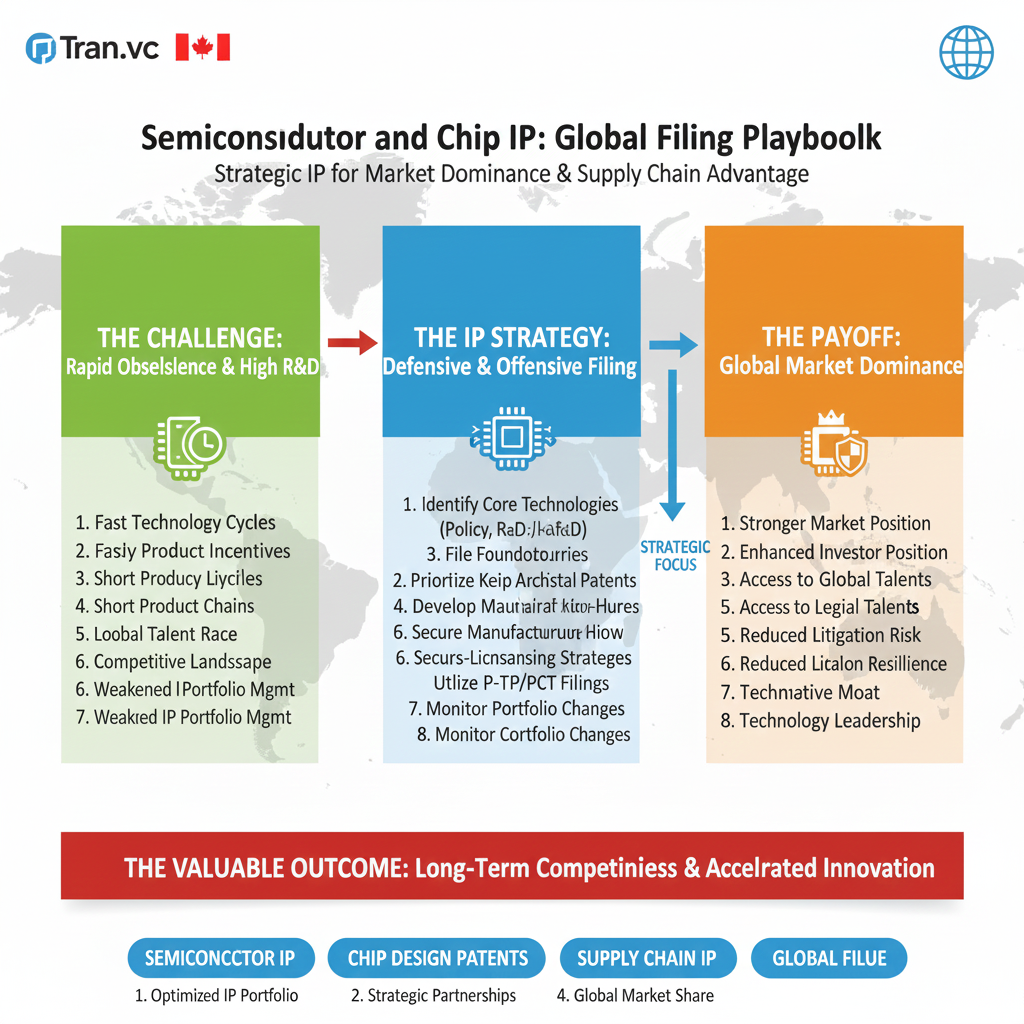

Semiconductor and Chip IP: Global Filing Playbook

Semiconductor and Chip IP: Global Filing Playbook If you build chips, you already know the truth: your real product is not only silicon. It is also the ideas inside it. The layout tricks. The timing fixes. The way your firmware talks to your hardware. The method that makes your power drop by 18% without hurting […]

Semiconductor and Chip IP: Global Filing Playbook Read More »