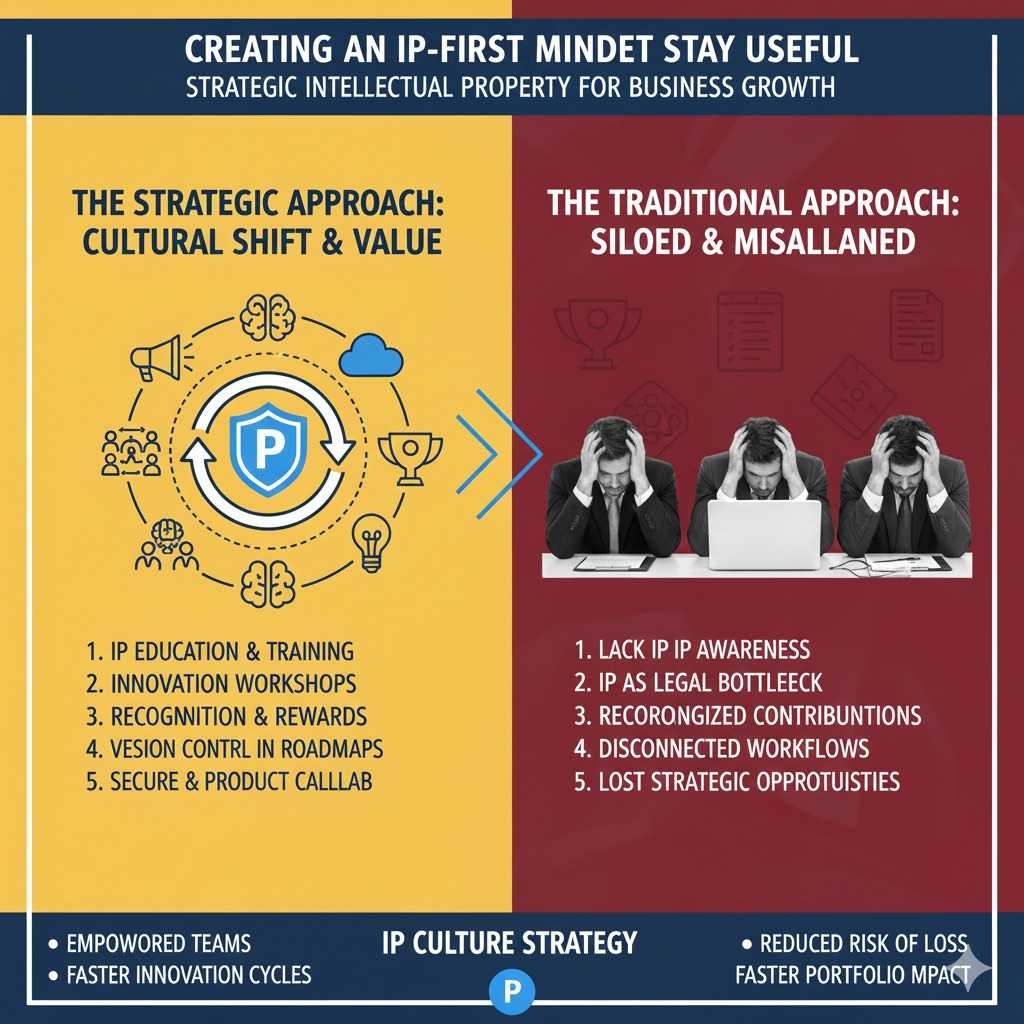

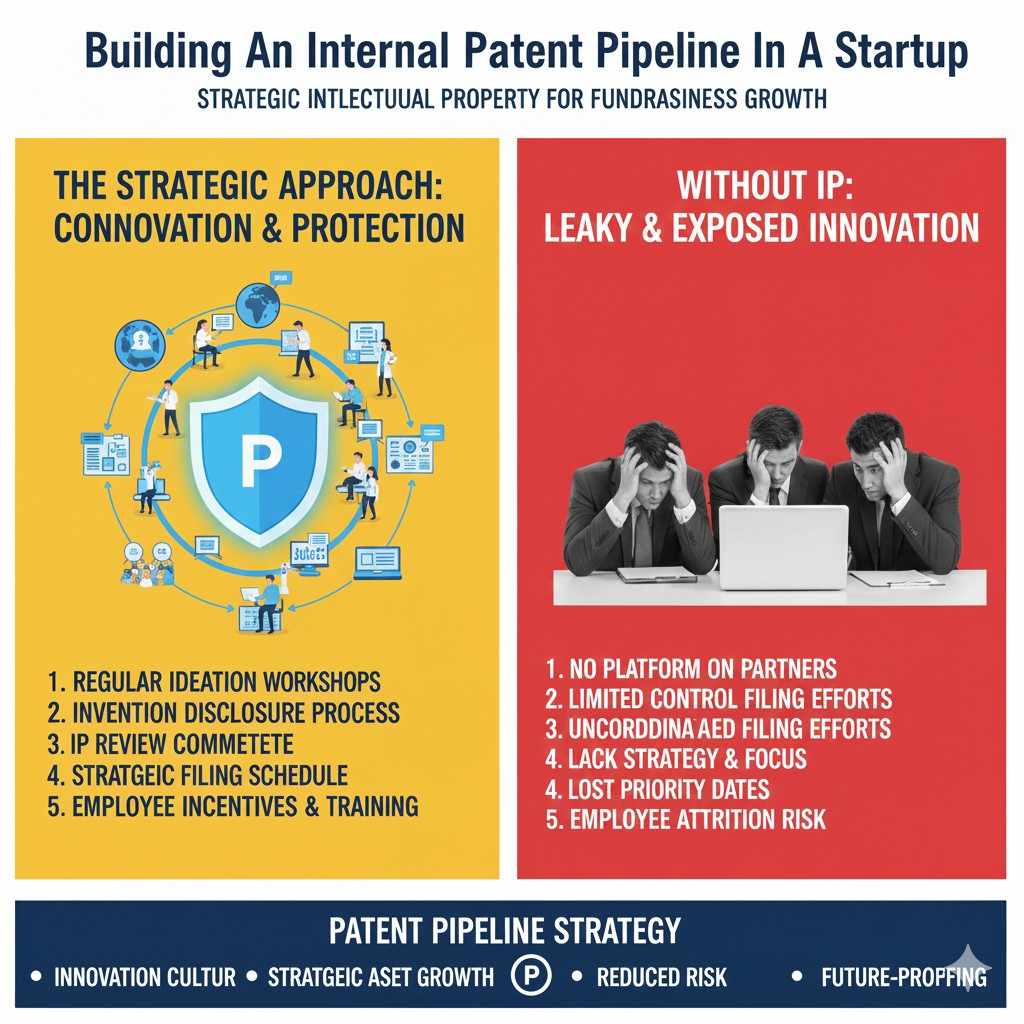

Creating an IP-First Mindset Across Product Teams

Most product teams move fast. They ship, they test, they fix, they ship again. That speed is a strength. But it can also hide something costly: the team may be building real invention every week and not capturing it. An IP-first mindset is simply the habit of noticing what your team is inventing, writing it […]

Creating an IP-First Mindset Across Product Teams Read More »