak.

If you are building in AI or robotics, this matters even more. These markets move fast, and many teams ship similar demos. Investors need proof that your team has a defendable core, not just a working prototype. A well-built patent portfolio can be that proof, if it is built with intent.

This blog post will break down, in plain language, what investors look for when they review AI and robotics patents, what signals make them lean in, and what mistakes make them walk away. I will also share practical ways to shape your portfolio so it supports your next round instead of sitting on a shelf.

And if you want help building an investor-ready IP plan from day one, Tran.vc can invest up to $50,000 in in-kind patent and IP services to help you lock down what matters before you raise. You can apply anytime here: https://www.tran.vc/apply-now-form/

What Investors Are Really Doing When They Read Your Patents

They are testing if your “edge” is real

When an investor flips through your patents, they are not counting how many you filed. They are asking a quieter question: “If a strong team copied this product, what would stop them?”

A patent portfolio is one of the few places where your advantage has to be written down in detail. It forces clarity. It also shows whether you know what part of your system is truly special, or whether you just filed broad language that does not match how your tech works.

If you can explain your moat in a pitch, but your patent filings do not reflect it, investors notice that gap.

They are checking if your portfolio matches your business plan

Investors want alignment. If your company says it sells to warehouses, but your patents focus on medical robots, it creates doubt.

The best portfolios feel like they were built from the roadmap and the customer pain. They protect what the buyer pays for and what the market cannot easily replace. That is why a good IP plan is not a legal task. It is a product and strategy task that legal supports.

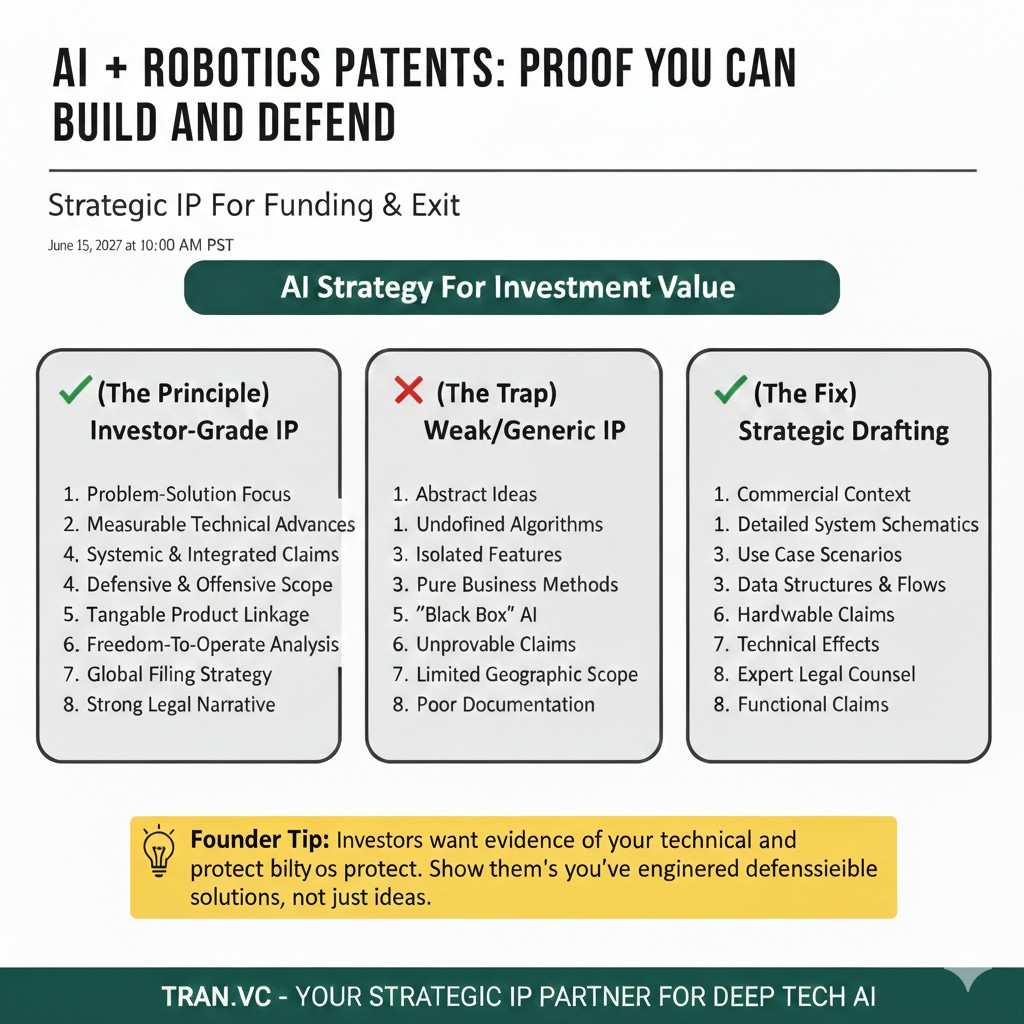

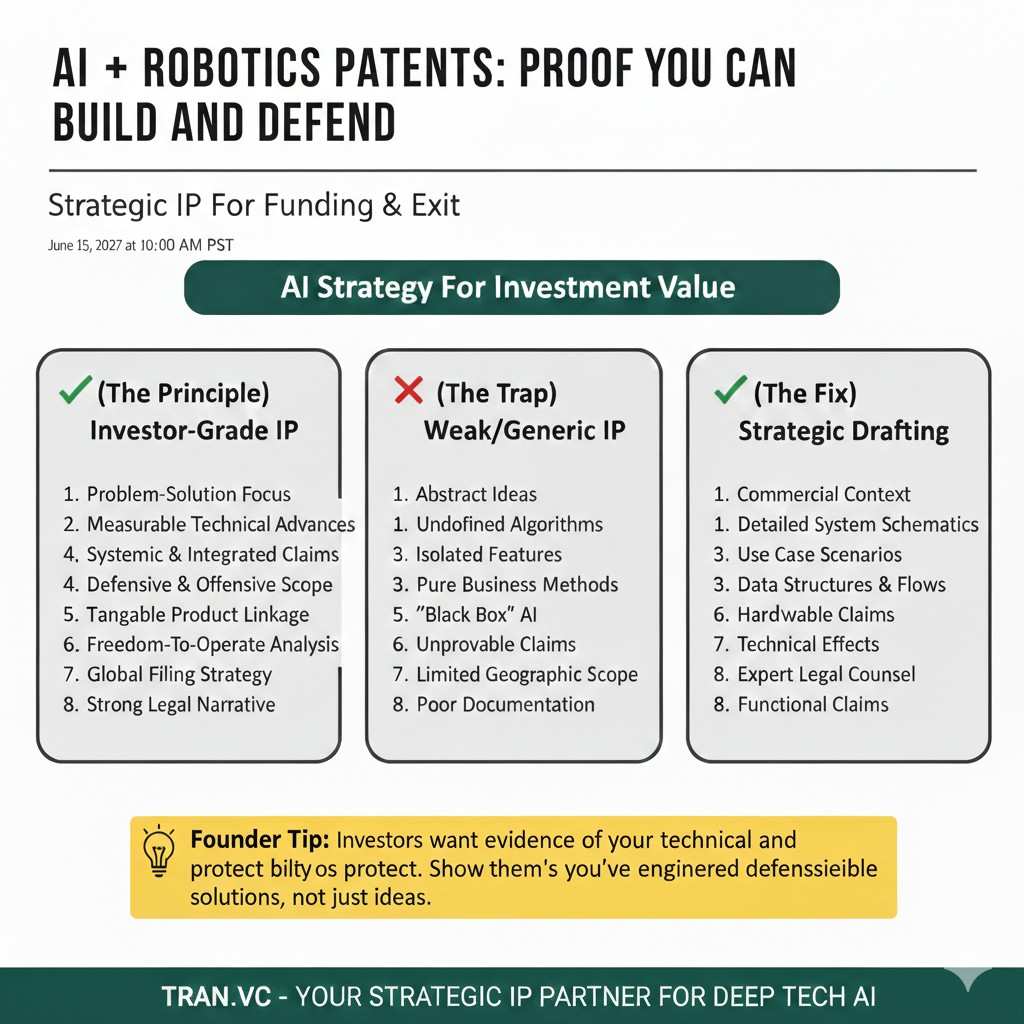

They are looking for proof you can build and defend

In AI and robotics, many founders can build a demo. Fewer founders can build a system that is hard to copy.

A thoughtful patent set signals that you are playing the long game. It tells investors you understand competition, you understand timing, and you understand how value gets defended when the market heats up.

If you want Tran.vc to help you shape that kind of IP story, you can apply anytime here: https://www.tran.vc/apply-now-form/

What “Strong” Looks Like in an AI and Robotics Patent Portfolio

The core inventions are easy to point to

Investors like portfolios that have a clear center. They want to see two or three core ideas that drive performance or cost, then supporting filings that protect the important parts around them.

When everything looks equal, nothing looks important. That often happens when founders file patents based on what is easy to describe, not what is most valuable to defend.

A strong portfolio makes it simple to say, “This is the main thing we own, and here is how the rest supports it.”

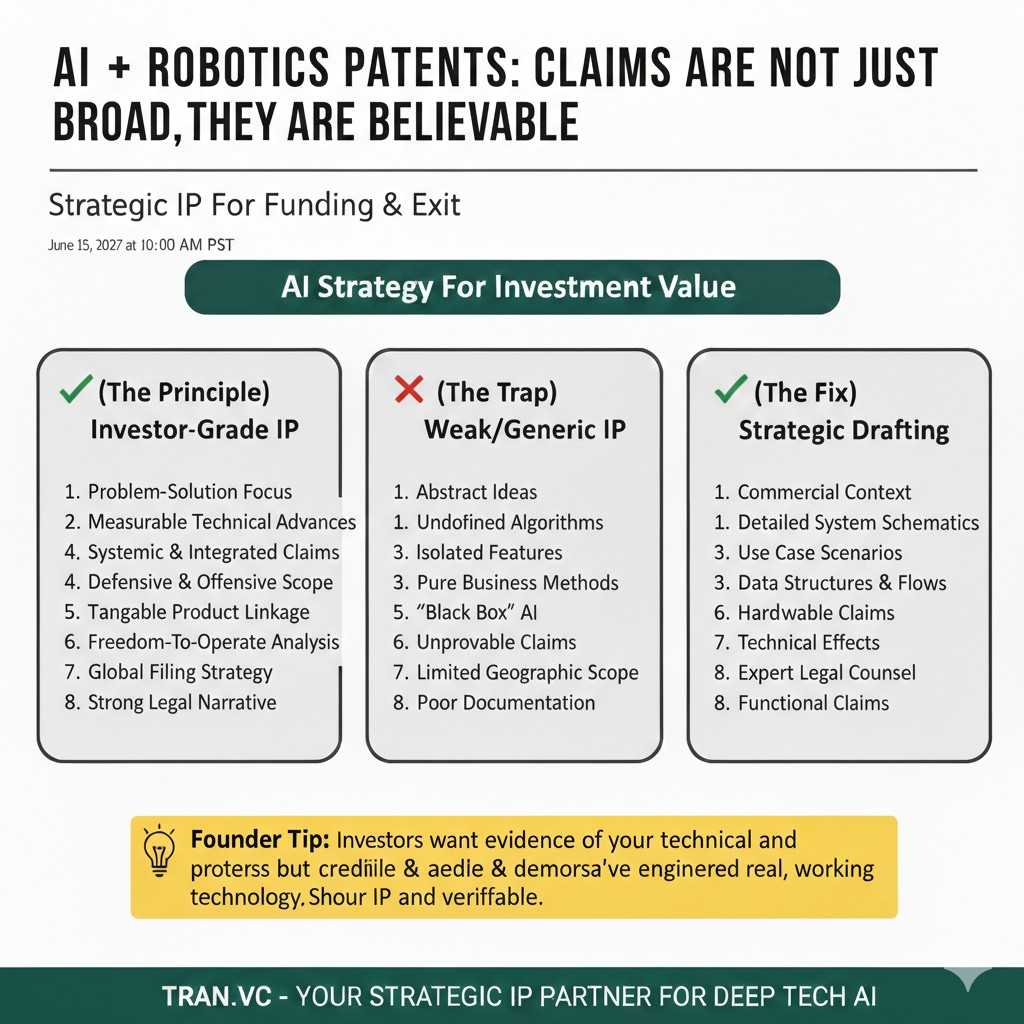

The claims are not just broad, they are believable

Founders often think broad claims are always better. Investors and experienced IP people know broad claims only help if they can survive.

A strong filing usually has a smart structure. It includes broad claims, but it also includes tighter claims that are easier to defend and harder to attack. That gives the company options later.

It is like having a front gate and a back gate. If someone tries to break one, you still have another way to protect the property.

The patents describe the “how,” not just the “what”

In AI, it is easy to say, “We use a model to predict X.” That is not enough.

Investors like patents that explain the parts that make your model useful in the real world. They want to see what you did about bad data, edge cases, drift, latency, noisy sensors, hardware limits, and safety needs.

In robotics, it is not enough to say, “We control a robot arm.” Strong patents explain the control choices, timing choices, sensing choices, and the way the system handles uncertainty.

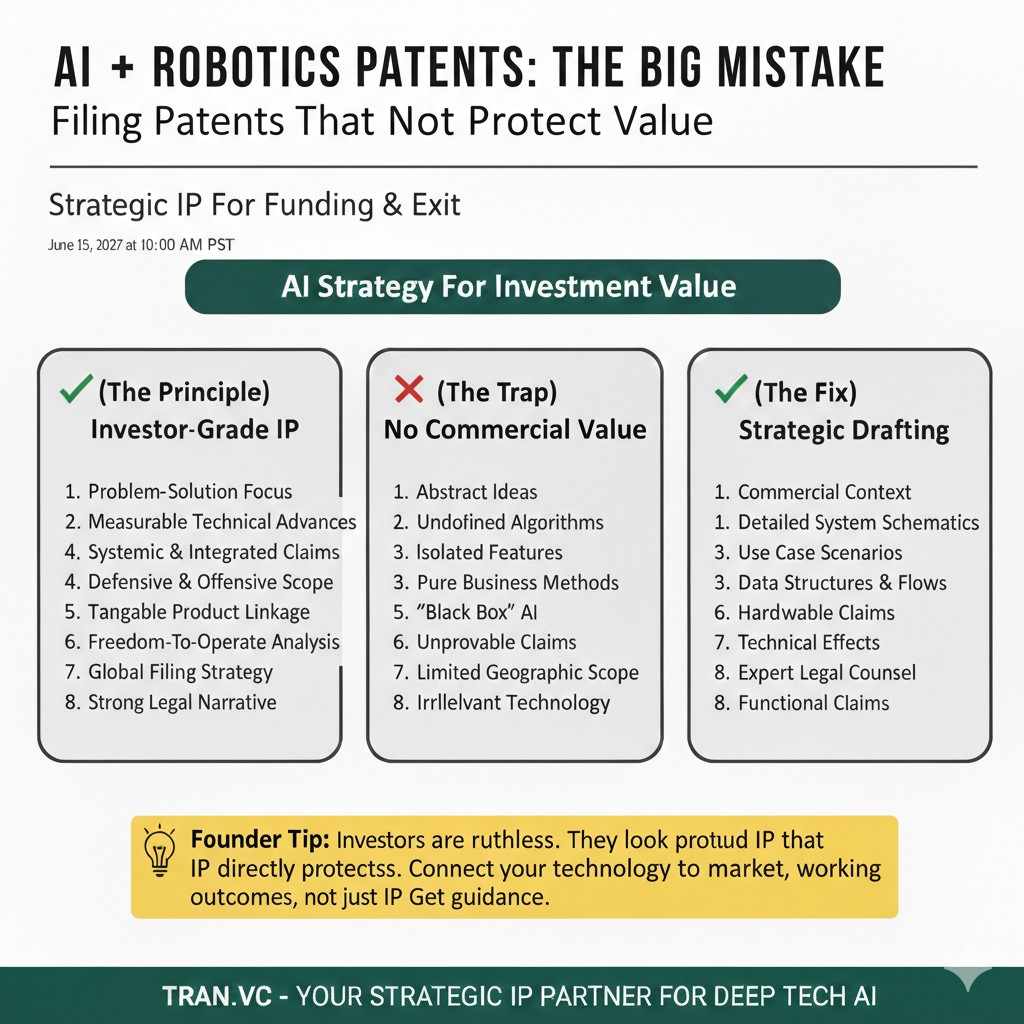

The Big Mistake: Filing Patents That Do Not Protect Value

Patenting features instead of leverage points

A feature is something a user sees. A leverage point is what makes the feature possible at a cost or level of performance others cannot match.

Investors want patents around leverage points. For example, if your robot picks faster because of a special grasp planning method, the valuable thing may not be the “picking.” It may be the planning loop that runs on cheap hardware while staying stable under slip.

If your patent only covers a surface-level workflow, a competitor can often rebuild the value using different steps.

Ignoring the system edges where competitors attack

Competitors rarely copy you exactly. They look for the seams.

They might change one sensor, one control step, or one part of the pipeline, then claim they are different. Weak portfolios leave these seams open. Strong portfolios anticipate them.

This is why investors like to see patents that cover not just one method, but the key variations that someone would try if they wanted to avoid you.

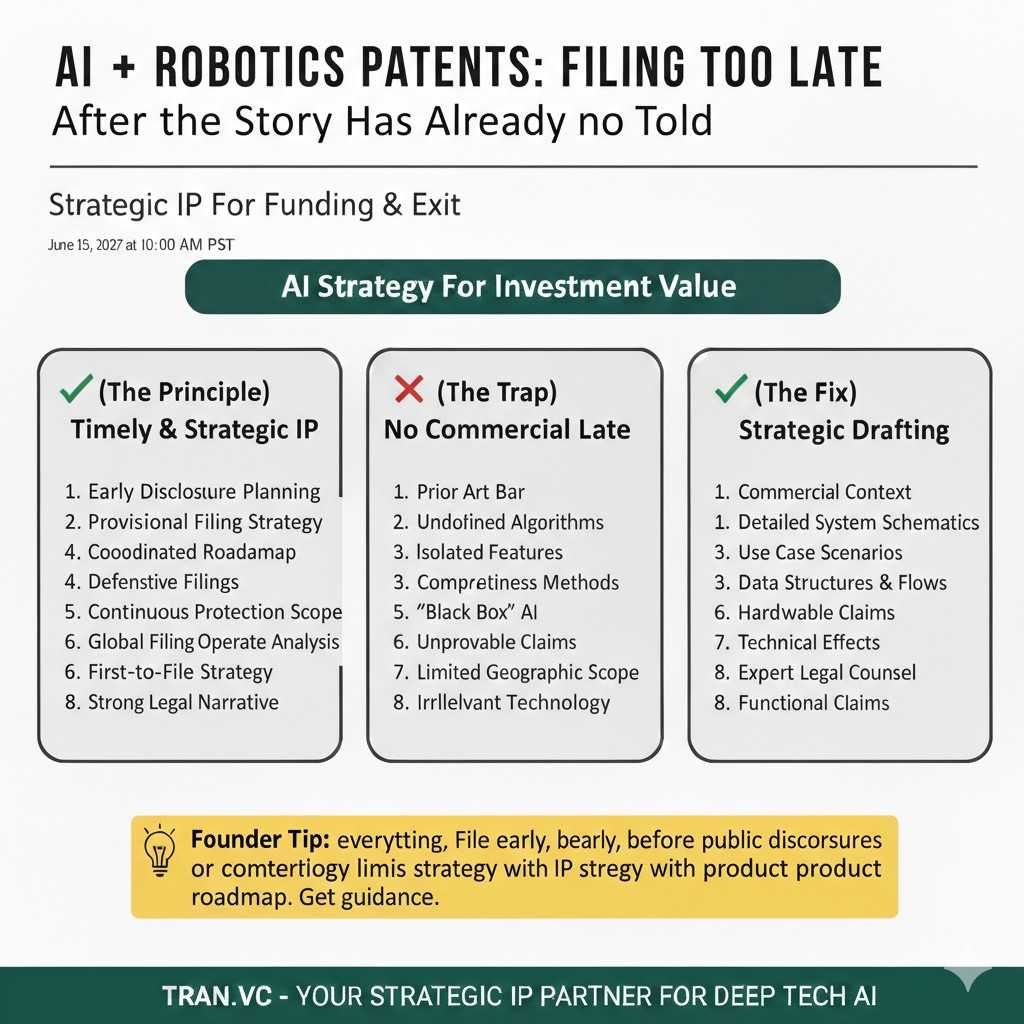

Filing too late, after the story has already been told

In many categories, founders publish blog posts, open-source code, demos, and conference talks. They then file patents after the public story is out.

That can limit what you can protect. Investors do not like seeing avoidable risk. If they believe you made your best ideas public before protecting them, they may wonder what else is being handled casually.

If you are early and unsure how to time it, Tran.vc can guide this process in a practical way and help you avoid costly mistakes. Apply anytime here: https://www.tran.vc/apply-now-form/

How Investors Evaluate AI Patents Specifically

They want more than “use a neural network”

Many AI patents fail because they read like a textbook. Investors can tell when a filing was written without a real engineering insight.

A strong AI patent usually protects something specific that improves outcomes in a measurable way. It might be a training approach that reduces labeling cost, a way to handle rare events, a better method for uncertainty, or a pipeline that makes deployment stable in messy conditions.

If the patent could apply to almost any AI system, it often does not protect yours.

They look for data advantage that is protectable

Data is a huge part of AI value, but data is not always easy to patent. What can be protected is often the method that creates or improves the data.

Investors like to see patents around data capture methods, labeling processes, synthetic data generation, privacy-safe learning, or ways to use weak signals that others ignore.

This shows you understand that the model is only part of the system. The engine around the model often matters more.

They look for deployment realities, not lab results

AI that works in a lab can break in the field. Investors know this.

They like patents that show you designed for real deployment. That includes on-device limits, latency, drift, monitoring, rollback, safety checks, and fallback logic when the model is unsure.

When a patent shows these details, it signals maturity. It feels like you have shipped, or at least built with shipping in mind.

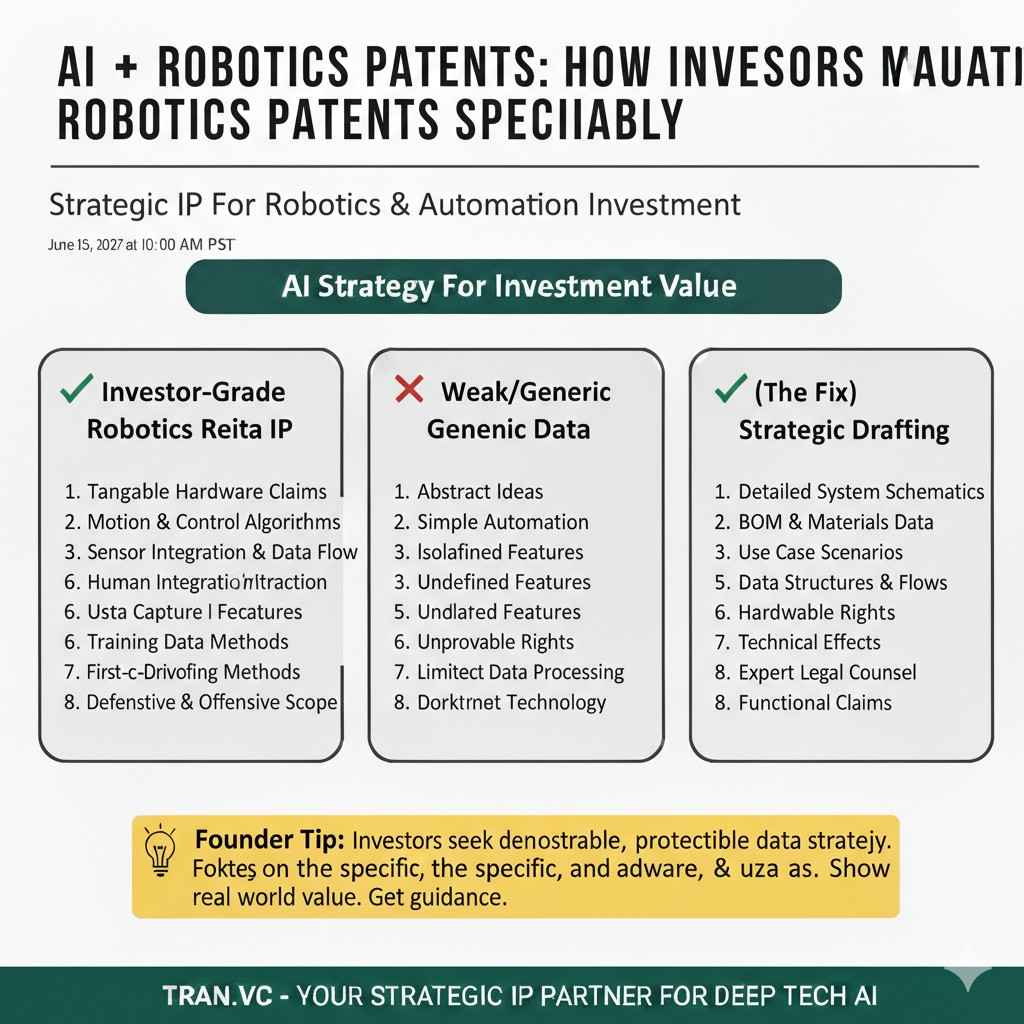

How Investors Evaluate Robotics Patents Specifically

They focus on the interaction between hardware and software

Robotics is a full-stack game. Many portfolios lean too hard into mechanical parts or too hard into software.

Investors like to see the “handshake” between the two. The best robotics patents often cover how sensing, planning, control, and mechanics work together to create stability, speed, and safety.

If your advantage depends on timing, calibration, compliance, or clever feedback loops, your patents should make that clear.

They want to see coverage of failure modes

Robots fail in ways that software-only products do not. Things slip, bend, drift, wear out, or get blocked.

Investors look for patents that show you understand this. Coverage around error recovery, safety stops, self-checks, and robust control can matter a lot.

It also reassures them that you are not building a fragile demo that will collapse when it meets real-world mess.

They look for manufacturability and scaling signals

A robotics investor is often thinking about scale early. Not just “can it work,” but “can it be built and deployed many times.”

Patents that consider assembly, calibration, modular design, and cost reduction signal that you are building a business, not a science project.

Even if you are not ready to manufacture today, showing these thoughts in your IP can help the investor believe you will get there.

The “Portfolio Shape” Investors Prefer

A small number of strong families beats many weak filings

A patent “family” is a core invention with follow-on filings, often in multiple places and with multiple claim angles.

Investors generally prefer a few well-built families that protect key value, rather than a pile of unrelated filings. A scattered portfolio can look like panic filing.

A focused set, built around your main advantage, makes the company easier to underwrite.

Continuations and follow-ons show you are still building

In many cases, investors like seeing that you have room to expand claims over time. This is where a smart filing plan matters.

If everything is filed once and never touched again, it can look like you treated IP as a one-time task.

A living portfolio, tied to product releases and engineering milestones, tells a better story.

International coverage is strategic, not random

Investors do not always expect global filings early. But they want to see you understand where the market and manufacturing will be.

If your buyers are in the US and Europe, or your manufacturing is likely in certain regions, investors want your IP strategy to reflect that.

Random country choices or no plan at all can signal that the portfolio was built without business thinking.

Turning Your Patents Into a Fundraising Asset

Build an “IP narrative” that matches your pitch

Investors rarely read every page. They want a clear summary that connects the portfolio to why you win.

A good approach is to be able to explain, in plain words, what each core patent family protects and why that matters. This is not about legal terms. It is about the business impact.

When your patents reinforce your story, they reduce perceived risk. That can change terms, not just interest.

Show what is filed, what is pending, and what is next

Investors like visibility. They want to know what is already protected and what will be protected soon.

This does not mean over-sharing sensitive details. It means presenting a clean, simple view of your filing plan and the logic behind it.

It also helps them see that you are using money wisely and not filing randomly.

Use patents to clarify partnerships and buyer trust

In robotics and AI, buyers often worry about long-term support and vendor stability. A strong IP position can help.

It can show that you own your system and are not just stitching together parts anyone can buy. That can increase trust during sales cycles.

When investors hear that customers care about IP, they pay attention.

If you want Tran.vc to help you craft this kind of investor-ready portfolio and story, apply anytime here: https://www.tran.vc/apply-now-form/

Red Flags That Make Investors Nervous

The portfolio feels disconnected from the product

One of the fastest ways to lose investor trust is when the patents and the product do not line up.

If your deck shows one core advantage, but your filings protect something else, it creates confusion. Investors start to wonder if the patents were filed by default, without a clear strategy.

In AI and robotics, this often shows up when a team files early academic-style patents that do not reflect the real system they are now building. It feels outdated. It feels unplanned.

Strong portfolios evolve with the product. Weak ones look frozen in time.

The claims are too generic to defend

When a patent reads like, “A system that uses AI to optimize a process,” investors know that will not hold up.

They understand that patent examiners push back on vague language. They also know competitors hire smart lawyers who look for easy ways around weak claims.

If your filings could apply to almost any company in your space, they likely do not protect you in a meaningful way. Investors see this quickly.

They prefer fewer patents with strong, specific claims over many that look impressive but protect little.

No clear ownership or messy assignments

Another red flag is unclear ownership.

If founders worked at a university, prior startup, or big tech company, investors want to know those past agreements do not affect the new IP.

If contractors wrote core code and there is no clean assignment agreement, it creates risk. During diligence, these details come up.

Investors do not expect perfection. They expect awareness and clean documentation.

Everything is provisional and nothing has progressed

Filing provisional patents can be smart. But if years go by and nothing converts to full applications, it signals hesitation.

Investors look at timing. They check whether filings were followed through. A trail of expired provisionals without a clear plan suggests IP was treated as a temporary checkbox.

A healthy portfolio shows forward motion.

How to Decide What to Patent First in AI and Robotics

Start with what creates unfair cost or performance

The first thing to protect is not the feature that looks best in a demo. It is the mechanism that gives you an edge.

Ask yourself a simple question: if a competitor had the same team and budget, what part of our system would be hardest for them to rebuild?

That is usually where the moat lives.

In AI, this might be a data generation method that cuts labeling cost by half. In robotics, it might be a calibration method that reduces setup time from hours to minutes.

These are leverage points. They change the economics of the product. That is what investors care about.